New local taxes and new local borrowing are a regular phenomenon in California elections, but this year our government union controlled politicians have outdone themselves. Let’s compare:

November 2014 – $11 billion in new borrowing proposed via 118 local bond measures, 81% passed. Of the 117 local proposals for new taxes, 68% passed.

June 2016 – $6.2 billion in new borrowing proposed via 48 local bond measures, an estimated 93% passed. Of the 42 local proposals for new taxes, an estimated 66% passed.

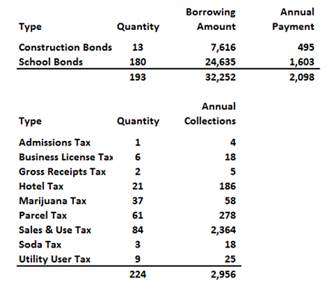

November 2016 – $32.2 billion in new borrowing via 193 local bond measures, and 224 local proposals for new taxes!

Not only do these general and primary and special election tax and bond measures accumulate year after year, but they nearly always pass! The primary source for this information is theCalifornia Tax Foundation, who have just produced another excellent guide “Local Tax and Bond Measures 2016.” This time, they have not only compiled a list of all of the proposed local taxes and bonds, but for each of the proposed new local taxes, they have compiled the projected annual collections. The result is stunning.

2016 California Local Tax and Bond Measures

As this table reports, $32.2 billion in new borrowing is being proposed, nearly all of it for schools and colleges. At 5.0% annual interest with a 30 year repayment plan, this borrowing will cost property owners another $2.0 billion per year in increased property taxes. If over 90% of these bonds are approved by voters, as recent history indicates is likely, California’s taxpayers will suddenly have saddled themselves with nearly $30 billion in new government debt.

Also as reported on the above table, the 224 proposed tax increases are estimated to cost taxpayers at least $2.9 billion per year. “At least,” because CalTax was unable to find revenue projections for 29 of them. And while “sin taxes” on marijuana and soda promise to bring in $58 million and $18 million, respectively, it is sales tax, that everyone pays, that will bring in most of the revenue, over $2.3 billion.

Because local taxes are numerous and dispersed onto hundreds of differing ballots across the state, they don’t get the visibility that state tax increases generate. But collectively they are just as significant. California’s Prop. 30, passed by voters in 2012, generated about $6.0 billion per year. That same tax, which was supposed to be temporary, will be extended through 2030 if voters approve Prop. 55 this year. But if you compare this statewide tax to the proposed local taxes, $2.9 billion per year, along with required payments on the local bonds, $2.1 billion per year, you are adding another $5.0 billion annual burden to taxpayers.

Passing Prop. 30 was a major fight. Similarly, Prop. 55 has huge visibility with voters. But because nearly all of the local measures pass, and because dozens if not hundreds of them appear on the ballot every election, local taxes and bonds matter more. Invisible, ongoing, and ever expanding, they are silently elevating the cost-of-living for ordinary Californians as much or more than state taxes.

Where does this money really go? Why is there an insatiable thirst for more taxes and more borrowed funds?

One word: Pensions. One cause: Government unions and their allies in the financial community, who together comprise what is by far the most potent political lobby in California.

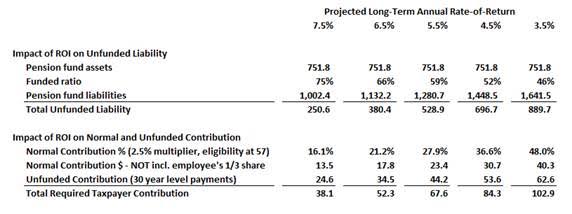

A May 2016 analysis by the California Policy Center, using the most recent data available from the U.S. Census Bureau, estimated that during 2014, California’s 80+ independent state/local government employee pension systems received $30.1 billion in contributions (ref. table 2-A). Later in that same report, on table 2-C which is displayed below, one can see how much these pension systems actually need to remain financially healthy. At a minimum, they are collecting $8.0 billion per year LESS than they need. And that is if the investments they’ve made yield an annual return of 7.5% per year for the next 30 years. At the modest reduction of that projection to 6.5% – which even CalPERS has announced they are going to phase in as their new projection for calculating required annual contributions, these pension systems are collecting $22.2 billion per year LESS than they need.

California State/Local Pension Funds Consolidated

2014 – Est. Funding Status and Required Contributions at Various ROI

If California’s state and local government workers participated in Social Security like the rest of California’s workers, instead of receiving guaranteed defined benefit pensions that on average pay FOUR TIMES what Social Security recipients can expect, there would be no insatiable need for more money for the pension systems. Even if California’s state and local government workers merely received defined benefits that paid, on average, TWICE what Social Security recipients can expect, these pension funds would currently have surpluses. Moreover, there would be money left over in local municipal and school district operating budgets to maintain facilities, instead of having to perpetually borrow.

Six billion per year ala Prop. 30 and Prop. 55. Another five billion per year thanks to new proposed local taxes and borrowing just this November. And it’s not even close to enough. California’s state and local government pension systems are going to need somewhere between $50 to $60 billion per year to stay afloat, and currently they’re collecting barely more than half that much.

No wonder there’s the perennial scramble for more. More. MORE.

* * *

Ed Ring is the president of the California Policy Center.