Today, Transparent California released 2015 pension payout data from the City of Fresno Retirement Systems (CFRS) — the first time this information has ever been made available to the public.

The CFRS is the only major California public pension plan with a funded ratio over 100 percent and, consequently, enjoys a $289 million surplus rather than contributing to the state’s approximately $300 billion in combined unfunded liabilities.

As a result, the City of Fresno has avoided the pension crisis currently sweeping the state — which is forcing many governments to hike taxes and reduce government services as they spend a growing percentage of their budget on pension debt.

The reason for the unique success of the CFRS is simple: they promised only what they could afford to pay for. While most public pension plans offer exorbitant benefits without accounting for their cost, the CFRS consistently maintained benefits at an affordable level.

The CFRS consists of two separate plans: the Fresno Police and Fire Retirement System serves safety employees and the Fresno Employees’ Retirement System covers non-safety employees.

The data reveals the average pension for a full-career retiree of the Fresno Police and Fire Retirement System was $70,627, while the average full-career retiree of the Fresno Employees’ Retirement System received $39,644.

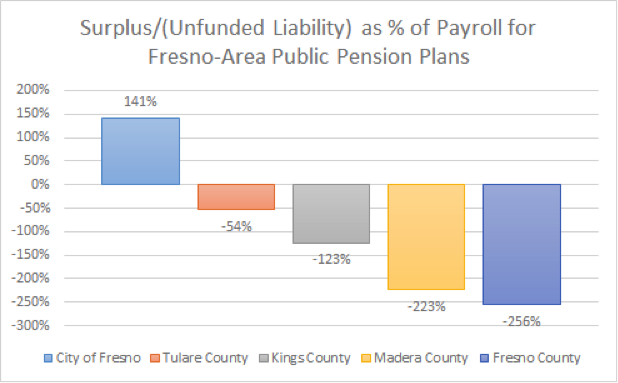

With a funded ratio of 76 percent and nearly $1 billion in unfunded pension liabilities, the Fresno County Employees’ Retirement Association (FCERA) is more representative of the precarious situation most California governments are facing.

So what is the City of Fresno and their retirement system doing so differently than every other California public pension plan? They provide comfortable, but not exorbitant benefits.

To wit, the average $61,513 pension received by full-career, non-safety FCERA retirees was over 50 percent more than the $39,644 that Fresno City retirees received, according to just-released 2015 FCERA data posted on TransparentCalifornia.com.

Naturally, there is a direct correlation between a pension plan’s richness and the cost to taxpayers. For example, Fresno County will spend a staggering 52 percent of pay on retirement benefits, which is over triple the 16 percent rate that Fresno City pays, and over 17 times more than the 3 percent that the median private employer spends on employees’ retirement accounts.

Unlike the inflated pensions found in Fresno County and most California governments, pensions at the City of Fresno are comparatively modest, illustrating that soaring pension costs are directly related to the generosity of the benefits promised.

Comparatively modest is the operative term. With the average Fresno County private worker earning only $36,975 in 2014, clearly the average full-career pension for City retirees is far from inadequate. Yet, by simply providing pensions that are comfortable instead of exorbitant, the City of Fresno enjoys one of the lowest — if not the lowest — retirement cost of any major California city.

Having served the City of Fresno for over 20 years now, the CFRS serves as a direct refutation to the post-hoc, unfounded claim that bloated pensions are necessary to maintain a quality workforce.

Fresno’s elected officials deserve considerable praise for having successfully balanced taxpayers’ interests against the need to provide a fair compensation package for their employees.

It’s a success story that should be replicated nationwide.

Robert Fellner is research director for Transparent California.