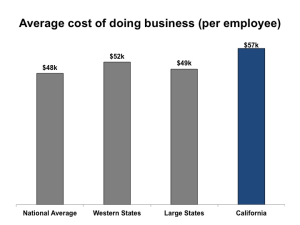

California businesses on average have 19 percent higher operating costs per job than businesses in the rest of the country, according to a study released by the California Foundation for Commerce and Education. Business operating costs in California are on average 16% higher than for firms in large industrial states, and are 10% higher than the average of Western states.

California’s per-job costs are higher than every other Western state, and most other large states. The high cost of creating additional jobs puts California at a substantial competitive disadvantage when attempting to retain or attract businesses that have a choice where to locate.

California’s per-job costs are higher than every other Western state, and most other large states. The high cost of creating additional jobs puts California at a substantial competitive disadvantage when attempting to retain or attract businesses that have a choice where to locate.

Among all states, California’s cost of doing business ranked 46th, based on cost per job. The state ranked 43rd on a cost-per-firm basis. (These relative rankings differ because California has a greater number of smaller firms with fewer employees than do most other states, which slightly dilutes the cost-per-firm ranking.)

“The main reason that operating costs are higher in California than in other states are the differences in labor costs,” said Loren Kaye, president of CFCE. “These costs include wages, unemployment insurance, workers compensation and the regulatory and litigation costs that are embedded in an employer’s payroll expense. While some of the difference is due to the state’s higher cost-of-living, public policy and regulatory mandates account for a substantial portion of the difference.”

California businesses pay about 15 percent more in labor costs than the national average. Employers here pay higher labor costs than every Western state and most large states. Average wages and workers compensation costs are substantially above national and regional norms, while unemployment insurance costs are less.

California has the third-highest minimum wage of any state, and is one of only three states that require paying overtime after an eight-hour day, instead of the federal standard 40-hour week. The state has one of the friendliest workplace litigation climates, including a private right of action for many labor laws.

California is also less competitive on measures of business taxes (22 percent higher than national average) and legal costs (15 percent higher than national average), measured on the job base.

Energy costs are a mixed bag in California. Our rates for electricity and transportation fuels are much higher than the national average, which has discouraged energy intensive industries from locating here. But because this has also created strong incentives for energy efficiency for California businesses, which has resulted in our companies having operating costs for energy at or below the national average. For energy intensive industries, high incremental costs mean more expense to locate or expand in California.

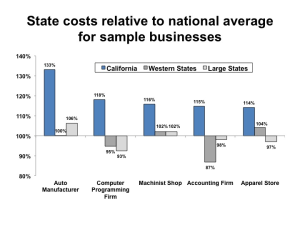

California’s national competitiveness on costs varies depending on the type of business. CFCE looked at costs for five sample businesses and found these indicators of competitiveness:

- An automobile manufacturer’s operating costs are 33 percent higher than the national average. The main drivers for this cost difference are substantially higher wages for skilled employees and higher electricity costs for an energy-intensive process.

- A computer-programming firm’s operating costs are 18% higher than the national average. The main driver for this cost difference is higher wages for highly skilled employees.

- A machinist shop’s operating costs are 16% higher than the national average. The main drivers for this cost difference are higher wages and higher electricity costs.

- An accounting firm’s operating costs are 15% higher than the national average. The main driver for this cost difference is higher wages for skilled employees.

- An apparel firm’s operating costs are 14% higher than the national average. The main driver is higher wages

Andrew Chang & Company, LLC, prepared the study, “The Cost of Doing Business in California,” for CFCE.

Andrew Chang & Company, LLC, prepared the study, “The Cost of Doing Business in California,” for CFCE.

The California Foundation for Commerce and Education is affiliated with CalChamber and serves as a “think tank” for the California business community. The Foundation is dedicated to preserving and strengthening the California business climate and private enterprise through accurate, impartial and objective research and analysis of public policy issues of interest to the California business and public policy communities.