Populist and anti-corporate rhetoric have captured the political and media narratives recently, with everyone from President Obama to Occupy<insert your town> bemoaning growing income inequality and corporate compensation.

No matter how the economy fares in 2012, Californians will be on the receiving end of tax-the-rich demands from now until the November election. Three ballot measures have been proposed to hike Californians’ income taxes, while several others take aim at corporate or business taxes.

Two of the three income tax proposals target the rich – in words as well as in fact. The Governor’s proposal finds,

“With working families struggling while the wealthiest among us enjoy record income growth, it is only right to ask the wealthy to pay their fair share…The chief purpose of this measure is to protect schools and local public safety by asking the wealthy to pay their fair share of taxes.”

The California Federation of Teachers really dials up the rhetoric:

“In addition to being one of the largest economies in the world, California has one of the largest income gaps between the wealthy and the middle class. Millionaires and billionaires have increased their wealth and have benefited from tax loopholes, low tax rates, and reductions in federal tax rates. In fact, study after study has found that the rich have gotten much richer over the past 30 years and now own an unprecedented share of California income, while middle class families have seen a decline in real wages. Over the last two decades, the average income of the top1% of Californians increased by 50%, after adjusting for inflation, while the average income of the middle fifth fell by 15%. In 2009, the average income of the top 1% was $1.2 million, more than 30 times that of Californians in the middle fifth. Yet the wealthy also benefit from well-funded schools and universities, social services, public safety, and well-maintained roads and bridges.”

To her credit, Molly Munger resists playing the populist card:

“As Californians, we all should share in the cost of improving our schools and early education programs because we all share in the benefits that better schools and a well-educated workforce will bring to our economy and the quality of life in our state.”

It certainly isn’t news that California is the home of choice for many wealthy people, some who made their money here; others who brought it with them; still others who inherited their wealth from hard-working forebears. The state also has a large population of unfortunate, uneducated or unmotivated poor – many of whom are, we hope, at the beginning of what could be a more lucrative life’s journey; others who came here from even more desperate countries; or others for whom life’s lottery was a bust.

But even stipulating income inequality exists in California, what is a fair share of taxes, especially for “the rich?” Wealthy Californians pay 10.3 percent of their income in taxes; middle-income residents don’t even begin to pay income taxes until (as a family of four) they make $54,500 in adjusted gross income.

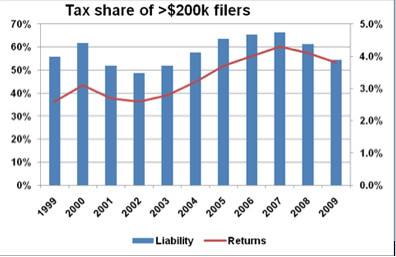

In fact, the California personal income tax is heavily weighted to the well-off, already. According to the Franchise Tax Board, the top 3.8 percent of tax filers in California – those who make more than $200,000 – paid a whopping 54.5 percent of all personal income taxes. And even this is low by historical norms. Absent a recession, the wealthy would be paying well north of 60 percent of all state income taxes (see chart, below). Adding five or ten billion dollars to the taxes of the wealthy would increase that share to 60% or 65%, or even above 70% in good times (assuming the rich stuck around to enjoy their new tax bills). Is that fair, more fair, or not fair enough?