In releasing his proposed budget last week, Governor Brown warned of over reliance on the “volatile personal income tax which, as history shows us, drops precipitously in time of recession.” He further cautioned that changes in the income of a relatively small group of taxpayers can have a significant impact on state revenues.”

He’s not exaggerating. As California’s economy has recovered, it’s gotten more crowded at the top. The share of taxes being paid on ever higher income tax collections is concentrating even more the share of taxes on upper income taxpayers. This trend has accelerated since 2012’s Proposition 30 tax increase.

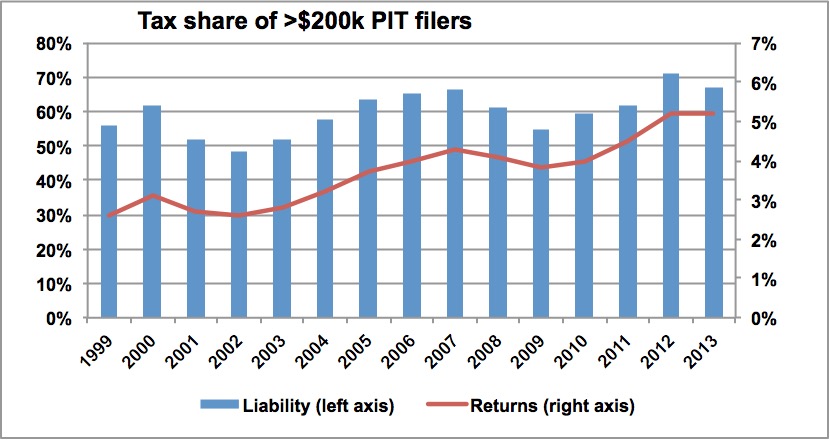

According to recently-released, but still dated, statistics from Franchise Tax Board, state income tax filers with more than $200,000 adjusted gross income increased their share of overall tax payments in 2012 to 67%, up from 59% in 2010. (This share is slightly lower than record 71% in 2013, due to unusual shifting of capital gains income to the 2012 tax year because of federal tax rate changes.)

The economy has only improved since 2012, so the steeply progressive income tax doubtlessly has pushed this tax burden even higher. With capital gains receipts at record levels, it is likely that upper-income taxpayers will again pay north of 70 percent of the state’s income tax this year.

At the same time, the income tax has become the overwhelming source for the state’s General Fund. This year income taxes account for 67.6 percent of all general revenues – a record high dependence on this revenue source. Translation: little more than 800,000 taxpayers (out of 39 million residents) will account directly for 47% of all General Fund revenues.

Tying state finances to such a small number of upper income earners is very risky. As the Governor warned, what goes up inevitably will come back down. This trend underscores the wisdom of California voters in adopting the Proposition 2 rainy day reserve in 2012, to hedge against further downturns. Lawmakers should do their part by keeping a tight rein on spending and improving the state’s investment climate.