Gov. Jerry Brown campaigned up and down the state in 2012 to pass a temporary measure known as Proposition 30, which raised the sales tax for four years and income taxes on high earners for seven years. It generated $8 billion a year to educate California’s 6.2 million elementary and secondary school students. This is the final year the state will enjoy full revenues under Proposition 30 before the temporary tax begins to taper off.

Voters are likely to hear a lot about the education budget this year because labor and health organizations hope to place an initiative on the November ballot that would extend Proposition 30’s tax on high earners at least through 2030. Taxes are always a difficult issue for voters. This time, the economy and school budgets have been doing well, but there are concerns looking ahead.

As Brown said in his budget proposal earlier this month, the state’s $71.6 billion school budget has increased more than 50 percent since 2011. The overall growth per student has gone up by more than $3,800, from $10,699 in 2011 to a projected $14,550 this year.

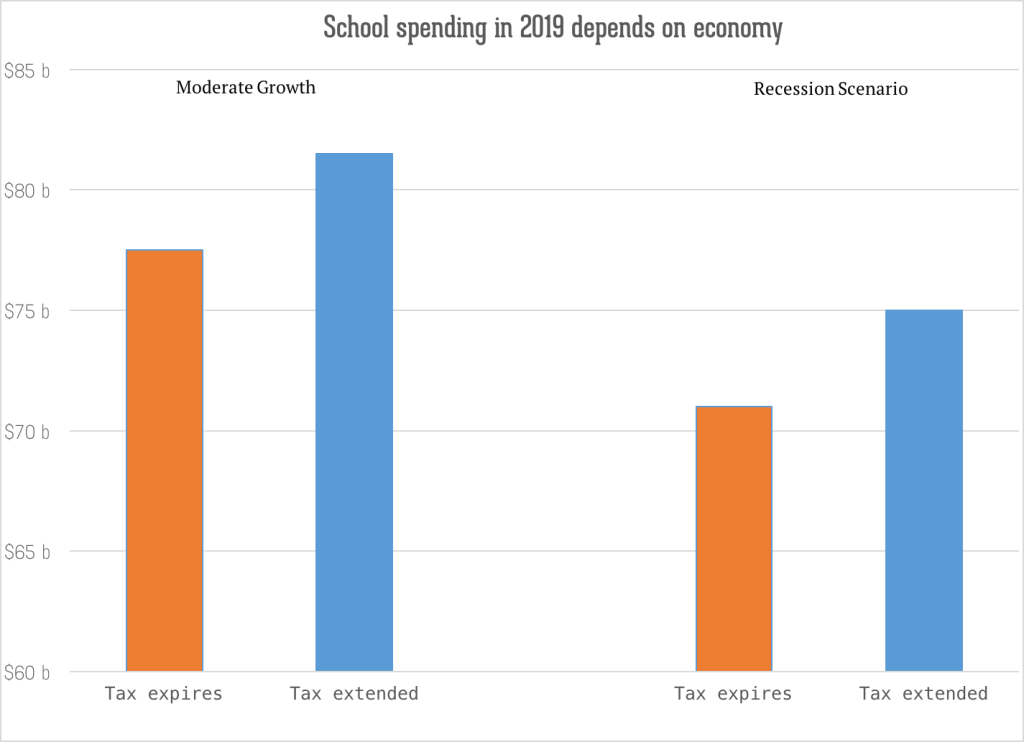

School spending is also projected to go up whether or not the Proposition 30 taxes are extended. The Legislative Analyst’s Office, the state’s nonpartisan budget analyst, projects the minimum funding guarantee for public schools and community colleges is projected grow to $77.5 billion in 2019.

In addition, if the economy continues to do well, it will trigger the so-called “maintenance factor” in the voter-approved school funding formula, generating another $6.3 billion state obligation for schools. The maintenance factor, which provides an added benefit for school budgets when revenues surge, is intended to be paid over future years.

If voters approve the tax extension, the budget analyst estimates it could raise between $5 billion and $11 billion a year depending on the health of the economy. Because schools get roughly 50 cents for each dollar of new revenue, the education guarantee would grow between $2.5 billion and $5.5 billion, meaning state school funding would be between $80 billion and $83 billion in 2019. In this case, school funding would keep up with the economy so that no maintenance factor is triggered.

If the economy stays healthy, either scenario — with or without a tax increase — appears positive for schools. But proponents of a tax extension make several arguments about the need to maintain the funding from Proposition 30.

An Education Week survey released earlier this month still ranks California at 41st in the nation on its financial support for schools. Supporters also say additional resources are needed to maintain education programs, lower class sizes and support teacher development.

School costs are also scheduled to rise significantly because of an agreement reached by lawmakers in 2014 to pay down about $67 billion in debt for the teachers retirement system. The agreement increased the amount teachers and the state will pay into the retirement program, but much of the increased cost was assigned to school districts. For them, the rising debt payment isprojected to consume about 38 percent of growth in the education budget between now and 2019.

Perhaps most ominous for school funding is the potential for the economy to slow down. Brown warns that a downturn is inevitable. And because the state budget is so dependent on income from high earners, state revenue is exceptionally volatile during economic changes.

If the state enters a recession, the budget analyst projects school spending will fall by $5 billion in 2017 and recover to $71 billion in 2019, roughly the same as this year’s projection. In this case, the state’s maintenance factor would be around $2 billion.

Without an extension of the Proposition 30 taxes, educators say the recession budget would force layoffs and service cuts to students.

The California Teachers Association, the California Federation of Teachers, California State Parent Teacher Association as well as public employee unions, hospitals and doctors are joining on aninitiative to stop the scheduled expiration of Proposition 30. While the quarter-cent sales tax hike would be allowed to expire, proponents are seeking to extend taxes on individuals earning more than $250,000 a year through 2030.

A second tax extension initiative has been proposed by the Service Employees International Union-United Healthcare Workers West to channel some of the proceeds to health care and early child development. In addition to making the taxes permanent, it imposes a new tax on millionaires. It’s unclear if the measures will be consolidated.

Brown, a Democrat, has signaled he isn’t keen on extending taxes even if they would only fall on the rich. The teachers unions’ initiative would also circumvent the state’s rainy day fund, a move he characterized as a “fatal flaw.”

An early survey shows voters appear supportive of extending a tax on the wealthy, even if they are unenthusiastic.

Last month’s survey by the Public Policy Institute of California found that just 37 percent of likely voters think extending Proposition 30 tax increases is important. But 54 percent of likely voters say they favor the extension.

Cross-posted at CALmatters.