Economic recovery means not just more income tax revenue, it also means concentrating even more the share of taxes on upper income taxpayers – even before last year’s Proposition 30 tax increase.

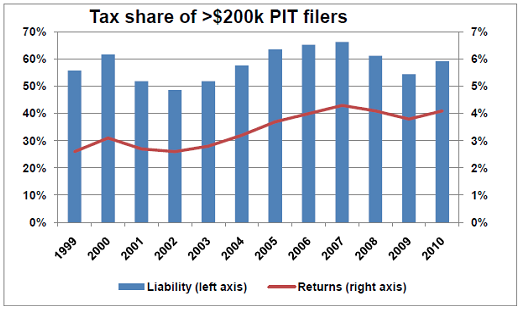

According to recently-released, but still dated, statistics from Franchise Tax Board, state income tax filers with more than $200,000 adjusted gross income increased their share of overall tax payments in 2010 to 59%, up from 54.5% in 2009.

This tax burden should continue to rise as the economy recovers; the steeply progressive income tax ensures this trend in a growing economy. Add to this the new upper income tax increases, beginning in 2012, and taxpayers making more than $200,000 will likely pay about two-thirds of all state income taxes.

At the same time, the income tax has become the overwhelming source for the state’s General Fund. The Governor’s 2013 budget proposes that income taxes account for 63% of all general revenues – a record high dependence on this revenue source. Translation: fewer than 700,000 taxpayers (out of 38 million residents) will account for more than 40% of all General Fund revenues.

Tying state finances to such a small number of upper income earners is very risky. Absent flattening the income tax, the best hedges against future volatility will be to improve California’s investment climate and keep a tight rein on spending.