Everyone has heard about pension costs but few have heard about the other retirement cost that’s burdening California governments and schools. “OPEB” — “Other Post-Employment Benefits” — are a form of deferred compensation, just like pensions. The principal OPEB benefit is a promise to cover post-retirement health costs. Because government employees in California may retire before they are covered by Medicare and often receive benefits on top of Medicare, OPEB promises in California add up to hundreds of billions of dollars.

The promises themselves are not a problem if sufficient money is set aside at the time the promises are made. You can see examples here of honestly-run enterprises that properly fund such promises. But if not, future budgets get invaded to pay off the past promises. That starves citizens at that time of the services they need because their taxes are being diverted to meet past unfunded retirement promises.

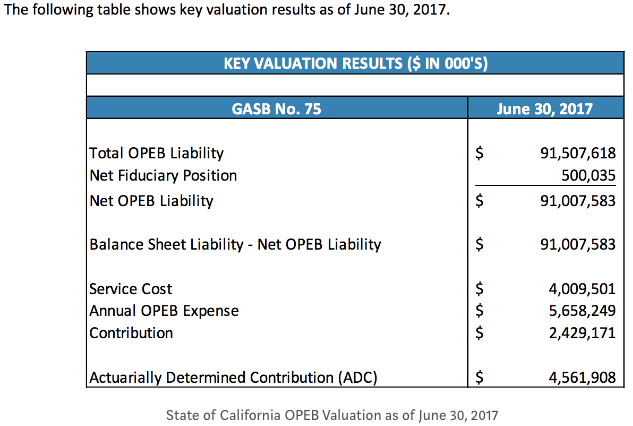

Elected officials in California have been making OPEB promises for decades without setting aside enough money to meet the obligations as they fall due. Every time they do so they create debt without voter approval. The result: the State of California has more OPEB debt than General Obligation Bond debt, which voters do have the right to approve. Last week State Controller Betty Yee reported that the state’s OPEB debt had reached $91 billion* at of June 30, 2017:

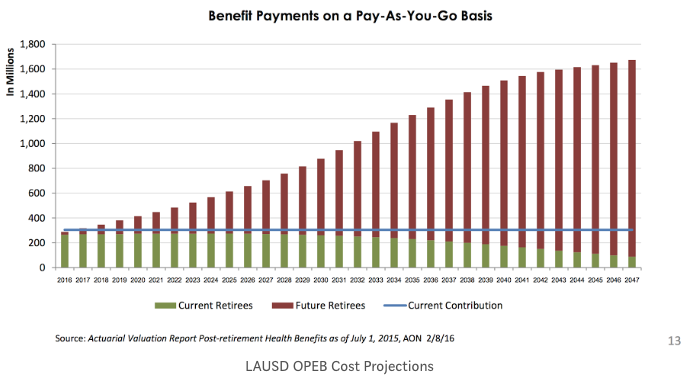

That’s just the state’s obligation. OPEB is also owed by many local governments and school districts. Los Angeles Unified School District alone has a $14 billion OPEB liability. Look what it’s doing to classrooms:

Now take a look at page 116 of the Governor’s Budget for 2018–19. Since Governor Jerry Brown took office in 2011, state spending on OPEB (retiree health and dental costs) has grown more than 50 percent to more than $2 billion per year. $2 billion in a $130 billion General Fund may not sound like much but all of it burdens a small portion of the budget that finances universities, courts, parks and other important programs, as explained here. That’s in part why their share of the General Fund has fallen nearly in half since 2010. Absent reform, that will worsen, especially when the state is no longer enjoying high revenues from a bull stock market.

The state has added more than $30 billion of OPEB debt since Brown took office in 2011. That will translate into an additional cost of $1.35 billion per year. Local governments and school districts have added billions more. To his credit Brown has boosted pre-funding of OPEB promises but to his discredit he hasn’t attacked the liability itself. That’s surprising because the Affordable Care Act and the state’s excellent Covered California insurance exchange provides one means for doing so. (Full disclosure: my wife and I are satisfied Covered California customers.) For example, in 2015 the City of Glendale enacted reforms that leverage the ACA and Covered California. But neither Brown nor Yee mention that option. Instead the only “solution” they mention is gradual pre-funding. As Yee puts it, “by 2048, it is estimated that the state will be 100 percent caught up in funding” the OPEB debt. But what Yee doesn’t tell you is that (i) OPEB is going to keep rising and crowding out critical services and (ii) her “100 percent” assertion is based on an accounting gimmick that’s derived from the same practice that allowed governments to hide the truth about pension promises.

You might ask why Brown and Yee don’t raise the obvious option of reducing the OPEB liability. Presumably they are afraid of the state’s politically powerful government employee unions that are the largest recipients of state spending and the biggest beneficiaries of OPEB debt. But don’t blame the unions. They are just doing their jobs. Blame Brown and Yee. They are supposed to represent the people.

In 2010 I testified to the California State Senate that one cannot both be a progressive and be opposed to pension reform. That’s because unfunded pension costs harm the state’s most vulnerable citizens. The same is true of OPEB. Cities all across California are regressively raising parking, traffic and other fees and the state and school districts are cutting back services, all in order to meet unfunded pension and OPEB costs. Yet instead of attacking OPEB and pension liabilities, California’s legislators are presently working to create a federal tax deduction for affluent people who have been disadvantaged by elimination of the state and local tax deduction over $10,000 per year. Doesn’t seem very progressive to me.