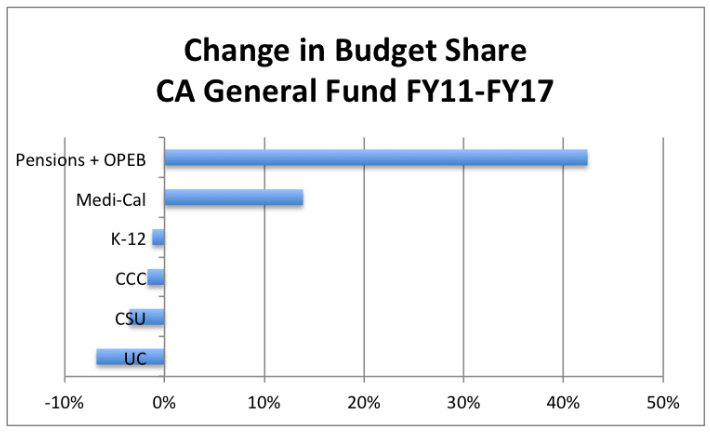

A review of California’s 2016–17 state budget yields a new pattern as spending surges on retirement and Medicaid (Medi-Cal) costs. Budget shares have changed dramatically since 2010–11:

A review of California’s 2016–17 state budget yields a new pattern as spending surges on retirement and Medicaid (Medi-Cal) costs. Budget shares have changed dramatically since 2010–11:

Much has been written about the spending surge on pensions and OPEB (retiree healthcare) but little has been written about the surge in spending on Medi-Cal, a voucher-style system under which health care is paid for by a combination of federal and state governments.

Total Medicaid spending in California will be nearly $93 billion in 2016–17 as enrollment rises to 13.5 million from 7.5 million in 2010–11, in part because of the Medicaid expansion under the Patient Protection Act (Obamacare). The principal recipients of that $93 billion in spending are hospitals, pharmaceutical companies, doctors and nurses. Under PPA, the federal government pays for newly qualified Medicaid enrollees for a period of time but a large portion of California’s new enrollment growth is not entitled to that higher level of reimbursement because of what’s known as the “woodwork effect,” which refers to Medi-Cal enrollees entitled to coverage before PPA but not enrolled. Because those enrollees qualified under the old rules, the state receives only old-rule (and materially-lower) federal reimbursement for their costs. As a result, enrollment grew 80% but federal reimbursement of California’s Medi-Cal spending in 2016–17 will be only four percentage points higher than in 2010–11 (70% versus 66%). Accordingly, General and Special Fund spending on Medi-Cal is budgeted in 2016–17 to rise 58% to $27 billion.

Pension and OPEB costs are just at the beginning of their upward climbs because of fast growing liabilities and inadequate pre-funding while Medi-Cal costs are likely to continue growing in correlation with general healthcare cost increases and any enrollment and coverage expansions approved by the governor and legislature. Absent reform, California’s budgets will increasingly be a contest among retirement costs, healthcare and education. Because pensions and OPEB are contractual, Medi-Cal is an entitlement and K-14 is constitutionally entitled to a fixed percentage, the likely outcome absent reform is K-12 and CCC maintaining flat shares, pensions, OPEB and Medi-Cal taking larger shares, and UC and CSU getting less. Another large component of spending is compensation and benefits for 206,000 active state employees under the Executive Branch on which General and Special Fund spending will be $20 billion in 2016–17 and whose share of GF and SF spending declined 9%, illustrating another impact of fast growing spending on retirement costs and Medi-Cal. See Schedule 4 of the Governor’s Budget for a breakdown of active Executive Branch state employees conducting directly-provided state services.