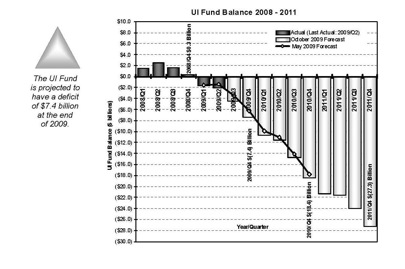

Lost in the avalanche of bad news this Fall about the state budget is the recent fund estimate for California’s Unemployment Insurance (UI) Fund. In its October report, EDD projected the fund to have a deficit of $7.4 billion by the end of 2009, growing to $18.4 billion by the end of 2010, and an amazing $27 billion deficit by the end of 2011.

What does this mean? Should employers, employees or current UI recipients be worried? What options does the state have?

The condition of the fund is shown in the chart compiled by EDD below, and contained in EDD’s October UI Fund Balance report. The full report can be accessed at EDD’s website, www.edd.ca.gov.

As late as December 2008, the UI fund had a positive balance of $326.2 million. The unprecedented speed with which unemployment rose in 2009 quickly changed this. UI is an employer-funded program, and the claims made on the UI fund in 2009 overwhelmed the fund contributions. California has had a negative fund balance in the past, as recently as the early 2000s, but all previous deficits are dwarfed by the current one.

To get a national perspective on the Fund situation, earlier this week I contacted Steve W. Carter, the Senior Manager for Government Relations-Tax at TALX Corporation. Steve knows more about UI funds throughout the country than anyone I know. Though TALX is based in St. Louis, Steve keeps in close touch with the California situation. When I spoke with Steve, he knew right away the fund balance for California as of last Friday. Steve made the following points about California’s fund dynamics:

* From a national perspective, California’s situation is not unusual. 25 states, including California, have negative fund balances today, and are borrowing from the federal government, to keep making UI payments. California has by far the largest loan from the federal government (nearly $5 billion as of last Friday), but this largely reflects the size of California’s workforce compared to other states. Seven states have borrowed in excess of $1 billion.

*Neither California nor the other states are in danger of defaulting on payments. The federal government is making loans to states for on-going UI payments; and under ARRA these loans are no-interest loans for 2009 and 2010.

*Only two states, Florida and Indiana, have taken legislative action in 2009 to increase the taxable wage base and/or the UI rate to cover increased claim costs. However, in both states, there is movement to reconsider the rate increases, due to fears that these increases will make job losses and slow hiring even worse.

In the California legislature, two bills have been set out to increase the taxable wage base and/or the UI rate. Currently, the taxable wage base is $7000 and the maximum rate is 6.2%. Previous proposals to increase the wage base/UI rate have failed, due to opposition of employer groups. It’s difficult to see a different result this year, with state unemployment at 12.5%–the highest since World War II—and no indications of a significant pick-up in hiring, even as other economic indices improve.

This does not mean that the deficit can last forever. UI recipients are not in danger of losing payments. However, if the state takes no action, the day of reckoning will come. The federal loan process includes a mechanism by which UI rates increase for state employers, if the loan is not repaid within several years. The UI fund solvency is likely one more financial matter the next California Governor must address in 2011.

And beyond the solvency issue, are the two other on-going UI Fund challenges: combating UI fraud and moving UI from a benefit system to a re-employment system. Both of these have been around for the 30 years that I’ve been following UI in California. They’re perhaps even more complicated than the solvency issue—and that’s saying something.