California Common Sense (CACS) released a brief analyzing how the State’s final budget has changed since 2007-08, the last time the budget was balanced. The state projects that its 2013-14 revenues will be $137 billion, $8.9 billion (7.0%) greater than the revenue it expected in 2007-08. Sill, funding for most services is expected to be lower due to growing health care costs, outstanding debt, and rising retirement obligation costs. Accompanying the brief is a data visualization that allows users to easily explore both budgets by department and agency.

Failing to address the state’s core structural challenges such as growing retirement benefit debt and rapidly rising health costs does not help protect the existence and quality of key services. It’s the opposite. Ignoring those worsening problems places services even more at the mercy of boom-and-bust budgeting.

The following are among the report’s findings:

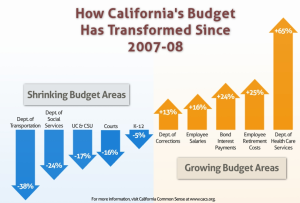

- Despite higher revenues, state spending for the following areas declined since 2007-08: Dept of Social Services (-24%), UC & CSU (-17%), K-12 (-5%), Courts (-16%), and Dept of Transportation (-38%).

- Spending increased for the following areas since 2007-08: Health Care Services (+65%), Dept of Corrections (+13%), Employee Salaries (+16%), Employee Retirement Benefits (+25%), and Debt Interest Payments (+24%).

- User fees have risen significantly. CSU tuition has doubled, and UC tuition has more than doubled. Vehicle registration fees increased 68%, annual park pass fees increased 56%, and court filing fees increased 36%.

- Personal Income tax and Motor Vehicle fee revenues account for the greatest portions of the increased revenues – 31% and 29% respectively.

- Personal Income tax revenue now accounts for 59.3% of revenue generated by the “Big Three” sources – Personal Income, Corporation, and Sales and Use – compared to 55.5% in 2007-08.

Access the brief here, the fact sheet here, and the data and visualization here.