David Crane’s argument above advocating doing away with the property tax protections in Proposition 13 is flawed. Crane says the state would function more efficiently if it relied more heavily on a stable property tax instead of more volatile income and sales taxes, but what makes the property tax so stable in California is Proposition 13.

Under the Proposition 13 formula, during economic downturns property tax revenue does not fall as much as the sales and income tax because many properties are not tied to current market values. If properties taxes were based on market values, as they were before Prop 13 passed, California schools and local governments would have taken an additional major hit during the recent recession because the taxable value would drop dramatically and the tax take would fall with it.

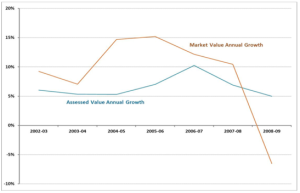

Look at the chart prepared by Pepperdine University professor, Michael Shires, which tracks the assessed (taxable) value of commercial properties compared to the market value.

The nosedive the market value took during the recession would have taken government revenues down steeply under the pre-13 tax structure. Because the assessed value under Proposition 13 dipped slightly, tax revenue to local governments did not fall as precipitously as a market value drop would indicate.

And, remember this chart is only for commercial property. Crane’s proposal includes doing away with Prop 13 for residential property as well. The revenue drop would be even more dramatic when all properties are included.

During the recession of the early 1990s, a Los Angeles County assessor official was quoted in the local press as saying, “Thank goodness for Proposition 13,” because the system stabilized the property tax and kept a steady flow of revenue coming into the county government during the economic downturn.

Proposition 13 creates the strong stability of the property tax which Crane heralds.

Crane says the shift away from Proposition 13 can occur over time with a guarantee that property taxes and other taxes would not explode. Politicians were no better at protecting taxpayers prior to Prop 13 passing than they would be today, especially the many politicians who are currently seeking new taxes and never ending sources for more spending.

While property taxes were robbing people of their savings and then their homes, politicians twiddled their thumbs. While inflation was raising the value of homes and increasing taxes based on the new values, local government officials claimed they were not to blame because they didn’t raise the tax rate. They didn’t have to — they let inflation and the resultant increase in property values do the dirty work for them.

Crane suggests that politicians must first do something about public employee pensions and health costs so that voters would know that new revenues would not go to retired employees. While Crane has down excellent work analyzing the problems associated with public pensions, the same politicians and governor who he expects to solve the pension problem have made little headway so far, with no promise that greater reforms are coming.

One argument that Crane makes is absolutely correct. Prop 13 did not stop spending or government revenue growth. But, limiting spending does not appear to be a goal of his proposal. He wants to shift the revenue sources. Spending will undoubtedly accelerate under his plan.

Proposition 13 did something revolutionary. It gave certainty to the taxpayer instead of the tax collector. Buyers know what they are paying in taxes when they purchase the home or property and know how much the taxes will go up each year. Voters will not give up this certainty in exchange for so-called guarantees from politicians.