The state budget hasn’t been very newsworthy for the past year, which is good news. A big voter-approved tax increase plus a stingy Governor plus a modest economic recovery has put what was a perennial fiscal crisis in the rear view mirror.

Legislative Analyst Mac Taylor yesterday confirmed this trend – and then some. Citing the economic recovery and other factors, Taylor released a state budget forecast that projects a $5.6 billion surplus by the summer of 2015, growing three years later to almost $10 billion.

This is good news for taxpayers, since it removes a major rationale from arguments to raise taxes. But it also provides impetus for the multitude of special interests, government unions and public agencies who will inevitably demand higher spending for one or another program.

We’ve seen this movie before.

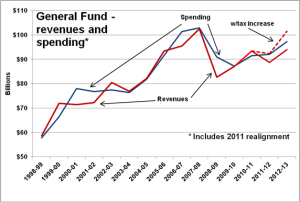

Twice in the past 15 years, California has enjoyed a budget boom followed by a revenue crash – resulting in deficits as far as the eye can see. The chart below shows deficits following the dot.com boom in 2000 and the housing boom in 2007. The rest is painful history. (This chart does not reflect the Proposition 30 tax increase in 2012.)

The third time can be a charm. Instead of building up new, ongoing spending based on one-time revenues, California’s political leadership can follow-through on a commitment made in 2010 to place a “rainy day reserve” before the voters. Postponed once by a skittish Legislature, the measure is scheduled for the November, 2014, election. The Governor and Legislative leadership should rally behind this measure as a show of good faith to the voters to not let the past repeat itself.