The U.S. and California economies in 2017 will start growing at a somewhat faster clip than in recent years, according to the 39th Annual Chapman Economic Forecast. It was given Dec.15 at the university before local business and community leaders by recently retired school President Jim Doti, also a top economist. The forecast is among the most accurate in the country.

The U.S. and California economies in 2017 will start growing at a somewhat faster clip than in recent years, according to the 39th Annual Chapman Economic Forecast. It was given Dec.15 at the university before local business and community leaders by recently retired school President Jim Doti, also a top economist. The forecast is among the most accurate in the country.

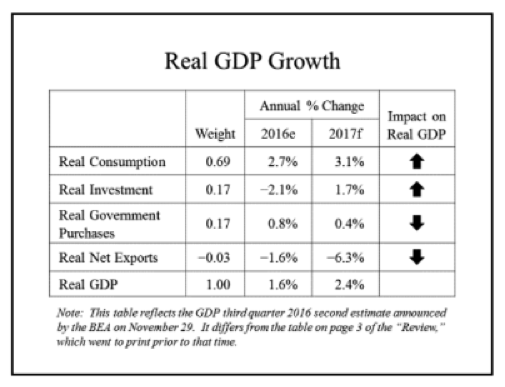

Doti forecast Real GDP will increase to 2.4% annually in 2017 from 1.6% in 2016. The economy finally will break above the 2% growth it has been stuck in during the Obama years. Doti attributed the new mini-boom to “Trumponomics,” a combination of tax cuts, regulatory reform, more defense and infrastructure spending and a “fix” for Obamacare.

The embargoed forecast came out Dec. 13 to the media and expected modest interest rate hikes by the Federal Reserve Board. That forecast quickly came true when, on the 14th, just before the Chapman Forecast presentation on the 15th, Fed Chairperson Janet Yellen announced rate hikes of a quarter point, with more hikes to come.

The media, ever hostile to Trump, branded it a rebuke by Yellen to the “bad boy.” In fact, Trump campaigned against the Fed’s Zero Interest Rate Policy (ZIRP), which now has lasted eight years, because it guts middle-class savings. So this actually is a plus for Trump. Historically, during normal times with no inflation, interest rates for the Fed’s inter-bank loans should be about 2%.

The Forecast also took account of the Trump Boom in the stock market that has occurred since his surprise election win on Nov. 8. That increase in wealth will lead to some additional spending and shore up retirement accounts, as well as government pension funds – even in anti-Trump states such as California. Santa Claus came early this year.

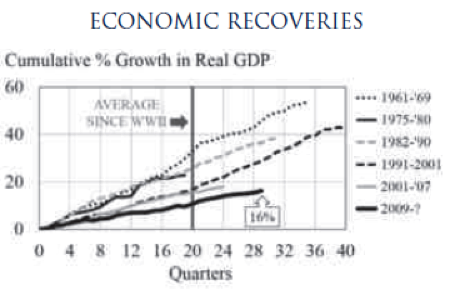

The growth means this soon could be one of the longest expansion periods since World War II, albeit at lower levels than previous growth spurts. As he has maintained in previous forecasts, Doti said that means the recovery still has “legs” to continue.

Doti expects inflation to rise by a 1.9 percent annual rate by the end of 2017, from 1.7 percent. I don’t see that happening because the dollar has been gaining in value against gold, going to $1,132 an ounce on Dec. 15 from $1,298 on Nov. 2, a 15% rise in such a short time. In fact, we now have the threat of the sort of de-flation that hurt the economy from 1997-2001. The problem with strong de-flation is that it cuts commodity prices, bankrupting oil and gas companies, farmers and almost all commodities enterprises, sending shock waves through the whole economy.

A stable dollar should be at a fixed price, such as the $35 level from the 1944 Bretton Woods accord until Nixon’s mistake of taking us of gold in 1971. If Trump understands this and pushes to peg the dollar at, say, $1,200 an ounce, growth will be accelerated even more, with zero inflation, as in the mid-1960s – until LBJ’s Great Society and Vietnam War wild spending started bankrupting the federal budget and the whole U.S. economy.

California’s Boom Boom Continues

Doti’s econometric model is more guarded than my prediction here last month on Fox and Hounds, but basically headed in the same direction. In “Here Comes California Boom Boom,” I enthused, “Like the rest of the country, California is poised for a Trumpian boom of Reaganesque proportions,” which would mean U.S. growth averaging 4% per year, above the Chapman expectation of 2.4%.

I also forecast, “Because of the state’s own anti-business obsession, it just won’t be as booming” as the rest of the country. Chapman expects the state will “downshift,” but still “outpace the nation. We’ll see.

For Chapman, the main factors in the slowdown (albeit of continued growth) will be lower hiring in Silicon Valley and reduced construction. The state’s tight housing market will stay tight, keeping up with demand, but just barely: good news for owners, bad news for buyers and renters. “Population demographics point to the need for 98,000 new units annually between 2015 and 2020, close to the actual number of housing starts occurring annually since 2015.”

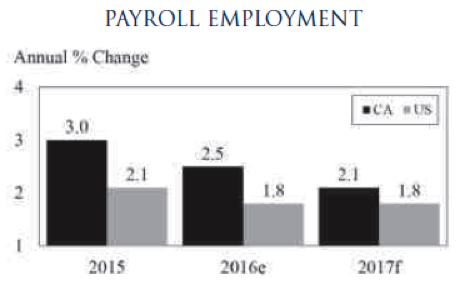

California payroll employment will continue to be a good indicator, rising an estimated 2.5% in 2016, compared to 1.8% nationally. But in 2017, it will rise a little slower at 2.1% in the state, compared to 1.8% nationally.

My guess is that the national number is too low, as Trumponomics brings boom times to the Rust Belt states that pushed him over the top in the Electoral College: Michigan, Ohio, Wisconsin and Pennsylvania. After the election, he took a victory lap through those states and will reward them big time.

Chapman also expects Trump’s threats of protectionism will not be too strong in practice, and the recent depreciation of the Chinese yuan, Mexican peso and Canadian dollar will boost imports by 4.2% in 2017, compared to a 0.9 percent increase in 2016. That will be a boon for California’s ports.

I’m hoping for a new Bretton Woods accord that would stabilize all currencies around gold, ending these harmful, unpredictable currency fluctuations.

In sum, whether you take Doti’s more cautious economic approach or my cheerleading for a Trump boom, we’re on our way to Make the Economy Great Again.

Longtime California columnist John Seiler’s email is: mailto:[email protected]