Crossposted on Advancing A Free Society

Pensions and other retirement costs will consume more than 23% of discretionary state spending in fiscal year 2012-13, according to the budget recently passed by the California State Legislature and signed by Governor Jerry Brown – nearly three times the share taken up by retirement costs just ten years ago.

For Californians, rapid growth in retirement costs has meant less money for universities, parks, courts and other services as well as a temporary tax increase in 2009 and another being proposed currently (one of three proposed tax increases on the November ballot – Propositions 30, 38 & 39). In the absence of reform, that share will grow, which means even more taxes and fewer services.

California’s general and special fund spending for 2012-13 is budgeted at $131 billion and effectively fits into three categories: Non-discretionary, Fiscally-protected and Discretionary.

Allow me to explain all three in layman’s terms:

- Non-discretionary spending consists of constitutionally-protected spending for K-12 education, community colleges and voter-approved general obligation bonds; special fund spending dedicated to specific purposes, such as for parks, environmental protection and motor vehicles; and court-ordered spending, such as on prison healthcare. Legislators have little control over Non-discretionary spending, which this year amounts to more than $80 billion. One exception is for the state employees’ salaries that make up a portion of that spending. Over the past ten years, legislators allowed salaries to grow 46% – more than the 36% growth in overall spending, but less than the 54% growth in revenue over that period.

- Fiscally-protected spending consists of state spending on Medicaid (known as “Medi-Cal” in California). Reductions in state spending on that service would result in reductions in federal support and thus produce no net budget savings.

- Discretionary spending, which for Fiscal Year 2012-13 amounts to $28 billion, or 22% of general and special fund spending, consists of everything else, including but not limited to pensions and other retirement costs; support for the University of California and California State University systems; prison spending not required by courts; spending on K-12 and community colleges in excess of amounts constitutionally required; discretionary health and human services spending; and non-special-fund spending for parks, courts and other services. It is with respect to Discretionary spending that elected representatives make all the decisions.

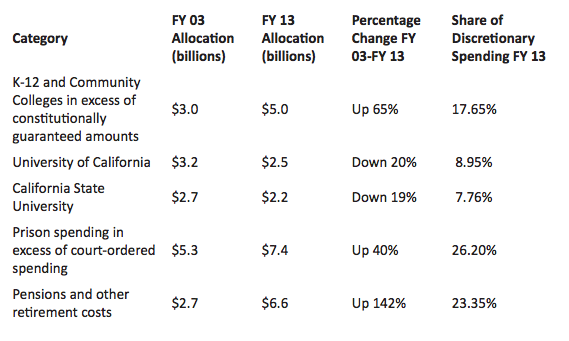

Based on enacted budgets, here’s how legislators chose among major categories, making up more than 80% of Discretionary spending in FY 13:

As the chart makes clear, over the past decade legislators chose in favor of retirement benefits, prisons, K-12 and colleges – and against universities and taxpayers (the 2009 tax increase). Presumably citizens would be pleased that legislators chose in favor of schools and colleges and perhaps public safety (though more than 50% of prison costs go to salaries, which grew rapidly), but not so that legislators chose in favor of retirement benefits, and to the point that more discretionary money is going to retirement costs than to schools and colleges.

Because Discretionary spending is just 22% of total spending, the growth of a relatively small portion of the total state budget can have a big impact on other programs. In FY 03, retirement costs consumed 2.84% percent of total spending, which at that time translated into 7.86% percent of discretionary spending. Ten years later, their share of the total budget had less than doubled, to 5.06%, but nearly tripled as a share of discretionary spending, to 23%. Not surprisingly, university tuition more than tripled and class sizes grew larger.

It doesn’t have to be this way. Legislators can reduce retirement costs. To do that materially, they must reduce un-accrued benefits for current employees. But to date, they have only reduced benefits for future employees, which has little budgetary impact and even then not for decades. Worse, in 2011 the state walked back from a 2010 agreement requiring employees to contribute to their healthcare. Worse yet, legislators now claiming to be interested in reform are talking only about so-called “abuses” such as “spiking” and “airtime,” which make for great headlines but have nothing to do with the retirement cost explosion.

Retirement costs are exploding because politicians made promises – even retroactively – to state employees totaling hundreds of billions of dollars without voter approval and without setting aside enough money to meet those promises. Big bills are now coming due and they’re going to be much bigger.

It would be wonderful to collect from those politicians – there are some very familiar names in that mix — but they have immunity. Everyone else, including the public employees receiving those benefits, is innocent, but the burden has fallen only on citizens, taxpayers and future employees. It’s not fair to any of them, but it’s time for current employees and retirees to share in the sacrifice.

Alicia Munnell, director of the Boston College Center for Retirement Security and formerly a member of President Clinton’s Council of Economic Advisors, recently reported on steps taken by other states to reduce benefits for current employees (the Center’s also looked at the funding status of states’ public plans). Those are the types of steps that must be taken in California if the burden of unfunded retirement promises is to be shared by all.

Some current employees claim that California law won’t allow changes to un-accrued benefits. But as Munnell explained and Amy Monahan of the University of Minnesota recently outlined, pensions are not constitutionally protected and current case law hangs on a thin and flawed thread. California’s Legislature should make it clear that the state has the power to adjust un-accrued benefits – and then act to do exactly that.

With the promise of action by month’s end, California’s lawmakers have an opportunity to do something of enormous benefit for their citizens by enacting real retirement benefit reform.

They should seize the moment.