Last week’s primary election garnered considerable statewide and national attention, with much of the focus on the governor’s race and contested congressional seats. Further down the ballot, however, voters were asked to decide on millions of dollars of local tax, bond, and fee initiatives. On the whole, these measures enjoyed considerable success across the state.

We found that Californians voted on 107 local tax, bond, and fee measures, representing the range of fiscal tools that local jurisdictions can use to raise revenue and borrow funds. Bond measures were the most popular, with 42 different local governments seeking voter approval (37 K–12 school districts; 2 community college districts; 3 cities). There were also 32 parcel tax measures; those related to K–12 schools (12) and fire/public safety (10) were most common. Ballots also included proposals to impose or increase taxes on cannabis (13) general sales (9), gross business receipts (2), and hotel stays (3). And there were proposals to raise utility fees (3), business license fees (1), and bridge tolls (1).

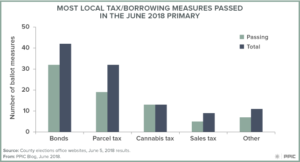

Most of the long list of funding proposals passed—but just putting a measure on the ballot did not guarantee success. Although counties are still counting some ballots, which could affect a race or two, at this time, we observe the following:

- Overall, voters passed 76 of the 107 measures.

- Of the 39 school bond measures, 30 passed. Proposition 39, passed in 2000, lowered the threshold for passing school bonds from a two-thirds majority to 55%. Had these measures been subjected to the previous standard, only 11 would have passed. The 19 measures approved under the current standard increased borrowing for investment in public schools by $1.8 billion.

- On the heels of one of the states’ worst seasons of wildfires on record, California voters held the line on parcel taxes intended to support fire protection, with only 3 of the 9 measures passing.

- All 13 of the cannabis tax proposals passed overwhelmingly.

California touched off a revolt against taxes 40 years ago. Primary voters in 2018 generally voted for increases but were relatively discriminating in their support, depending upon the type of tax and its intended purpose. This discernment comes at a time when the state’s economy is growing and unemployment is low. It will be interesting to see what happens in November, when we expect to see even more funding measures on the ballot.

Originally published by the Public Policy Institute of California.