More good news and bad news for the California housing economy.

Home prices continue their unabated decline, but existing home sales are on a roll – especially in inland California. New housing starts are still anemic, but government programs are poised to subsidize that end of the market.

First the bad news:

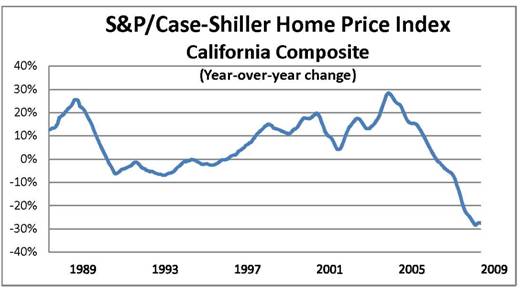

California home prices continued their freefall into 2009. The Standard and Poor’s monthly index of metro home prices showed California registering another record year-over-year drop. The composite average for San Francisco, Los Angeles and San Diego prices dropped in January by 27 percent from the previous year, the same as December’s year-over-year drop, but short of the recorded by the state, and exceeded only by the Sunbelt cities of Phoenix and Las Vegas.

According to this index, composite home prices for metropolitan areas of California have fallen to 2002 levels, although for San Francisco Bay Area itself, prices have dropped to 2000 levels.

The crumb of good news is that the tracking for annual change hasn’t gotten any worse for the past five months, which may mean that the price decline has hit bottom.

?

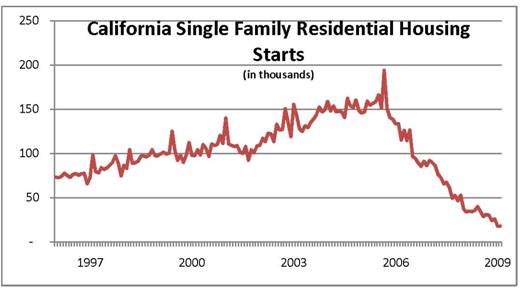

Tumbling home prices continue to devastate the new housing market, which remains in historic doldrums . However, new and generous federal and state tax incentives have apparently gotten the attention of some new home buyers and are being snapped up – although it is too early to gauge their effectiveness in jump-starting new housing construction. A major impediment remains financing for new construction projects.

?

A major bright spot in housing is a rally in home sales, especially the resale marketplace. Driven by plummeting home values and a large inventory of existing homes (including a large pool of foreclosed homes), resales throughout California are on the rise.

According to MDA Dataquick: An estimated 36,215 new and resale houses and condos were sold in California last month. That was up 23.9 percent from 29,225 in November and up 47.4 percent from 24,565 for March, 2008. Sales have increased on a year-over-year basis for the last nine months.

Of the existing homes sold last month, 57.4 percent were properties that had been foreclosed on. A year ago it was 35.5 percent.

Also according to Dataquick, the market is continuing to clear the low-cost inland foreclosures in Southern California. The median price paid for a home was unchanged from January and February, indicating that the market may be exploring price floor levels. The more expensive markets remain in a wait-and-see mode as lenders continue to hold back on making “jumbo” home loans. Once financing opens up for more expensive homes, that market could begin to clear. This could be a leading indicator for recovery in the housing market in California.