How Many Ways Can You Say It? We Need More Growth

The California

economy is struggling to recover, so what are the top public policy

priorities of legislative Democrats and the regulatory bureaucracy?

- Increasing taxes by billions to maintain an unsustainable spending appetite.

- Raising the cost to hire new workers by mandating new employee leave benefits, restricting the use of credit checks and credit reports, criminalizing employment disputes, and increasing litigation expenses in employment cases.

Voter Initiatives Promise Real Choices in November

For all the

handwringing about the initiative process, this November will certainly

confirm its intent as a balancing mechanism to the California

Legislature. From the left and the right, from business and labor and

citizens, measures are being placed on the ballot that specifically

address failure by the Legislature.

Voters will have a meaty ballot in

November, with real choices not just among candidates but also among

ballot measures. (The hyperlinked numbers refer to the Attorney

General’s identification system.)

-

09-0024.Changes California law to legalize marijuana and allow it to be regulated and taxed.

Democrats’ Budget Bid: Higher Taxes and Deficit Spending

The

state budget, taxes and massive new debt have emerged at the top of the

Legislature’s agenda this month. Some wonder how the Legislature could

have been working on any issues other than jobs, the economy and the

budget, given the gravity of those problems. But making up for lost

time, legislative leaders have laid on the table billions in new taxes

and mixed in a stunning proposal for new deficit spending.

After two weeks of proposals and counterproposals, the Assembly

Democratic leadership this week doubled down on the deficit, proposing

to borrow more than $9 billion to paper over part of the current

deficit, avoiding the tough decisions needed to balance the budget.

Their proposal finances existing, unfunded programs by borrowing money

and increasing taxes to pay off the new debt over the next 12 to 20

years. This one-year "solution" leaves $9 billion worth of programs in

place without any future source of revenues.

Arizona Raises Taxes – Could California be Next?

Voters in Arizona agreed to increase their sales tax by one cent for three years. And it wasn’t close – 64 percent of voters approved the measure, running away in 14 of 15 counties.

Are we witnessing a tax-friendly trend by voters in western states, as some have observed? After all, just last January, voters in Oregon also approved tax

increases. But Oregon is, as Jean Ross paints it, "a blue-green state,"

while Arizona’s leanings are crimson-red. And Arizonans increased the

broad-based sales tax, which comes out of everybody’s pocket, while

Oregonians increased the burden on the reviled upper income and

corporate taxpayers.

So what do the Oregon and Arizona efforts have in common? Most obvious

is campaign financing: Oregon government unions outspent taxpayers

by about 1.5 to one; they poured into the Oregon campaign what in

California would have been the equivalent of a sixty million dollar

effort.

Memo to Jerry, Meg and Steve: Still want to be Governor?

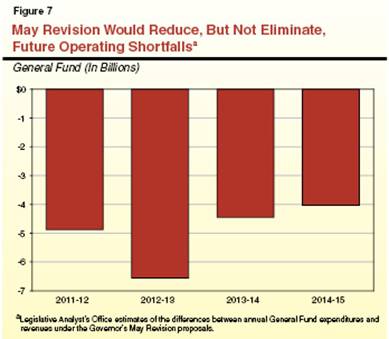

Here is the Legislative Analyst’s estimate of future structural budget deficits in the unlikely event that the Legislature adopts all the Governor’s May Revision proposals:

No new taxes – for now

No new taxes – at least none proposed by the Governor last Friday. Kudos to him and his team for recognizing the damaging effect that more taxes would have on the hoped-for economic recovery. Businesses and individuals are paying tens of billions in higher and more aggressively collected taxes enacted during the past two years.

But additional taxes remain on the table as the politicos and interest groups clear their throats. Legislative Democrats have lined up a parade of tax increases to keep pressure on budget negotiators. And even the Governor is counting indirectly on a tax increase for nearly nine hundred million dollars of his budget solution. The state receives a small portion of the federal inheritance tax, and unless Congress takes action to reduce or repeal it, the federal “death tax” will be reinstated come 2011.

Tax Increases Then and Now

The Governor

announces his May Revision of the budget today. Early indications are

that the Governor will hold the line on tax increases and instead

propose a budget heavy on expenditure cuts and other non-revenue

solutions.

The Governor has probably learned that raising taxes during a recession is tricky business.

The hard fought and politically-damaging battle to increase taxes in

February of 2009 has been the equivalent of dumping rip-rap into a

burst levy – for every ton that’s dumped in, hundreds of pounds wash

away.

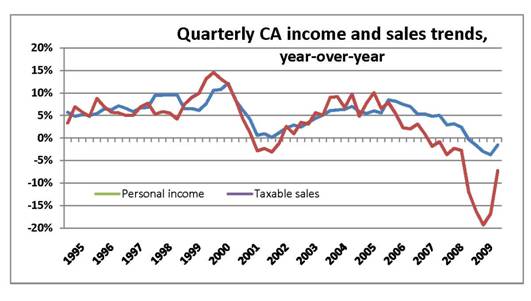

No Surprise In State Tax Returns

The April surprise in state tax returns

this year should be no surprise – except to those who crave the fantasy

of painless solutions over the economic reality of every day

California.

After all, what in the personal income and retail sales

numbers could have spurred this unwarranted optimism?

How Does Our State Grow?

California added nearly 400,000 residents in 2009, bringing the state’s population to 38.4 million. But the real tale remains in the composition of that growth.

Over the past two decades, between one-half and two-thirds of the gross increase in population was from natural increase – births minus deaths. But the interesting story is the net population increase. In 12 of the 19 years since 1990, more Californians have left the state to go to other states than moved here from the rest of the country. The net outflow of Californians since 1991 has been more than 1.5 million residents. That has been more than made up by foreign immigration – both legal and illegal. Since 1990 California has enjoyed a net increase of nearly four million foreign immigrants.

Risky business – going it alone with AB 32

The effort to regulate greenhouse gas emissions in California has evolved from grand statements of global leadership to the nitty-gritty chores of program design, regulation writing, and selection of economic winners and losers.

In 2006 the authors of AB 32 could confidently write, in the bill’s findings and declarations, “(A)ction taken by California to reduce emissions of greenhouse gases will have far-reaching effects by encouraging other states, the federal government, and other countries to act.”

But it hasn’t quite worked out that way, and California now faces a crossroads: should the state implement far-reaching, costly regulations to reduce GHGs ahead of other efforts by neighboring states, Canadian provinces, and the national government? Four years ago it seemed the world – or at least America – was moving inevitably toward a unified regulatory scheme for carbon emissions, and just needed a nudge from California. Today, even after the election of a President and Congress who declaim the urgent need for these policies, California is still alone in its legislative commitment to action.

A just-released study emphasizes the risk to California from going it alone.