Sails Pitch

I agree with the Planning and Conservation League.

But first, a little background.

San Francisco Mayor Gavin Newsom is considering asking the Legislature

for an exemption from the California Environmental Quality

Act (CEQA) so his city won’t have to prepare an environmental impact

report to host the America’s Cup yacht race in San Francisco Bay in

2014.

That’s right. An EIR for a yacht race.

A Path To Pension Reform

A

recent report that the Governor is considering borrowing $2 billion from

the giant state pension system may seem incongruous with his earlier statements

advocating full funding of pension obligations – not to mention sound

fiscal management. But if these reports are true, then the Governor may have

found a way to thread the pension reform needle to the long-term benefit of the

state.

I

should know – I was Governor Wilson’s Cabinet Secretary in 1991

during California’s last Great Recession. Then – as now – the

state’s contribution to the CalPERS system was seen as a legitimate

source of temporary revenues to balance the budget. Then – as now –

the Governor sought to make structural reforms to the state’s retirement

system to control spiraling pension costs yet maintain a fair and adequate

benefit to retirees.

The

difference today is we’ve had hard-knocks experience with what happens

when the path to reform is not taken: a $650 million estimated

obligation turns out to cost taxpayers $3.5 billion – and counting.

Sales Tax On Services? Again?

An

old friend is back in town, at least according

to George Skelton. He shows up every so often trying to settle in, but

after making an initial good impression, the neighbors usually politely ask him

to keep moving on.

I’m

talking about the proposal to extend the state sales tax to services, which is

apparently a tax reform being considered by the Governor’s Office.

We’ve

been through this before, most recently when the Commission on the 21st Century

Economy ("Tax Commission") began to consider reforming the tax

code to make it more stable and "fit with the state’s 21st century

economy."

California Crackup Suggests Another Round Of Reform To Remake California’s Constitution

Editor’s Note: I asked both Loren Kaye and Cal State Sacramento professor and former legislative staffer, Tim Hodson, to review “California Crack-Up” by Joe Mathews and Mark Paul in an attempt to get two perspectives of the book. Unfortunately, Tim disclosed recently that he is battling an illness. We want to take this opportunity to wish Tim and his family well. Loren’s review of California Crackup is below. JF

In California Crackup, Joe Mathews’ and Mark Paul’s provocative yet breezy prescription for what ails the Golden State, the authors exhaustively survey the history of governmental and political reform that has long defined the California polity.

They convincingly argue that five separate efforts over more than 150 years to make and remake the California Constitution "would prove no more successful than its predecessors."

Their solution: another round of reform to remake the California Constitution.

So When Will We Have A Budget?

"What’s

the deal with Mel Gibson?" is probably the most common question being

asked by Californians.

But

in the six blocks surrounding the State Capitol, the most common question is,

"When will we have a budget?"

I’ll

leave the mysteries of Mel to the deep thinkers on ETV. But for the rest of

you, here are simple answers to your questions about when the state’s

budget will emerge.

California’s (Government) Jobs Budget

Legislative

leaders released their latest budget proposal, called the "Jobs

Budget," which again is heavy on tax increases and light on boosting the

state’s economic competitiveness. Touted

as "saving 430,000 jobs," the plan would increase taxes by more

than $5 billion and continue speculative and one-time spending to support

ongoing programs.

Key

tax changes include:

-

A

permanent tax rate increase of one percentage point for every personal income

tax bracket except the top bracket. This increase in personal income tax rates

would be for the 2010 tax year, so would in effect be retroactive to all income

earned this year, even thought it would be implemented in the fourth quarter.

Also, the one-quarter percentage point "temporary" increase in PIT

rates enacted in 2009 would be made permanent.

If President Obama can do it, why can’t the California Legislature?

The

White House, as part of a broad policy review, has

asked business leaders to "identify specific regulations that they

believe are obstacles to job-creating private investment."

The

Administration is responding to an increasingly forceful chorus of criticism

from national business organizations and individual companies, including a comprehensive,

54-page catalog of legislation and regulations prepared by the Business

Roundtable and Business Council.

The organizations claim that these measures’

"cumulative effect will help defeat the objectives we all share –

reducing unemployment, improving the competitiveness of U.S. companies, and

creating an environment that fosters long-term economic growth."

Biggest Threat on November Ballot

An

initiative sponsored by government

worker unions has qualified for the November ballot – and it may well

be the most threatening issue facing businesses and taxpayers in 2010.

So

what does it do? According

to sponsors, Proposition 25, the "On Time Budget Act," merely

reduces the legislative vote requirement to pass the state budget from

two-thirds to a simple majority, and stops paying legislators if the budget is

late.

But

when you think about it, why would the California Federation of Teachers,

California Faculty Association, California School Employees Association,

California Professional Firefighters, Professional Engineers in California

Government, American Federation of State, County and Municipal Employees, and

California Nurses Association invest millions of dollars in a measure simply to

reduce the vote on the state budget? What else does it do that its sponsors are

not talking about?

Legislative Democrats Begin Mock Negotiations

On

the last day of the just-completed fiscal year, the Assembly Speaker and Senate

President Pro Tem announced agreement on what

they call a unified Democratic budget "framework" that purports

to reconcile their different approaches and "signals the next step of

negotiations" with the Governor.

It

does no such thing.

But

don’t take my word for it; read the previously-confidential paper here.

You will find that this is not a document that anyone could negotiate from.

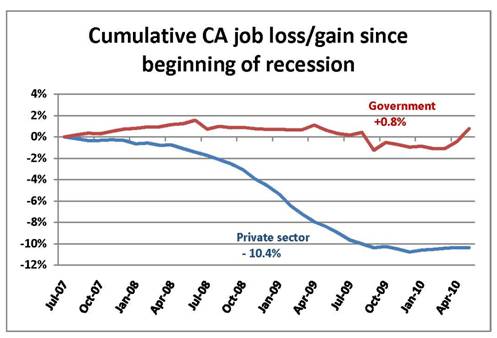

Whose jobs were stimulated?

Unemployment

ticked down a little in California in May. Good news? Well, maybe –

depends on where you work.