In January 2012 California Governor Jerry Brown announced he would ask California voters to approve temporary increases in income and sales taxes. Later that year his proposal was embodied in Proposition 30. Projected by the Legislative Analysts Office to raise $6 billion per year for four years and smaller amounts for three years (ie, $42 billion or less), 40 percent of P30 revenues were to be provided to schools and community colleges*, the balance to the state. Marketed as “Temporary Taxes to Fund Education,” P30 passed.

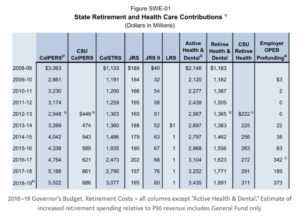

Seven budget years later, the results are in. As examined in Part I of this series, >100 percent of schools’ expected Prop 30 revenue went to increased school spending on retirement costs. As illustrated below, >70 percent of the state’s expected Prop 30 revenue went to increased state spending on retirement costs:

Net, citizens received less than 20 percent of expected P30 revenues. Of projected revenues of $42 billion, citizens received the benefit of <$8 billion.

Those outcomes were predictable but elected officials chose not to disclose them to voters. The cover-up also allowed the problem to grow worse, which will produce greater retirement spending down the road.

It’s one thing to pay higher tax rates for better services, quite another to pay higher tax rates in order to fund increased retirement costs. Misled again in 2016, voters approved an extension (Proposition 55) of the income tax portion of the P30 initiative. But that revenue will also be absorbed by growth in retirement spending because of already-scheduled increases and $230 billion of unfunded retirement obligations added in the last decade.

Absent reform, governments across California will continue to seek tax increases that won’t improve services. That problem will worsen when the bull market ends and revenues decline while retirement costs keep rising.

To start, the state legislature and governor should act now to eliminate or reduce subsidies for retired employee health costs. Retired state employees don’t need taxpayer-provided health insurance subsidies. Those aged 65-and-over are entitled to Medicare. Those choosing to retire before age 65 can get coverage from California’s Obamacare exchange, Covered California. Reform would save more than $2.5 billion per year, mostly to the benefit of vulnerable programs, as explained here. Examples of reform have already been provided, as explained here.