For the last few years, using data provided by the watchdog organization CalTax, we have summarized the results of local bond and tax proposals appearing on the California ballot. Nearly all of them are approved by voters, and this past November was no exception.

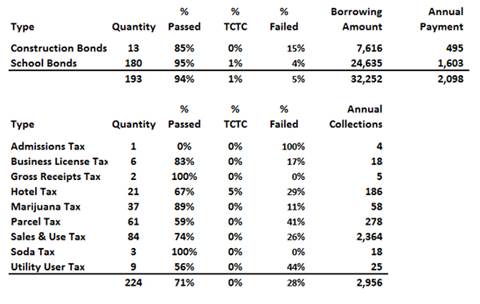

With only a couple of measures still too close to call (TCTC), as can be seen, 94% of the 193 proposed local bonds passed, and 71% of the proposed local taxes passed. Two years ago, 81% of the local bond proposals passed, and 68% of the local tax proposals passed. No encouraging trend there.

Outcome of Local Bond and Tax Proposals – November 2016

A simple extrapolation will provide the following estimate: Californians just increased their local tax burden by roughly $4.0 billion, in the form of $1.9 billion more in annual interest payments on new bond debt, and $2.1 billion more in annual interest on new local taxes. But that’s not even half the story.

California’s voters also supported state ballot initiatives to issue new bond debt and impose new taxes. Prop. 51 was approved, authorizing the issuance of $9.0 billion in new bonds for school construction. Prop. 55 extended until 2030 the “temporary” tax increase on personal incomes over $250,000 per year, and Prop. 56 increased the cigarette tax by $2.00 per pack. The cost to taxpayers to service the annual payments on $9.0 billion in new bond debt? Another $585 million per year. Even leaving “rich people” and smokers out of the equation, California voters saddled themselves with nearly $5.0 billion in new annual taxes.

But as they say on the late-night infomercials, there’s more, much more. Because California’s state legislators don’t have to ask us anymore if they want to raise taxes. November 2016 will be remembered as the election when a precarious 1/3 minority held by GOP lawmakers was broken. California’s democratic lawmakers, nearly all of them controlled by public sector unions, now hold a two-thirds majority in both the state assembly and the state senate. This means they can raise taxes without asking for consent from the voters. If necessary, they can even override a gubernatorial veto.

And they will. Here’s why:

There are three unsustainable policies that are considered sacrosanct by California’s state lawmakers and the government unions who benefit from them. (1) They are proud to have California serve as a magnet for undocumented immigrants and welfare recipients. (2) They are determined to continue to overcompensate state and local government workers, especially with pensions that pay several times what private workers can expect from Social Security. (3) They have adopted an uncritical and extreme approach to resolving environmental challenges that has created artificial scarcity of land, energy and water, an asset bubble, and a neglected infrastructure that lacks the resiliency to withstand large scale natural disasters or civil emergencies.

All three of these policies are extremely expensive. “Urban geographer” Joel Kotkin, writing in the Orange County Register shortly after the Nov. 8th election, had this to say about these financially unsustainable policies:

“This social structure can only work as long as stock and asset prices continue to stay high, allowing the ultra-rich to remain beneficent. Once the inevitable corrections take place, the whole game will be exposed for what it is: a gigantic, phony system that benefits primarily the ruling oligarchs, along with their union and green allies. Only when this becomes clear to the voters, particularly the emerging Latino electorate, can things change. Only a dose of realism can restore competition, both between the parties and within them.”

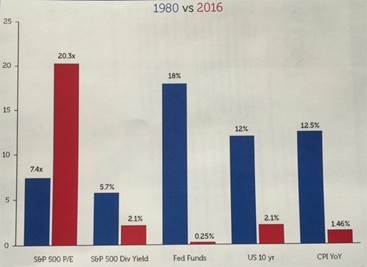

Despite the increase in consumer confidence since the surprising victory of Donald Trump in the U.S. presidential election, the stock and asset bubble that has been engineered through thirty years of expanding credit and lowering rates of interest is going to pop. The following graphic, using data from Bloomberg, explains just how differently our economy is structured today compared to 1980 when this credit expansion began.

As can be easily seen from their price/earnings ratios today, publicly traded stocks are grossly overvalued. Equally obvious is that interest rates have fallen as low as they can go. For more discussion on how this is going to affect the economy, refer to recent California Policy Center studies “How a Major Market Correction Will Affect Pension Systems, and How to Cope,” and “The Coming Public Pension Apocalypse, and What to Do About It.” Despite healthy new national optimism since Nov. 8th, the economic fundamentals have not changed.

California’s democratic supermajority legislators, and the government unions who control them, are going to have a lot of explaining to do when the bubble bursts. For decades they have successfully fed their unsustainable world view to the media and academia and the entertainment industry. For over a generation they have brainwashed California’s K-12 and college students into militantly endorsing their unsustainable world view. This year they conned California’s taxpayers into approving another $5.0 billion in new annual taxes. But the entire edifice exists on borrowed time.

* * *

Ed Ring is the vice president of research policy at the California Policy Center.