“Waiter and Waitress Nation” is the title of a recent posting by American Enterprise Institute economist James Pethokoukis. Of the 175,000 net payroll jobs added nationwide in May 2013, more than half were created by three sectors associated with lower wage jobs, the restaurant sector (38,100 jobs), retail trade (27,700) and temporary employment (25,600 jobs) .

Is there a similar distribution in California? Are the jobs being created in California in recent years mainly in lower wage sectors? Will we all be food service workers soon?

Economist Jordan G. Levine, Director of Economic Research at Beacon Economics is one of our state’s leading experts on employment and wages. He has been carefully tracking the job creation in California since February 2010, and forwards the following charts.

Since February 2010, California has added 760,000 payroll jobs. Among states, California ranks second in the number of jobs gained during this period (below Texas), and among the top ten in percentage of job growth—though we are still 600,000 jobs short of the payroll jobs we had before the start of the Great Recession in the latter part of 2007.

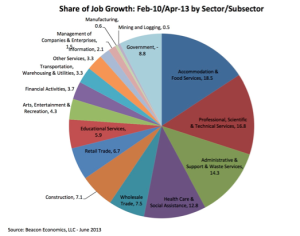

The first chart below shows the breakdown of this job gain by sectors/sub-sectors between February 2010 and April 2013. As is true of job gain throughout the past decades in California, the gains are not limited to one or two sectors but are distributed widely. The Accommodation & Food Services sub-sector is the leading job gainer with 18.5% of the jobs gained. It is followed by the following 3 sub-sectors that each have over 10% of the jobs gained: Professional, Scientific and Technical Services (16.8%), Administrative & Support Services/Janitorial (14.3%) and Health Care and Social Assistance (12.8%). Only Government shows a job loss (66,000 jobs) during this period.

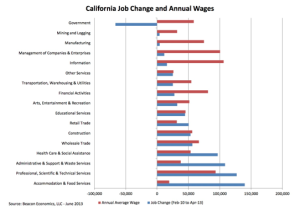

The second chart shows the sector/sub-sector job growth rates along with the average annual wage in the sector/sub-sector.

Accommodation and Food Services, the sub-sector with greatest job growth, is also a sub-sector with one of the lowest average annual wage levels, $19,422 annually. Administrative & Support Services/Janitorial, another of the top job growth sub-sectors has the low annual average wage of $37,777. At the same time, Professional, Scientific & Technical Services is among the highest of the average annual wages at $93,421, while Health Care & Social Assistance is near the middle with an annual average wage of $53,506.

Overall, slightly less than half of the jobs added (49.3%) are in sectors/sub-sectors with average annual wage of less than $50,000. Slightly more than half are in sectors/sub-sectors with average annual wage of more than $50,000.

We will all not be food service workers, and by no means are all the new jobs in low wage sectors/sub-sectors. The wage picture among sectors/sub-sectors is a mixed one, with job gains spread among industries and occupations and spread among wage levels.

At the same time, the prominent role of lower-wage sub-sectors in job growth since February 2010 suggests another element of the New Normal in California employment. Far more research is needed on the individual job wage level, to understand emerging wage dynamics. However, added to other New Normal changes we have discussed in recent years (breakdown of full-time work, rise of part-time and contingent employment and independent contracting) may be a growth in lower wage jobs, larger than we have seen in previous decades in California.