Financing for California’s transportation system is suffering not only because the gasoline tax is insufficient, as I explained in a recent article, but also because of public policies that are making matters worse.

California has made impressive gains in maximizing the value of its roads and highways. For a far-flung, suburban-style state, we have robust public transit. State and local transportation system operators use technology to manage traffic flows and spot bottlenecks. We have hundreds of miles of highway lanes devoted to car pools. But California’s inexorable growth plus the dispersion of jobs throughout metropolitan areas means that highway travel continues to increase.

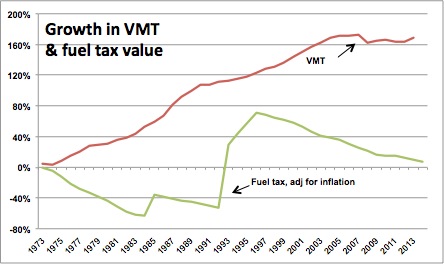

Combine the inevitability of more use with the obsolescence of the gasoline tax, and you find the mismatch illustrated in this chart. Since 1973, total travel on state highways (VMT) has increased nearly 170%, while the value of the base gasoline excise tax has barely kept even with inflation – even though the tax itself has more than doubled (7 cents/gallon to 18 cents/gallon).

State and federal policies are designed to exacerbate this mismatch.

State and federal policies are designed to exacerbate this mismatch.

Pressed by national corporate average fleet economy (CAFE) standards (and consumer demand), fuel economy for passenger cars has more than doubled since the early 1970s. Indeed, the most recent mandate to increase CAFE requirements for passenger cars to 54.5 miles per gallon by 2025 was motivated in part by a state law passed in 2002, which attempted to set a California-only fuel economy standard.

For two decades, regulators and elected officials have attempted to mandate, cajole and reward Californians into upping the number of zero emission vehicles in the automobile fleet. These cars use little or no gasoline – and therefore pay almost nothing to use the roadways – but they also produce far less criteria air pollution and emit fewer greenhouse gases.

For many years the California Air Resources Board has attempted to enforce a mandate on manufacturers to sell ZEVs in California. More recently, the Legislature has provided financing to the ARB to provide rebates to car buyers who purchase vehicles that use little or no gasoline. Today, buyers can get rebates of up to $2,500 for electric cars, and up to $1,500 for plug-in hybrids.

For the two fiscal years ending in 2011, the state paid just over $10 million in rebates for just short of 1,900 passenger vehicle purchases.

Governor Brown wants to take this program to the next level. Using proceeds from the cap-and-trade auction, his proposed budget would provide $200 million to the ARB to, in part, continue and expand upon this rebate program.

The ultimate goal, as articulated by the Governor, is to “deploy 1.5 million zero emission vehicles in California by 2025.” This would amount to 5% to 8% of the state’s automobile fleet – punching another big hole in the gasoline tax revenue base.

Next: What are the financing options that can fill the transportation hole?