Big Pharma remains in the headlines, and those headlines have centered around the Golden State lately. After all, the California Drug Price Relief Act did earn itself a ballot measure next November with well over 500,000 signatures (only 366,880 were needed), and according to recent polling research by the Kaiser Family Foundation, over 70% of Americans think something should be done about the cost of pharmaceuticals.

Here is a quick refresher on the ballot measure: the California Drug Price Relief Act would demand that the California government use its bargaining power to lower the price on pharmaceutical drugs. If a bill is passed enacting drug pricing relief, California would tie the amount it spends on a drug to the price the U.S. Dept. of Veterans Affairs pays, which is typically 20% below current market value. The goal would be limiting the price of drugs and increasing transparency in the pharmaceuticals industry.

While noble in its intentions, the relief act may not offer the benefits Californians are seeking. Someone has to pay for the changes in either money or consequence; here are four concerns with the ballot measure.

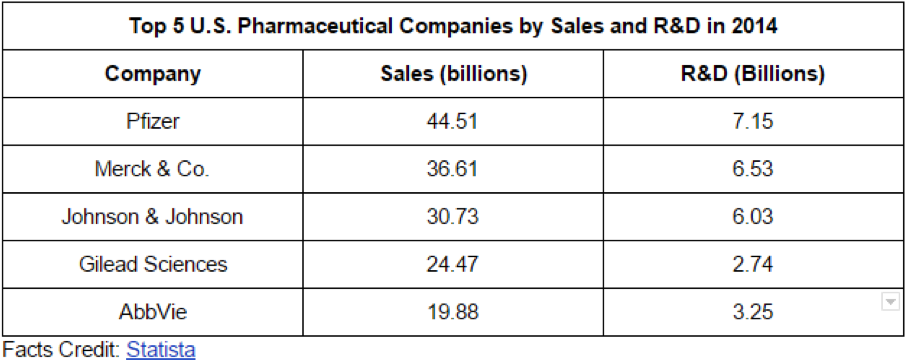

- Will government price regulation impede innovation in the pharmaceutical industry? The amount of money Big Pharma commands in sales is staggering—one would think that research and development could continue, “business as usual.” Despite the sizeable numbers, however, pharmaceutical spokespeople argue that research and development would not be sustainable with a pricing slash in effect. Whether that is true or not remains to be seen. For now, here is a table showing five of the largest corporations’ sales, research, and development (R&D).

- Secondly, by tying the price of pharmaceuticals to that of the V.A., aren’t we setting the V.A. up to suffer a price raise? Without a bill limiting how much the U.S. Department of Veterans Affairs pays for a drug, pharmaceutical companies could simply raise the price for the V.A.. Pharmaceuticals will get their money somehow; V.A. drug prices generally rest 20% below the industry standard. Pharmaceutical corporations may adjust that rate if they deem it necessary.

- Tax Attorney Joe Garza expressed concern for another side effect of the ballot measure—taxes. “If [the measure] passes, taxpayers in California may foot a portion of the bill,” Garza said. “Bills like these often look good at first glance, but you might find the government reaching into your pockets rather than the pharma companies.”California Lawsuits will be costly and commonplace in order to enforce the lowered drug costs, and the added bureaucratic red tape will mix further taxpayer funds into the situation. Will the cost of implementation passed on to the population provide a worthwhile return to the citizens of California? That leads us to the last concern.

- The ballot measure to regulate pharmaceutical costs wouldn’t benefit every Californian. Generally speaking, the ballot measure would benefit only those citizens under state-sponsored healthcare. Californiahealthline.org lists the following beneficiaries among the 5 million or so citizens who would be helped:

- 7 million non-HMO Medi-Cal beneficiaries

- 2 million CalPERS and California State Teachers’ Retirement System members;

- 112,000 inmates; and

- 31,000 residents who receive AIDS drugs from government-assistance programs.

In short, someone will end up paying for the slash in pharmaceutical costs. We all hope it will be Big Pharma—most would agree that they make enough money as it is, and their manipulation of pricing to squeeze dollars out of needy people has been all over the news—but ordinary citizens of California may end up paying for it with taxes instead. Perhaps veterans and their families will foot the bill too, or maybe we will all suffer because of stymied pharmaceutical innovation.

All said, California voters carry the responsibility for the ballot measure next November. Pharmaceutical regulation is a popular and necessary notion—voters should educate themselves in the upcoming months as more research and cost prediction comes available.