It’s election time, so expect a lot of attacks on Proposition 13, the landmark 1978 tax-cut initiative. Slate just ran Henry Grabar’s “These Graphs Explain Why California’s Property-Tax Regime Is the Worst.”

It’s election time, so expect a lot of attacks on Proposition 13, the landmark 1978 tax-cut initiative. Slate just ran Henry Grabar’s “These Graphs Explain Why California’s Property-Tax Regime Is the Worst.”

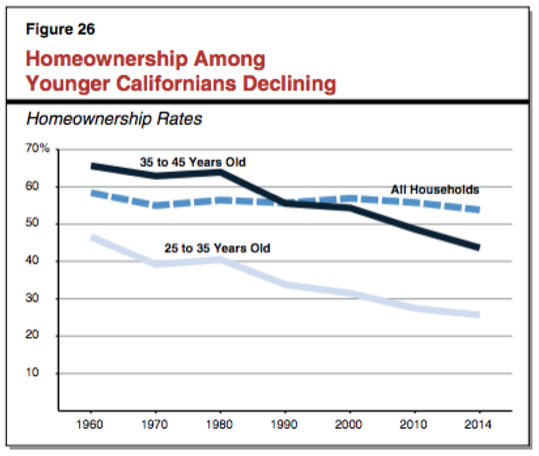

No they don’t. The graphs basically show declining home ownership among two groups, 25 to 35 year olds and 35 to 45 year olds, beginning about 1980. So that’s just two years after Prop. 13 passed. But Prop. 13 wasn’t the only event affecting real estate.

Grabar writes: “Prop. 13 fixed the statewide property tax rate at 1 percent, and applied that millage to purchase price (plus a small annual rate of increase), rather than market value. That means that as home values have skyrocketed in California, property taxes have not. If you bought a home in California in 1980, the difference between the market value and assessed value of your home is, on average, $300,000.”

That is correct. But there’s more to it. For one, because California has the highest income and sales taxes of any state, investors looking for a tax break inevitably are forced into real estate – even if they have to make a purchase today, paying the 1 percent tax on a high valuation. If income and sales taxes were cut sharply, as they ought to be, the Prop. 13 tax break would be less consequential.

And he writes, “More anecdotally, longtime homeowners are among the most stringent opponents of new housing. They’re the ones lining up behind L.A.’s Neighborhood Integrity Initative.” This is the NIMBY effect – not in my back yarders. That’s a factor as well.

But there’s way more to it. Here are 11 other major factors driving up prices. Combined, they’re deadly to young households seeking to purchase a home. And let’s not forget that Prop. 13 was enacted in the midst of a $5 billion state budget surplus ($18 billion in today’s inflated money) the Legislature and Gov. Brown refused to return to taxpayers in other ways, such as through income or sales tax cuts.

- Nixon taking us off the gold standard in 1971, which sparked massive inflation of everything, especially real estate. The higher valuations artificially forced homeowners to pay higher property taxes, dragging grandmothers out of their homes and stoking efforts to cut taxes, leading to Prop. 13.

- More divorces, especially after California’s No Fault Divorce law passed in 1970, which means two households instead of one.

- A huge increase in population. Gov. Jerry Brown declared the 1970s an “era of limits,” cutting spending on roads, reservoirs and other infrastructure. People kept coming anyway, with population up 18.6% in the 1970s, 25.7 percent in the 1980s, 13.8 percent in the 1990s and 10 percent in the 2000s.

- Immigration. According to a PPIC study, “In 2011, 27% of California’s population was foreign-born, about twice the U.S. percentage.” Immigrants are less wealthy, younger and have more children than those born here. Those factors skew home ownership downward for young people.

- Social Security taxes increased sharply after the 1983 Greenspan Commission recommended doing so to keep the system solvent. That’s a direct subsidy by young taxpayers for old homeowners.

- Medicare has expanded greatly since the program was imposed in 1965, even as people have lived longer. In 1972, “speech, physical and chiropractic therapy were added.” In 1982, hospice care was added and became permanent in 1984. In 2003, President Bush added Medicare Part D, covering most drugs. Young folks pick up the tab; old folks benefit and use the savings to pay their mortgages.

- College debt, which hardly existed for Baby Boomers in the 1960s and 70s, now totals more than $1 trillion. How can kids pay for a mortgage when they’re paying forever for the $100,000 debt for their worthless sociology degree?

- Stagnant incomes. The lousy economic policies of Presidents Bush and Obama, especially the record deficits, have produced, at best, slight income increases for 15 years. So have the policies of the Greenspan-Bernanke-Yellen Federal Reserve Board, especially its eight-years-long zero interest-rate program (ZIRP). That means the federal government itself borrows money at close to zero interest, but loans it out to students at 5%.

- Absurd tuition increases. A major reason for this is the doubling of university administrators the past 20 years, who now outnumber professors in the UC and CSU systems. It’s also a national problem.

- LAFCOs – local area formation commissions. According to a study by Randal O’Toole of the Cato Institute: “It wasn’t always this way. In the 1960s, California was growing much faster than it is today, yet housing was no more expensive than in most other parts of the country. California was growing so fast that cities often competed with one another over which would get to annex (and collect taxes on) land suitable for development.“To minimize such competition, in 1963 the California Legislature created a local area formation commission (LAFCO) for each county. These commissions could approve or veto the formation of new cities or special service districts and annexations to those cities or districts. Most commissions were dominated by representatives of the city councils in each county.“The cities soon realized they could use LAFCOs to keep most taxpayers within their boundaries. No longer could a developer build houses on vacant land outside of a city’s limits and incorporate a new city or service district to provide the water, sewer and other infrastructure needs for those homes.

“After eliminating the competition from such developments, cities could impose costly and time-consuming planning restrictions that further drove up housing costs. What was portrayed in public as a war on sprawl was, in reality, a war on taxpayers seeking to escape the high tax rates imposed by cities.”

- Finally: Silicon Valley and San Francisco. The digital revolution is bringing untold wealth to the area as the world’s brightest minds concentrate there. Facebook moved there, not somewhere else. Even now, Austin, Boston and other high-tech areas are satellites of the California tech mecca. The immense need for housing, combined with the other causes listed above, would make it impossible for Steve Jobs’ working-class parents to own the Palo Alto home that birthed Apple in the mid-1970s.

This is a unique area, like Manhattan and Wall Street for finance; or Washington, D.C., for vampiric government functionaries. Unique areas bring higher housing prices even if there are no other factors.

Veteran California columnist John Seiler now publishes the Seiler Report. His email: mailto:[email protected]