As California’s economy continues to improve, it’s getting more crowded at the top. The share of taxes being paid on ever higher income tax collections is concentrating even more the share of taxes on upper income taxpayers. This is even before 2012’s Proposition 30 tax increase.

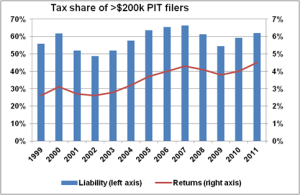

According to recently-released, but still dated, statistics from Franchise Tax Board, state income tax filers with more than $200,000 adjusted gross income increased their share of overall tax payments in 2011 to 62%, up from 59% in 2010.

This tax burden should continue to rise as the economy continues its recovery; the steeply progressive income tax ensures this trend in a growing economy. Add to this the new upper income tax increases, beginning in 2012, and taxpayers making more than $200,000 will easily pay two-thirds or more of all state income taxes.

At the same time, the income tax has become the overwhelming source for the state’s General Fund. The Legislative Analyst recently reported that income taxes account for 66% of all general revenues – a record high dependence on this revenue source. Translation: little more than 670,000 taxpayers (out of 38 million residents) will account directly for 41% of all General Fund revenues.

Tying state finances to such a small number of upper income earners is very risky. What goes up inevitably will come back down. Even while enjoying the fruits of a balanced budget, California leaders must hedge against future volatility by improving the state’s investment climate, keep a tight rein on spending, an enacting a mandatory rainy day reserve.