CalChamber poll (Part 2): Voters crave sensible policies, no new taxes

Yesterday we reported that Californians are taking the Covid-19 pandemic seriously, and expect their elected leaders to do the same. But the pandemic isn’t the only issue troubling Californians. The cost of living remains a profound concern. When asked if their family would have a better future if they left California, a stunning 54 percent […]

CalChamber poll (Part 1): Voters serious about addressing pandemic consequences

Californians are taking the Covid-19 pandemic seriously, and expect their elected leaders to do the same. The sixth annual CalChamber poll, The People’s Voice, 2020, found that voters are keenly aware of the widespread effects of the pandemic. Nearly half of all voters have suffered an economic impact: reduced work hours, lost job, pay cut, […]

Census deadline approaches

The unremitting pandemic and economic crises of 2020 have overshadowed what would normally have been a dominant event of community action: the decennial census. Most of you are probably generally aware of the census, but few of you likely know that the census will conclude at the end of this month. The census is more […]

Legislative Fumble

The California Legislature fumbled a chance to boost economic recovery in the state by choosing the easy path: business-as-usual. Facing the three horsemen of the CApocalypse – pandemic, economic collapse, and social unrest – the Legislature instead took refuge in the warm embrace of its special interests, legislating as if millions of residents weren’t jobless […]

Legislators Gotta Legislate

Despite their leaders’ vow to concentrate their attention on the pandemic and economic crises, it’s business-as-usual at the California Legislature. In early Spring, the Legislature had good reason to give the full measure of their focus to the state’s worst modern health crisis and economic freefall. Legislators scrambled their schedule, going on hiatus for two […]

The People’s Voice: Coronavirus Edition

California voters are understandably anxious about the health and economic crises facing families and workplaces. CalChamber commissioned a brief survey to better understand how voters want state leaders to address key economic issues as the clock ticks down on the 2020 Legislative session. The chilling events over the past three months have moved California voters […]

How to sabotage a recovery: Raise taxes

Even before Covid-19, many Californians were struggling with the high cost of living here. The long-time willingness of many Californians to pay the “sunshine tax” premium for living in a state with great weather, universities, entrepreneurial culture, and lifestyle has eroded in the face of high costs of daily life. Things have gone from bad […]

Help small businesses recover by pausing the annual minimum wage hike

Small businesses have suffered a severe setback from the recent, understandable public health actions by state and local leaders to reimpose restrictions on commerce involving public gathering. These small businesses, especially restaurants, hospitality, tourism, entertainment and personal services, also employ many low-skilled, low-wage workers, often in entry-level jobs on the lower rungs of the economic […]

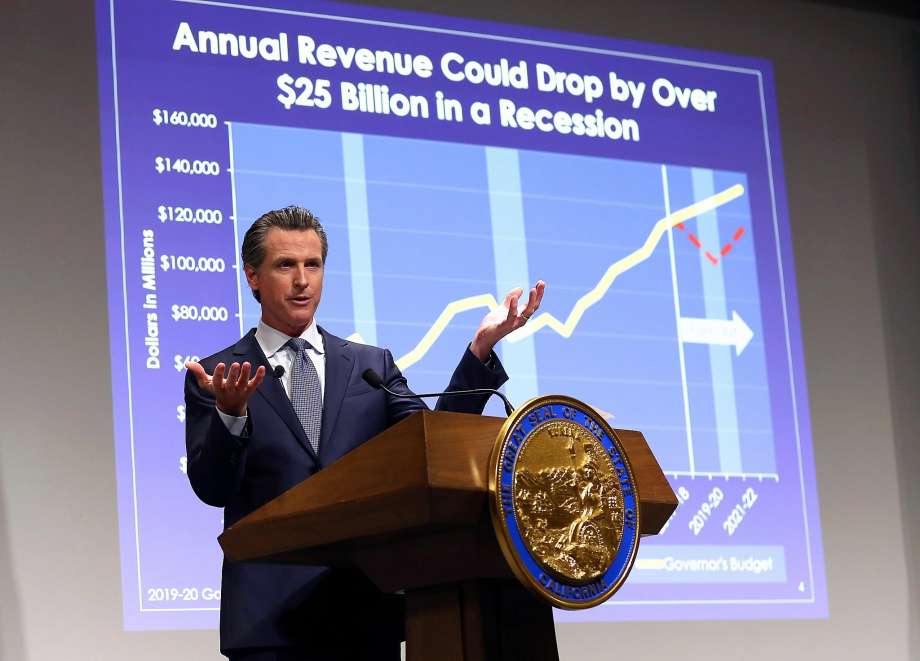

Too Soon for Taxes in State Budget

Despite facing a June 15 deadline to pass a state budget, Governor Newsom and legislative leaders are, prudently, deferring a number of major fiscal decisions until they receive better information on the intention of Congress on state assistance and the actual level of state income tax payments that were deferred for three months. Given those […]

Remote Voting by the Legislature should be Narrowly Framed

Most of us have logged onto a Zoom call or Teams meeting or Facebook happy hour. But what about remote voting – by the Legislature, anyway? What would have seemed absurd in January is now under serious consideration: a proposal to enshrine in the State Constitution protocols for Senators and Assembly Members to vote on […]