Following the passage of Proposition 30, California has the highest capital gains tax rate in the nation (13.3% for California; 33% state and federal combined) – second only to Denmark in the industrial world, for the matter.

The funny thing is this wasn’t supposed to be the case for all Californians. Recognizing the detrimental effects taxing capital gains at high rates has on investment, innovation, and risk-taking – largely because of the high elasticity of capital gains taxation – California in 1993 created a state qualified small business stock credit (QSBS) which allowed business owners with 80% of their employees and assets in California to exclude from state taxes 50% of their capital gains on stock, as long as the company was not worth in excess of $50 million. This tax rule incentivized Silicon Valley venture capitalists to invest in risky tech start-ups as well as gave business owners a reason to maintain a vast majority of their operations in California.

Fast-forward now to August 2012 and the California Court of Appeals, in Cutler v. Franchise Tax Board, deeming the 80% requirement unconstitutional. The FTB then declared the entire QSBS invalid and announced it would retroactively collect the remaining 50% for the years not covered by the statute of limitations (2008 and onward). In December, the FTB notified about 2,000 such business owners that they owe the state back taxes totaling roughly $120 million, subject to increase due to interest accumulation. This decision by the FTB runs dangerously close to a bill of attainder and in every essence is ex post facto law.

Today’s “Spotlight” looks at two pieces of legislation – AB 1203 (Republican Assemblyman Jeff Gorell) and SB 209 (Democratic Senator Ted Lieu) – which ensure that individuals who adhered to the law as it stood are not punished for their law-abiding actions because of the whims of an un-elected bureaucratic tax board.

AB 1203 prohibits the FTB from collecting interest or penalties on tax bills if they are related to back taxes resulting from a court decision. SB 209 will be amended to block retroactive tax bills. The FTB claims it doesn’t have the administrative ability to fix the problem. As Sen. Lieu states, “Our goal is to fix this problem. Since it can’t be done administratively, we’ll fix it legislatively.”

To better appreciate this rare act of Sacramento bi-partisanship, let’s take a step back and examine the broader context of both California’s tax environment as well as its business climate. First, at issue is the ex post facto nature of the FTB’s actions and its connection with the state’s poor standing with the business community. Second, California’s tax revenue stream is extremely exposed to capital gains, which makes California’s budget heavily reliant on such income.

Starting a business or investing in a business as an “angel investor” is not something to take lightly. An individual is putting substantial amounts of money into a venture that may or may not actually pan out. In California—most particularly in the Silicon Valley/Bay Area—business start-ups tend to be venture-backed firms. However, based on research out of Harvard Business School, only a quarter of such firms actually survive. Owning a business is not for the faint-hearted and prior to jumping into such an endeavor, entrepreneurs examine the comprehensive business environment, especially the tax code. Certainty and trust in the rule-of-law are above all the most important factors for entrepreneurs. Indiscriminate rule fluctuations or retroactive alterations only act as deterrents to would-be entrepreneurs.

The FTB’s decision is a prime example of ex post facto rule-making, regardless of the agency’s claims that it had no choice in the matter. Business owners and venture capitalists who dared to either invest in California start-ups or build their business operations in the Golden State, now find themselves being punished . . . simply for following the law.

In particular, this retroactive tax increase impacts Silicon Valley/Bay Area’s venture investors and business owners as well as early-stage employees who invested in the start-ups for which they worked. And venture capital is very important to California, which receives almost ½ of all venture capital in the U.S. This money flows predominately into the Silicon Valley/Bay Area, driving one of California’s most important economic engines. According to Bureau of Labor Statistics data, the Silicon Valley/Bay Area alone accounted for 42% of all non-farm employment gains in California in 2011-2012.

Yet, a decrease in faith of California’s rule of law is only one of the problems the FTB’s decision creates and AB 1203 and SB 209 attempt to remedy; California’s budget currently finds itself a hostage of income tax revenue, which makes any hostility toward income generation a major problem for future budgetary health (if any exists at all).

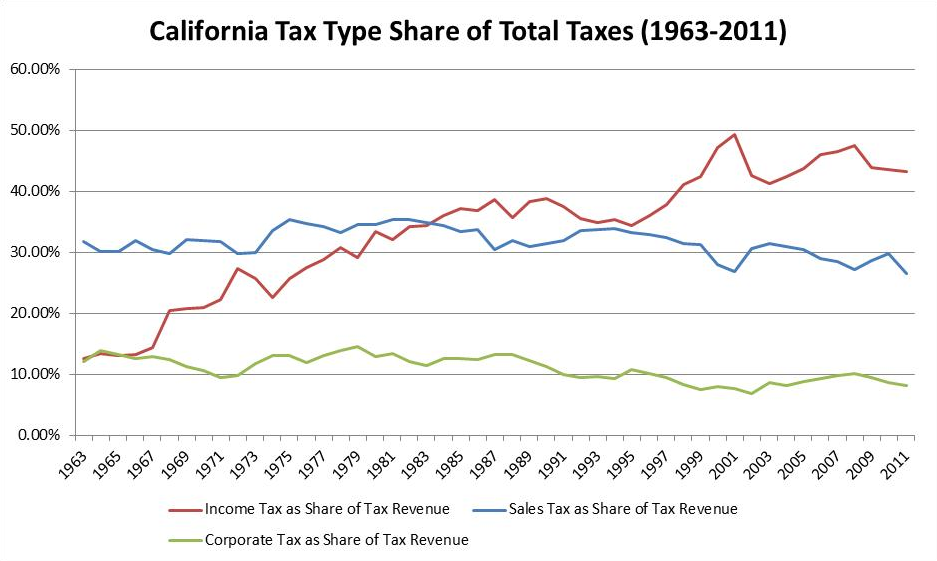

As the chart below shows (using Census Bureau data), income taxes in California have become the dominant revenue for the state’s budget. Between 1963 and 2011, income tax revenue as a share of total tax revenue ballooned from about 13% to over 40%, while both sale tax revenue and corporate tax revenue remained fairly constant.

This is notable and problematic because California’s excessively progressive income tax is extremely volatile. With the top, non-“millionaire” tax bracket starting around $48,000 AGI (for single filers), even the middle-class in California pays a top tax rate on its income. Because of this, however, the share of tax revenue is significantly skewed to the left. For instance, in 2010, the top 10% of earners in California paid approximately 75% of all income taxes with the top 1% paying just over 40%.

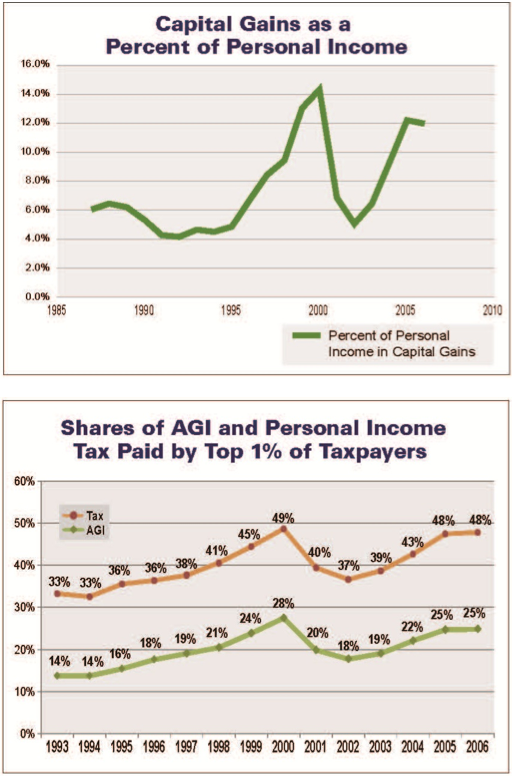

Unfortunately, though, for California, the wealthiest individuals also feature the most volatile swings in income. Capital gains income drives this fluctuating-income phenomenon. The next two charts are from the Commission on the 21st Century Economy Final Report, commissioned by former Gov. Arnold Schwarzenegger to provide recommendations on tax reform. As it shows, the upsurge (followed by the drop) in both the top 1%’s share of taxes paid and their share of AGI corresponds with the increase (and subsequent decrease) in the share of capital gains for personal income. These lines track the California economy perfectly as well. Between 1993 and 2000, California real GDP (in 2006 dollars) increased by 34 percent, but between 2000 and 2002, real GDP only grew by 0.6 percent.

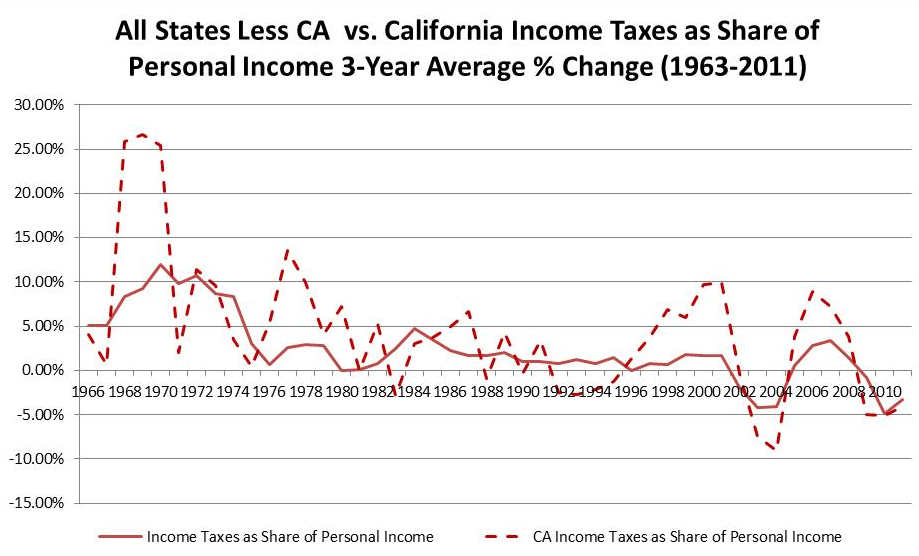

All of this leads to an extremely volatile income stream for California, especially compared to the other 49 states. Using Census Bureau data, the chart below tracks the three year moving average percent change in the income tax revenue as a share of the state’s personal income.

In the 1960’s and 1970’s the divergence shown wouldn’t have really mattered since income tax revenue was not the dominant source of income. However, since the 1980’s, this volatility makes budget planning very difficult. As the California Legislative Analyst Office showed in its 2005 revenue volatility study, California’s income tax volatility could alter income tax revenues by up to $6 billion—the annual amount Prop 30 is supposed to generate.

As such, California is overly reliant on income tax revenue, which is overly reliant on wealthy taxpayers, who have volatile incomes largely due to their reliance on capital gains income. All of this means California’s budgetary process is overly reliant on capital gains.

The rise in uncertainty surrounding the treatment of capital gains will inhibit investors and business owners’ willingness to invest in California which could have dire consequences on the state’s tax revenue flow further harming California’s already fragile budget. AB 1203 and SB 209 ensure this kind of uncertainty won’t transpire again.

Check-out the previous “Sacramento Spotlight”: AB 10 – Minimum Wage Increase

Follow Carson Bruno on Twitter: @CarsonJFBruno

Crossposted on Advancing a Free Society – Eureka