The State of California’s 2017–18 Enacted Budget confirms an ominous trend as state spending on retirement costs continues displacing state spending on the University of California and California State University.

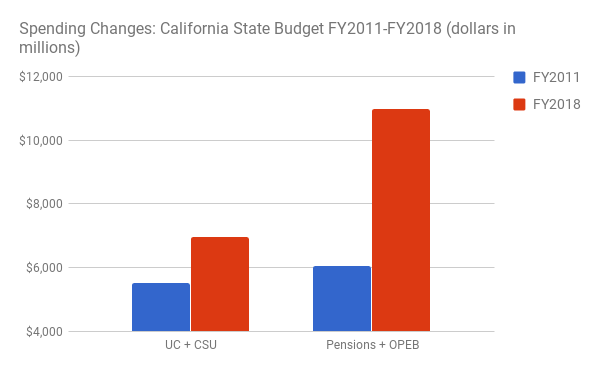

Seven years ago the state provided $5.5 billion for UC and CSU and $6 billion for retirement costs. The new budget provides $7 billion for UC and CSU and $11 billion for retirement costs:

FYE2011 and FYE2018 Enacted Budgets; Pension costs not including supplemental contribution; OPEB = Other Post Employment Benefits (eg, retiree health care)

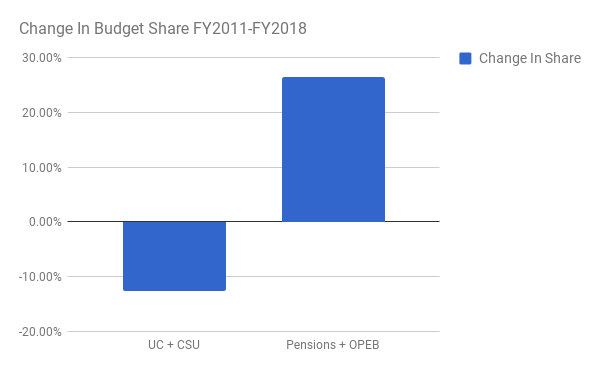

The boost for UC and CSU is just 27 percent, a bit more than half the rate at which total expenditures grew while the boost in spending on retirement costs is 83 percent, nearly twice the rate at which total expenditures grew. The difference produces a dramatic shift in budget share:

FYE2011 and FYE2018 Enacted Budgets; Pension costs not including supplemental contribution; OPEB = Other Post Employment Benefits (eg, retiree health care)

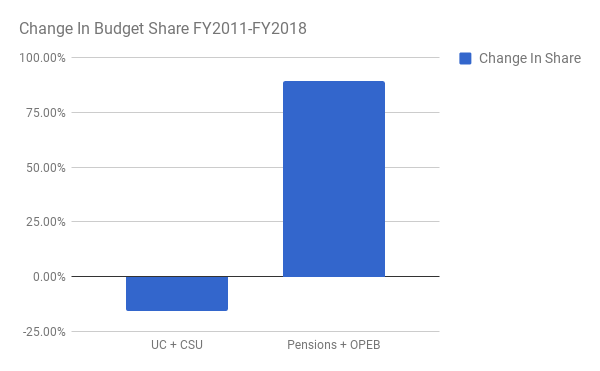

But that’s not all. To add insult to student injury, for FY2017–18 Governor Jerry Brown and the California Legislature borrowed $6 billion from a special fund to finance a “supplemental” pension contribution with the objective of using investment earnings from that contribution to reduce future pension costs by an estimated $11 billion (for a fuller understanding, see more here). With the supplemental pension contribution included, the change in budget share is even more dramatic:

FYE2011 and FYE2018 Enacted Budgets; Pension costs INCLUDING supplemental contribution; OPEB = Other Post Employment Benefits (eg, retiree health care)

As a thought experiment, consider that Brown and the Legislature could’ve deposited that same $6 billion with endowments being run for the benefit of UC and CSU and that earn as much or more than state pension funds. That way college students would have benefitted from the expected $11 billion of investment earnings that instead — as a destructive confirmation of Thomas Piketty’s apt description of “debt devouring futures” — will go to the service of past debts.

Unfunded retirement obligations are having a ruinous impact on education (see here for the impact on K-12). California’s dangerous trend of shortchanging education in order to finance retirement costs is growing and will not abate until elected officials attack retirement costs, as explained here.