The worst since the Great Depression? Since the early 1980s? In our lifetimes? It’s too early to tell, of course, but so far in California this recession has been neither the mildest nor the worst during the past several decades. However, none of the economic signs on the horizon are encouraging; most of the leading indicators point south.

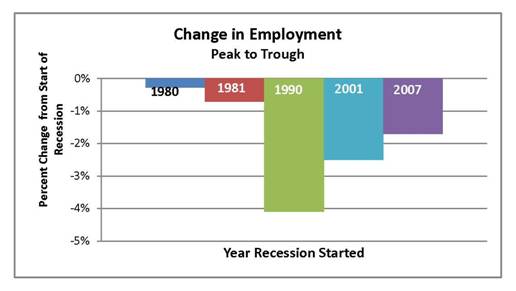

Employment is a lagging indicator of recessions, so the worst is probably yet to come. One-year into the downturn, California’s employment losses have been material, but not nearly as bad as the two most recent recessions. Ultimate job losses from the 1990–93 recession amounted to a stunning 4.1 percent of employment from the 1990 peak. To reach that level of employment, California would have to lose another 365,000 jobs, about half-again the number lost so far.

?

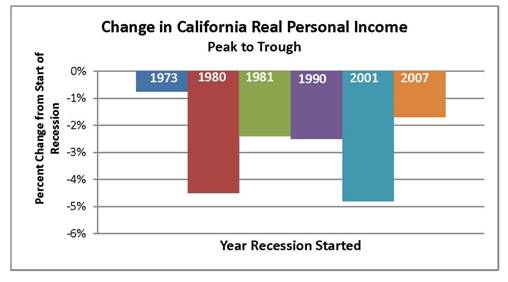

Income has also suffered, but again, not as severely as other recessions – so far. The 1981 recession saw a sharp 4.5% drop in real personal income, but the economy quickly recovered before the next downturn. The California economy took a severe beating in the 2001 recession, losing nearly five percent on an inflation-adjusted basis. So far, this recession has resulted in a 1.7% drop in real personal income, although no-one believes it has hit bottom yet.

?

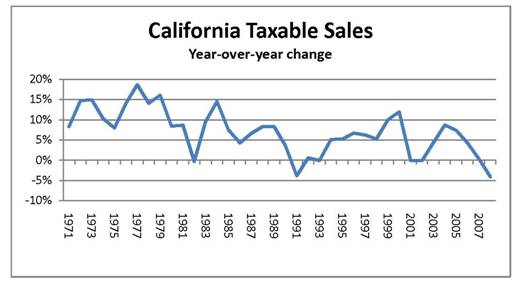

To be sure, this recession has hit certain sectors of the California economy disproportionately hard, including construction, financial services, and retail. The pullback in consumer spending has sharply affected retail sales.

?

Of course, the changing California economy has radically changed the effect of recessions on state and local treasuries. Regarding taxable sales, the current recession is on par with the severe downturn of the early 1990s. A quarter-century ago, California was more dependent on traditional manufacturing, with its strong wage base. The recessions in the 1970s and the early-1980s were relatively mild. Since then, more of the state’s revenues have come in the form of capital gains and stock options, which are far more sensitive to economic and financial signals. Therefore, the more recent recessions have had a worse effect on state and local budgets than earlier downturns.