It’s time to bring in some “Mad Men,” like those vintage Madison Avenue advertising professionals in the critically acclaimed television show, and run the name of a new state retirement savings plan up the flagpole and see who salutes.

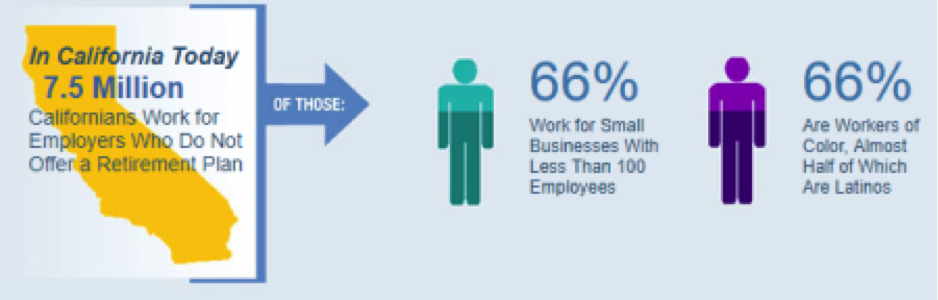

The current name, Secure Choice, doesn’t say much about a big new program that in five years could be a mandatory option to supplement Social Security for an estimated 7.5 million Californians currently not offered a retirement plan by more than 200,000 employers.

Secure Choice also has a kind of generic bureacratic tone, not exciting or appealing to young people, said a staff report given to the Secure Choice board last week, and it has an “association with other sensitive policy issues,” presumably like pro-choice on abortion.

Early attention to the “brand” comes as the program, authorized by legislation last fall after a feasibility study approved in 2012, prepares to begin no earlier than 2019. A three-year phase-in starts with large employers and moves on to those with five or more employees.

“How you want people to see you, how you want people to know you, and how they feel about it when they hear it — that’s your brand,” said board member Yvonne Walker, president of SEIU Local 1000.

Illustrating the need for professional help, board member William Sokol, a labor attorney, said he would never have chosen a “stupid” name like Google or a name like Apple, with a logo of an Apple with a bite out of it.

“I’ve learned how little I understand about marketing and branding,” said Sokol. “But I’ve learned it’s critical in this new world we live in.”

The board gave the Secure Choice executive director, Katie Selenski, the go-ahead for her plan to contract with a California-based firm to test names and logos. If another name appears best for marketing, Secure Choice could still remain as the name of the program.

California’s version of Obamacare is named the California Health Benefit Exchange but marketed as Covered California, said the staff report. The Oregon Retirement Savings Plan is marketed as OregonSaves.

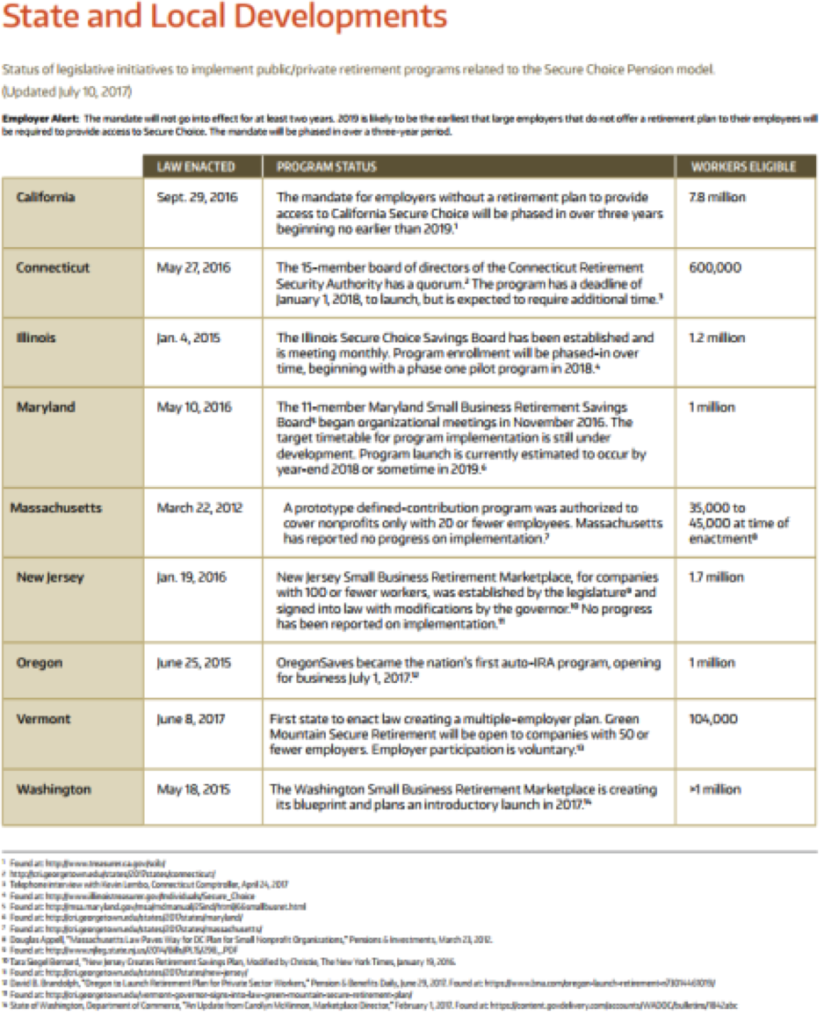

This month, Oregon became the first state to launch a state-run retirement savings plan for private-sector workers, a small pilot with volunteer employers. A half-dozen other states have authorized various retirement plans. Two dozen states are said to be considering one.

Pioneering is not the only reason Oregon is in the spotlight. Sokol asked the Secure Choice attorney, David Morse of K&L Gates, if there has been a hint of litigation anywhere against the state retirement programs.

“There has been complete silence,” said Morse, referring to the launch of the Oregon program on July 1. “So maybe the dark side has realized these programs are good and legitimate. But there is nothing, not a hint.”

A crucial legal issue is whether the state retirement programs are exempt from a federal law covering private-sector pensions. If not, employers could be exposed to liability, disclosure requirements, and other administrative burdens.

California was among the states that successfully urged the Obama administration to issue labor regulations clarifying an exemption from federal pension law. The new Republican-controlled Congress repealed the regulations with legislation signed by President Trump.

Not being covered by the federal law for private-sector pensions, the Employee Retirement Income Security Act of 1974 (ERISA), is required by the state law authorizing Secure Choice, SB 1234 by Senate Pro Tem Kevin de Leon, D-Los Angeles.

Secure Choice is an “automatic IRA.” A deduction from the employee’s pay, probably 3 percent in the first years, will go into a tax-deferred savings account — unless the employee opts out.

Secure Choice is an “automatic IRA.” A deduction from the employee’s pay, probably 3 percent in the first years, will go into a tax-deferred savings account — unless the employee opts out.

Experts say an automatic payroll deduction, not requiring a decision during day-to-day household budget pressures, sharply increases savings in private-sector 401(k) individual investment retirement plans.

Prior to Trump’s expected signing of the the regulation repeal in May, the Secure Choice attorney, Morse, said he believed the program would remain exempt from ERISA under a 1975 labor regulation.

Morse followed up with an advice letter that includes the issue of whether not requiring the employee to “opt in” is employer influence that might fall under ERISA. He said the employer has no say because offering the program is required by state law.

After Trump signed the repeal, De Leon and state Treasurer John Chiang said at a news conference they always thought Secure Choice was exempt from ERISA under previous regulations, but sought the clarification last year to ease the concern of business groups.

De Leon said “a handful of big banks” profiting from managing retirement plans pushed the repeal legislation. In a letter to California Congress members opposing the repeal, Gov. Brown said “Wall Street institutions” were trying to protect their retirement products.

The U.S. Chamber of Commerce, urging repeal in a letter to Congress, said the regulations allow retirement plans with less worker protection than ERISA plans, may cause some employers to forego ERISA plans, and could cause problems for multi-state employers.

The California Chamber of Commerce has no position on Secure Choice and has not done a legal analysis, said Marti Fisher, a Chamber lobbyist. She said the Chamber is participating in Secure Choice’s employer stakeholder working group.

The only opposition in a Senate analysis of De Leon’s bill last year was the Financial Services Institute. Financial advisors design plans in the best interest of the individual not a group, said the Institute, and Secure Choice would disrupt their robust and competitive market.

The bill analysis, listing 40 groups in support, said De Leon’s argument is that the average monthly Social Security payment, $1,328, is inadequate for retirement. And an AARP-Small Business Majority poll found two-thirds of small business owners support a state savings program.

Some conservatives oppose Secure Choice as government expansion into the private sector that could lead to more public debt. The legislation says the savings fund is not guaranteed by the state and employers are protected against liability.

To avoid state costs, the feasibility study authorized by De Leon’s legislation in 2012 was funded by $1 million in donations. The state loans for Secure Choice startup costs, $15 million this fiscal year, are expected to be repaid by the self-sustaining program.

De Leon’s failed legislation in 2008 and 2009 to create a state program called it the “California Employee Savings Program.” The Secure Choice name may have come from a 2011 National Conference on Public Employee Retirement Systems paper updated recently.

“The NCPERS plan reflected the recognition by public employees that the quality of their own retirement coverage could be at risk if their counterparts in the private sector lack access to a retirement system,” a Center for Retirement Research at Boston College report said last year.

Last week, the Secure Choice board also approved proposals to hire a California-based firm for employer community outreach and to plan a newspaper-style publication with short features about persons affected by the Secure Choice program.

A key hire, a program consultant to help find staff, has been delayed by bid eligibility and liability issues. An evaluation committee apparently selected a candidate later last week and a board meeting was scheduled Aug. 7, three weeks before the regular monthly meeting.

National Conference of Public Employee Retirement Systems chart

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com.