Our Bureau of Labor Statistics (BLS) regional commissioner, Richard Holden, passes along the news this week that BLS is proposing to re-start its Contingent Work Supplement (CWS) survey. It is welcome news. The revival of the survey should help address the growing debate in California and nationwide: to what extent is the gig economy—the economy of part time, project-based, temporary and other contingent employment and independent contracting–becoming the new normal of employment.

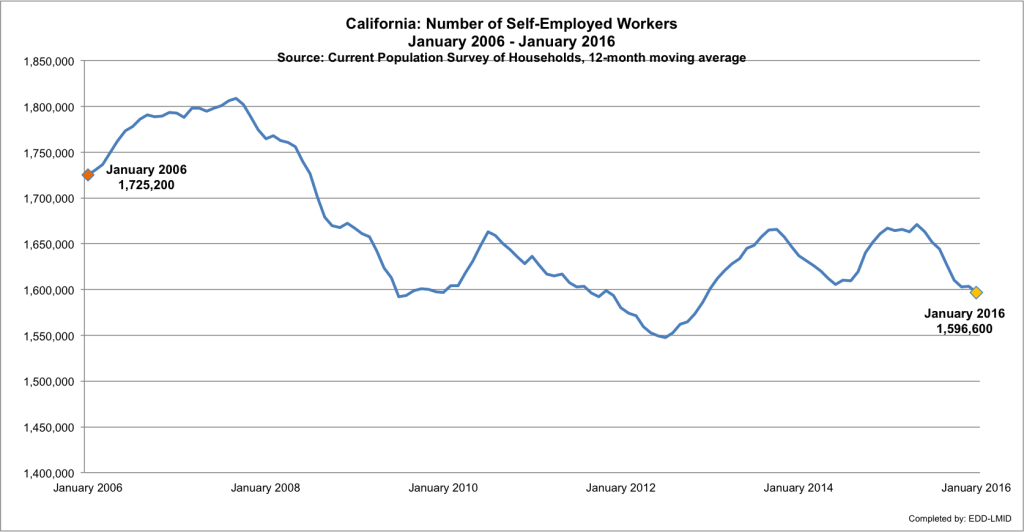

On the surface, the gig economy is still far from the normal in California. he monthly employment figures from the state Employment Development Department (EDD) continue in early 2016 to show the great majority of workers as in payroll jobs, as employees, rather than as independent contractors. In fact, the numbers of unincorporated self-employed workers in California, a main part of total independent contractors, has actually declined over the past decade, as shown in the chart below (click to enlarge) recently prepared by Mr. Brandon Hooker and Mr. Paul Wessen of EDD’s labor market division.

California had 19,019,000 adults in the labor force in January 2016, with 17,930,000 listed as “employed” and 16,272,600 in non-agricultural payroll jobs. So the self-employed, at 1,596,600 in January 2016, while significant, comprised only around 9% of the workforce.

Yet, the payroll jobs numbers nveiled each month mask a lot of the shifting within the nature of payroll (W-2) employment, away from full-time or near full-time employment. This movement involves the growing the number of part-time employment in California that we have tracked in the past few years (here and here). It involves the growth of temporary help services, staffing and perhaps most of all project-based and time-limited employment.

To speak of the “gig economy” or “contingent economy” is to speak actually of numerous forms of work and employment separate from full-time somewhat stable employment. A good starting point for thinking about these forms and their size in the economy is a 2015 report by the United States General Accountability Office. The GAO defines the gig/contingent economy as including “all individuals who maintain work arrangements without traditional employers or regular, full time schedules”. It divides these individuals into three broad categories, and seeks to estimate the size of these categories as of 2010. The categories and estimates are as follows:

- Agency temps, direct-hire temps, on-call workers and day laborers, and contract company workers. These are the workers who generally lack job security (though some staffing assignments are multi-year), and/or have work schedules that are variable or unpredictable. The GAO estimates that in 2010, these workers totaled 7.9% of the employed labor force.

- Independent contractors and self-employed workers: These are workers who are outside of the employer-employee relation (generally receive 1099s). The GAO estimates that in 2010 this group totaled 16.1% of total employed labor force.

- Part-time workers: These are workers employed less than 35 hours per week, including both the category of workers involuntarily working part-time (preferring full time work) and those who say they prefer part time employment. The GAO estimates this group as 16.2% of the employed labor force in 2010.

In conclusion, the GAO study characterized the gig/contingent economy as ranging from 7.9% of the workforce to over 40% of the workforce depending on the definition of gig/contingent work. The 7.9% represented to GAO the “core contingent arrangements”, the narrower view of contingent work. The 40% estimate represented all three groups, and a broader definition of contingent work.

The GAO study as mentioned is a good first step for thinking about the gig/contingent economy nationwide and in California (our state estimates in each of the three categories are similar to the national estimates). However, it is only up through 2010, and now more than 6 years old.

We are in need of new data. The BLS did a survey of contingent work arrangements in 1995, 1997, 1999, 2001, and 2005, before halting, due to lack of funds. Restarting the survey in the near future will provide valuable tracking of the growth of various forms of contingent work, if not the final word on the meaning of contingent work.