In addition to its regular pension spending, the State of California is providing an extra $12 billion over a four-year period to boost the assets of the state’s two pension funds in an effort to reduce future pension spending. But the impact will be negligible. That’s because pension liabilities will grow >10x as much over the same period.

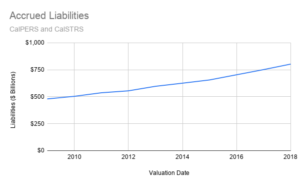

Pension liabilities grew >$300 billion from 2009 to 2018:

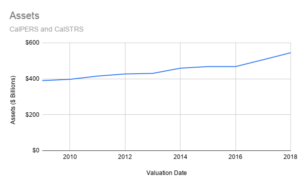

That growth is automatic because California’s pension funds suppress the true value of pension liabilities* when they are first created, as explained here. Even a tripling of the stock market and a tripling and doubling of pension spending by schools and governments couldn’t boost pension assets enough to keep up:

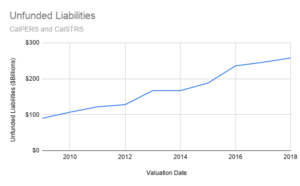

As a result, the difference between pension liabilities and pension assets (“Unfunded Liabilities”) nearly tripled:

Pension costs for schools and governments rose alongside, forcing schools to lay off teachers, shut programs and provide insufficient raises for young-in-career teachers. But you ain’t seen nothin’ yet. In 2010 I published a Wall Street Journal op-ed entitled Dow 28,000,000: The Unbelievable Expectations of California’s Pension System that explained the levels stock markets must reach to meet the projections employed by California’s pension funds. Failure means both increased tax payments and reduced government services — as amptly demonstrated by school strikes and layoffs despite major tax increases in 2012 and 2016.

It is only a coincidence that this note is being written during a sharp market decline, which is largely irrelevant to what will continue to be an upward curve of pension spending. That’s because the Dow Jones Industrial Average would already have to be at >50,000 for state pension funds’ expectations to have worked out.

More money from taxpayers will not solve the pension problem. At this stage only a reduction in liabilities will work. That means a suspension in automatic benefit increases and a reduction in benefits for years not yet worked. But elected officials in California have been too afraid of government employee unions to act.** The only way that will change is through persistent and permanent protection of lawmakers who legislate in the general interest.