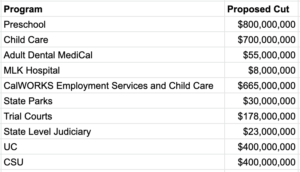

Governor Newsom’s Revised Budget proposes cuts to programs in the event more federal COVID funds are not provided. We propose a solution that would free the 10 programs below and improve the state’s structural deficit without jeopardizing the financial security of retired state employees.

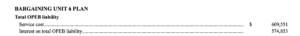

The first eight programs would be funded by savings from substituting Oregon’s or Colorado’s programs for providing medical and prescription drug benefits to retired state employees and their dependents. Referred to as “OPEB” (“Other Post Employment Benefits”), the change would save ~$2.5 billion in cash per year and avoid ~$2.5 billion in new debt per year. Unlike federal funds, the savings would be on-going.

Retired state employees would fare perfectly well under the Oregon or Colorado plan. Under current California law, retired state employees and their dependents receive premium-free medical and prescription drug benefits even if the retiree is eligible for subsidies from others. As a result, California expends $5 billion per year on OPEB compared to $10 million and $30 million in Oregon and Colorado. Adjusted for population differences, California spends 60x and 24x the amounts per resident spent in Oregon and Colorado. Here’s how it works:

Retirees Under Age 65: Currently, a California prison guard who retires with a pension at age 50 receives OPEB subsidies regardless of income and even if the retiree takes another job or is eligible for Medicaid or premium support from the Affordable Care Act or from Covered California’s Middle Class Subsidies enacted into law last year. That means the state already provides ample health insurance support for individuals with incomes up to $75,000 per year and $200,000 per year for families of four. As a result, retired state employees under the age of 65 rarely need OPEB subsidies, yet that’s the most expensive OPEB group for taxpayers. Annual cost plus interest just for prison guards is more than $1.1 billion per year:

Oregon provides no subsidy to this group. Colorado provides a subsidy capped at $230 per month but does not provide Middle Class Subsidies (i.e., both probably aren’t necessary). At a minimum, OPEB subsidies for this group should be a last resort, not a first stop.

Retirees aged 65 and older already get health insurance at a low cost via Medicare, but support may still be needed in some cases. Oregon and Colorado limit their subsidies to this group to $60 and $115 per month but California imposes no limit. A cap should be imposed.

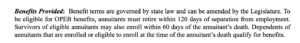

In case you’re wondering, page 136 of the state’s CAFR states that OPEB benefits may be amended by the Legislature:

The other two programs (UC and CSU) would get their money by being required to adopt the same reforms, which would save each ~$400 million in cash plus permit them to avoid issuing an equal or greater amount of new debt each year.

There is no financial or moral reason to cut programs for vulnerable Californians in order to maintain lavish subsidies for special interests who have access to other subsidies, including Middle Class Subsidies funded by individual-mandate penalties assessed on ordinary Californians. The solution is not to rely on one-time federal funds that, as the LAO has pointed out, would worsen the state’s structural deficit but rather to make full use of subsidies, reduce ongoing OPEB expense, and reduce the structural deficit.

More programs could be saved by pension reforms, but that’s a subject for another day.