Last Friday, Governor Newsom released a budget proposal for the next fiscal year for the legislature’s consideration. Our comments on the principal spending items of interest to the Govern For California Network are below:

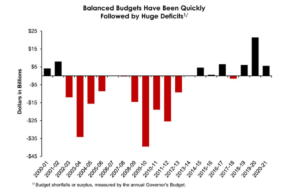

Reserves. We are pleased the governor proposes to use much of a projected budget surplus* to build additional reserves. Because California’s tax revenue is dependent on personal income taxes that are derived in significant part from volatile investment gains, tax revenues are hostage to stock and other investment markets that have been on the rise for more than a decade. When that music stops — and it always does — the negative consequences for California’s budget will be enormous. As the governor makes clear, even $20 billion is just a fraction of those consequences. Until the state adopts a more stable revenue generation system, hefty reserves are the best defense. We would add even more.

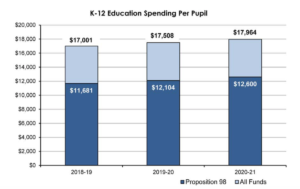

K-12. At $84 billion, Proposition 98 spending is nearly 70 percent greater than ten years ago and total K-12 spending will exceed $100 billion this year on nearly six million students but student performance has not materially improved and many school districts are in fiscal distress despite record revenues. The causes predate Governor Newsom’s tenure but still we are disappointed the governor proposes only to modify bureaucratic LCAP forms and to boost training dollars rather than to enact bold reforms that would enable school districts to manage workforces and budgets for the benefit of students. 90 percent of California’s public schools are operated by public employees under an Education Code written by elected officials who have been heavily influenced by public employee unions since 1975. When combined with the centralization of school funding in Sacramento following the passages of Proposition 13 in 1978 and Proposition 98 in 1988, one result has been central control that runs schools chiefly for the benefit of those unions instead of students. GFC believes school boards and principals must be liberated to govern districts for the benefit of students. We recognize the difficulty of taking on long-time special interests but times are changing and support is there for legislators willing to stand up for students.

Also, the Governor’s Budget doesn’t address easily fixable fiscal distress in school districts such as Sacramento City where, despite record revenues, young teachers are currently being laid off in part because — believe it or not — that district is unnecessarily diverting money from classrooms to subsidize out-of-pocket health costs for retired employees, including retirees covered by Medicare or eligible for Obamacare or new state subsidies for middle-class Californians enacted last year. Several other school districts, including LAUSD and SFUSD, make similar elections to the detriment of students and current teacher staffing and salaries. We believe the legislature should require school districts to means-test retiree health subsidies and to make full use of other sources of funding before allowing classroom funding to be invaded to pay for such subsidies.

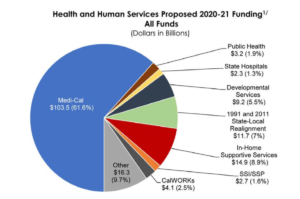

Medi-Cal. Medi-Cal is another $100 billion per year program, in this case serving nearly 13 million Californians. We are pleased to read the governor proposes a greater focus on improving health itself. Despite a doubling of Medi-Cal spending since 2010, health has not materially improved and emergency room visits are up. Towards that end we hope the legislature will focus attention on liberation of health care providers from state rules that favor special interests (chiefly doctors represented by the California Medical Association) that limit access for Medi-Cal patients and opportunity for providers. A top priority in 2020 for GFC is AB 890, a bill to liberate nurse practitioners.

Also, the Governor’s Budget doesn’t address easily fixable fiscal distress in school districts such as Sacramento City where, despite record revenues, young teachers are currently being laid off in part because — believe it or not — that district is unnecessarily diverting money from classrooms to subsidize out-of-pocket health costs for retired employees, including retirees covered by Medicare or eligible for Obamacare or new state subsidies for middle-class Californians enacted last year. Several other school districts, including LAUSD and SFUSD, make similar elections to the detriment of students and current teacher staffing and salaries. We believe the legislature should require school districts to means-test retiree health subsidies and to make full use of other sources of funding before allowing classroom funding to be invaded to pay for such subsidies.

Also, we note the governor wishes to extend Medi-Cal coverage to undocumented residents over age 65. Whatever their views of that policy, we hope the legislature understands that the costs of Medi-Cal expansions fall primarily on discretionary programs such as CSU, UC and the Judicial Branch. While the consequences are less noticeable during robust revenue years such as we are experiencing now, they are harsh when the state suffers a drop in tax revenues. There really is no free lunch.

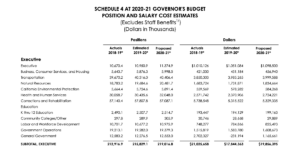

Corrections and Rehabilitation (CDCR). At $13.4 billion, CDCR is the third largest consumer of the General Fund. To put it into perspective, CSU, UC and courts together will receive only $10.8 billion from the General Fund. The state’s prison population has declined to 125,000 and we are encouraged by the governor’s consideration of closing at least one prison within five years. This year the legislature and the governor will enter into a new compensation contract with CDCR employees that we hope will rein in excessive spending that, including benefits, approaches $10 billion for 57,000 employees.**

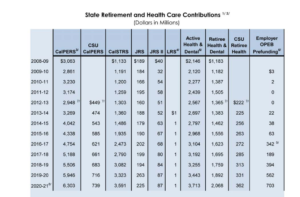

Retirement Costs. Spending on pensions and other post-employment benefits continues growing at a rapid pace, up 133 percent compared to ten years ago to $14 billion including Special Fund spending. In addition, in 2017-18 the state started making $12 billion of supplemental pension contributions designed to improve the earning ability of state pension funds. While those additions to pension assets will help to reduce future pension spending a bit, it’s too late to make a difference. That’s because the savings to be obtained are trivial compared to the cost of nearly $800 billion of pension liabilities accreting (growing) at 7 percent per annum. Ultimately legislators and the governor will have to reduce pension liabilities — and not just for the state but also local governments and schools — by suspending automatic benefit increases and reducing un-accrued benefits for years not yet worked.

Similarly, it’s too late for the state to obtain much value from belatedly pre-funding obligations for retiree health subsidies. Instead (and as expressed above about schools), we encourage the legislature to require the state and all California governments to means-test retiree health subsidies and to make full use of Medicare, Obamacare and the state’s premium support for applicants with incomes up to 600% of the poverty level before invading government budgets for these subsidies.

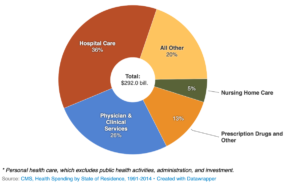

Reducing Healthcare Costs. The governor proposes to establish a single market for drug pricing within the state and to negotiate partnerships to establish the state’s own generic drug label. We hope the legislature also looks for measures relating to larger categories of spending.

Among those measures we believe would be of value to Californians is liberation of more practitioners from the state’s special-interest-protecting (and sometimes downright feudal) licensing rules.

If you detect a liberation theme in our comments, you’d be right. For decades, little has changed in the delivery of California’s public services, and every year the same special interests say the same thing: all they need is more money to improve those services (eg, CMA says “raise Medi-Cal reimbursement rates for doctors,” CTA says “raise taxes, spend more money on training,” etc.). Meanwhile, despite $200 billion per year of spending, neither learning nor health have materially improved and state services operate under illiberal straitjacket rules that all too often favor providers or cronies over customers. Everyone in Sacramento knows the real reason nothing changes: fear of CMA, CTA, CCPOA*** and other long-time insiders. They also know that political philanthropists like us traditionally have been unreliable and unknowledgeable supporters while insiders know how things work and play a ruthless game. When once I asked then-US Senator John Kerry why he and other politicians of both parties so often did the bidding of special interests, his response was “David, they are always there for us.” He’s right — and from that comment I learned that WE must also always be there for legislators willing to govern in the general interest. If not, special interests will always win.

*It’s less of a surplus than meets the eye. That’s because states often employ budgeting methods that omit and/or understate certain expenses, as illustrated in a four-part series in 2017 that may be found here, here, here and here. California is one of those states but is not unique among states in doing so.

**Errata: As attendees at the Policy Retreat may recall, I cited a $15 billion figure for all-in CDCR spending because at that time I believed that not all costs of employee benefits were included in reported sizes of department budgets. But Department of Finance staff has kindly informed me that all CDCR-related benefits costs are reflected in the reported size of the CDCR budget.