There must be something inherently gratifying about governing by crisis. I imagine it gives policymakers a sense that their heroic actions to save our state from perpetual crises are why they entered public service in the first place. After all, planning for the future may not bear fruit until long after a lawmaker’s term has expired.

One might be justified in making the assertion that forecasting revenue in California is more of an art than a science. But even calling it an art is a stretch. It’s really more like a lottery.

As astute readers of this blog are well-aware, California’s volatile revenue structure is the result of a reliance on high-income earners – whose earnings often comprise capital gains as a significant share. In other words we’ve allowed our tax system to be unnecessarily vulnerable to the ups-and-downs of the economy. Take, for example, Legislative Analyst Mac Taylor’s perspective on the likelihood of a Facebook IPO later this year:

“In the coming months, the state’s revenue forecasts will need to be adjusted somewhat to account for the possibility of hundreds of millions of dollars of additional revenues related to the Facebook IPO. These revenues could affect the budgetary outlook beginning in 2012–13. We caution that it will be impossible to forecast IPO–related state revenues with any precision, and it is likely that little information about the state revenue gain from the Facebook IPO will be available before investors file tax returns in April 2013.”

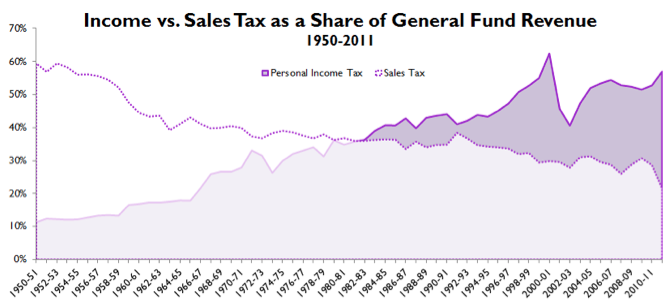

That’s only part of the problem. Over the past 50 years, the primary source of revenue for the state budget has shifted from the sales tax to the personal income tax:

Taxing income at a higher rate than consumption greatly distorts market decisions because it limits the availability of private investment for the production of goods and services, resulting in a deadweight loss for public coffers.

The challenge for policymakers in a world of finite resources and infinite demands is that they feel boxed into a corner and overcommit to unsustainable spending levels (including tax expenditures) in good years, knowing full well that those programs will need to be cut in bad years. Democrats and Republicans are equally culpable of this behavior.

We can address this structural myopia by continuing to blame members of the “other” party or we can actually try to solve our fiscal problems at their root. Sure, spending limits and tax increases are legitimate options, but why tinker around the edges when we can go to the core of the problem?

Moving toward a more modern system with a broader base and lower overall rates – like that proposed by the Think Long Committee for California – is a better solution that can break us out of our manic cycle of public finance. Oh that’s right, we like crisis. Besides, there’s no trust in the system, so why would voters ever believe that allowing them to keep more of their money while taxing more of their consumption at lower rates would make everyone better off?

I like roller coasters as much as the next thrill seeker. But without more trust in the system, Californians are unable to have an honest conversation about the inevitable tradeoffs embedded within our deeply flawed revenue structure. Then again, maybe that’s the point.

The blame game is a necessary ingredient for perpetuating our ongoing fiscal crises. If we actually started looking at how we could solve our problems with an approach that encourages shared responsibility instead of placing the blame with someone else, governing starts to get boring really quickly.

Perhaps Mr. Zuckerberg’s possible decision to make Facebook public this year will lay the golden egg we need to continue delaying the conversation we all know it’s time we had: What services do we want and what are we willing to pay for?