California voters are often asked to make important tax and spending decisions at the ballot box, yet their mastery of basic fiscal facts is poor. PPIC’s surveys have consistently found a “knowledge gap” between what voters know and budget realities. In our January PPIC survey, just 8 percent of likely voters correctly named both K-12 public education and the personal income tax as the top state spending and top state revenue areas. The voters failed to grasp the state’s budget details even when the fiscal crisis took center stage and California grappled with massive deficits, spending cuts, and tax increases.

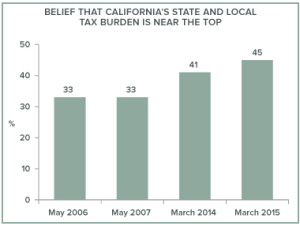

But survey respondents just passed another fiscal pop quiz with high marks. With the April 15 tax deadline approaching, seven in 10 likely voters in the March PPIC survey say that California currently ranks “near the top” (45%) or “above average” (26%) in state and local tax burden per capita compared to other states. Large majorities gave this response in earlier PPIC polls. In this area, the public’s perceptions are in line with fiscal reality.

California’s tax ranking varies depending on data and methods, but we are always on the high side in national studies of the 50 states. Recently, California ranked #4 in the Tax Foundation report and #15 in the Tax Policy Center report on state and local tax burdens. The reasons include our high cost of living and the public investments that we are making in our education system, environmental quality, and infrastructure.

What is most striking is the growing share of likely voters who say that California’s state and local tax burden is “near the top.” In the March PPIC poll nearly half (45%) express this view. The increasing number of voters who perceive the tax burden this way runs counter to other trends: the governor’s and legislature’s approval ratings are rising, more Californians say that the state is headed in the right direction, more say the economy is experiencing good times, and fewer say the state government is in a budget crisis.

What is most striking is the growing share of likely voters who say that California’s state and local tax burden is “near the top.” In the March PPIC poll nearly half (45%) express this view. The increasing number of voters who perceive the tax burden this way runs counter to other trends: the governor’s and legislature’s approval ratings are rising, more Californians say that the state is headed in the right direction, more say the economy is experiencing good times, and fewer say the state government is in a budget crisis.

Interestingly, the growing perception that California’s state and local tax burden is “near the top” is taking place in the years since the voters passed the Proposition 30 tax increases in November 2012.

Two groups known for their anti-tax sentiment—Republicans (50%) and conservatives (52%)—are predictably among the most likely to say that our state’s tax burden is near the top. Surprisingly, though, this view is widely held in more politically diverse circles—those annually earning $80,000 or more (58%), independent voters (52%), those living in households with children (51%), college graduates (49%), Latinos (48%), and homeowners (47%). About four in 10 Democrats (38%) and liberals (44%) also say that their state’s tax burden is near the top.

Importantly, the view that California is a national leader in high taxes has implications for fiscal preferences. Likely voters are closely divided on a Proposition 30 tax extension (48% favor, 45% oppose). But the majority (55%) of those who oppose a Proposition 30 tax extension say the state’s tax burden is near the top. Most likely voters say they want major (53%) or minor (31%) changes in the state and local tax system. The majority (52%) who want major changes also say that the state’s tax burden is near the top.

There are many reasons why tax proposals are a tough sell even in Blue California. They include high government distrust and little fiscal knowledge. We have identified a major force to be reckoned with as tax initiatives take shape for the 2016 ballot: a widely held perception that Californians are among the most burdened with state and local taxes in the nation. Tax proponents will have to convince voters that their plans will improve California’s ranking—as the state with the most promising future.

Cross-posted at PPIC.