Crossposted on MPowered

The California Air Resources Board’s (CARB) cap-and-trade auction will create needless costs for employers at a time when our state must compete, scrap, wrangle, advocate and fight for every high-wage job we can get.

These costs will seriously hamstring our ability to grow. What most people don’t know is that CARB is asking employers to pay for far more emission credits than are needed to reach our goals. California will reach it’s 1990-level greenhouse gas emissions without the economy-debilitating cap-and-trade auction, but CARB continues to move forward.

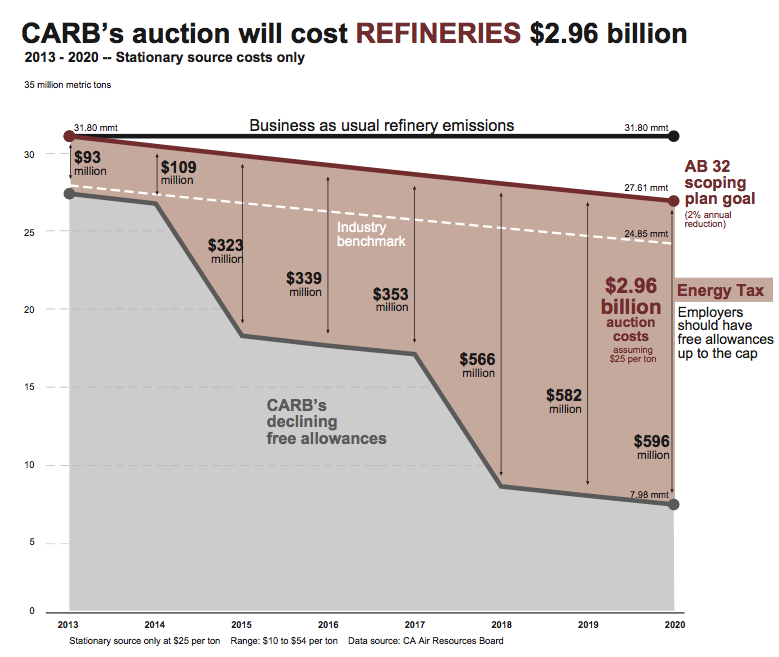

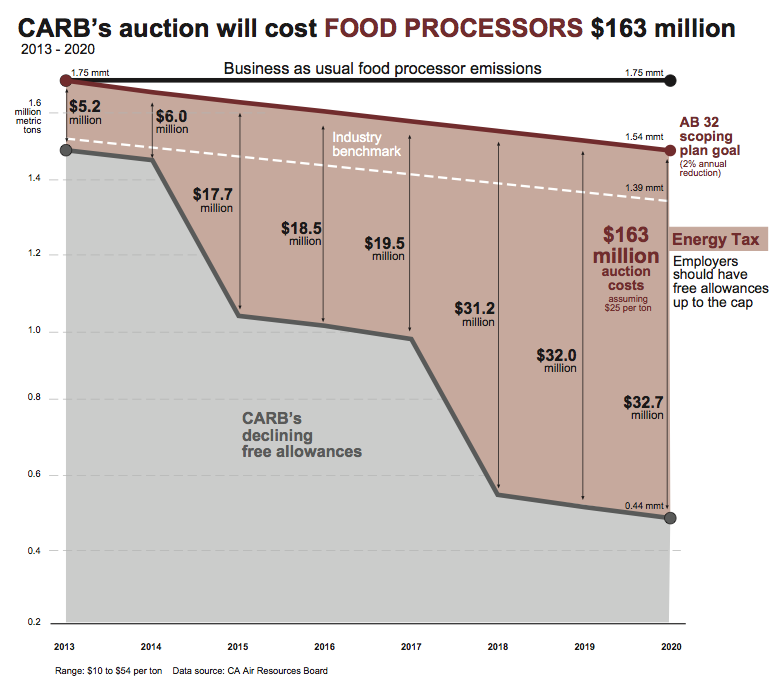

In the charts below, the red zone represents the amount that two particularly critical sectors — refiners and food processors — will have to pay to purchase emission credits in CARB’s auction over the next eight years. Those credits will be purchased even though the particular sector will already be on track for 1990 levels, with annual 2 percent reductions.

This punitive energy tax equals $2.96 billion in California-only costs on the refining industry and $163 million on the food processing sector. Remember too, while this auction raises a windfall of money, the 2006 AB 32 legislation prohibited revenue collection beyond the administration of the program.

Click images for larger size.