Since 2009 at Fox & Hounds, we have periodically discussed the structural shifts in California’s employment, primarily the movement away from the employer-employee relation with some expectation of stability, to alternative and more contingent work arrangements. This movement has included the rise of independent contracting and freelance work, as well as the rise of employment that is through staffing companies or project based, or part time. The “gig economy” is the name often attached to this movement.

Since 2009 at Fox & Hounds, we have periodically discussed the structural shifts in California’s employment, primarily the movement away from the employer-employee relation with some expectation of stability, to alternative and more contingent work arrangements. This movement has included the rise of independent contracting and freelance work, as well as the rise of employment that is through staffing companies or project based, or part time. The “gig economy” is the name often attached to this movement.

The Labor Market Information Division (LMID) of EDD does not maintain data on all of the elements of our state’s gig economy. But it does maintain statewide data on several of these elements that are worth checking in on in early 2017: self-employment, staffing services, and part-time employment.

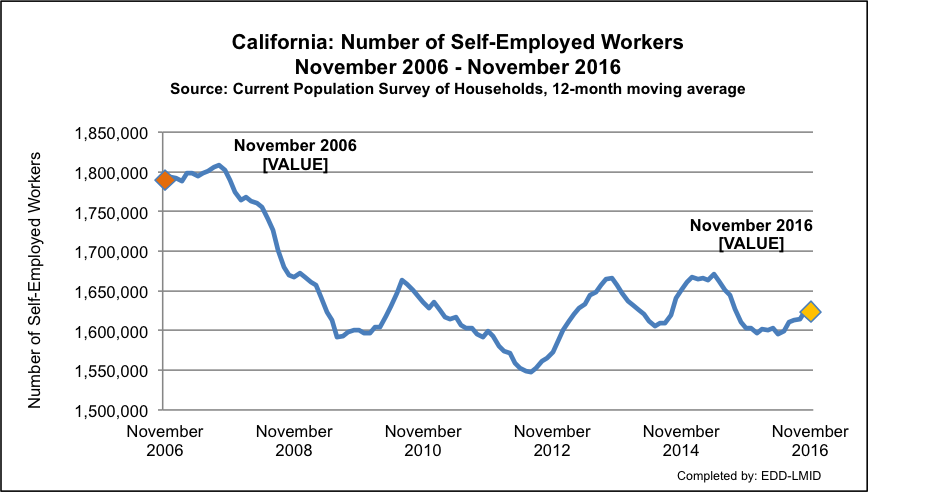

Self-Employment in California: Let’s start with self-employment. The chart above shows the change in self-employment (incorporated and unincorporated) for the ten year period from November 2006 through November 2016—the most recent data available. Self-employment stood at 1,623,800 workers in November 2016, an increase from the 1,602,700 self-employed workers of November 2015. But it was actually below the 1,789,000 workers considered self-employed in November 2006.

As BLS regional commissioner Richard Holden reminds us, self-employment historically goes up during recessions and down during periods of employment growth. However, while self-employment did tick up during the Great Recession and immediate aftermath period of early 2009 through November 2010, it has fluctuated since. The data do not show a significant increase in the past three years, even as journalists and researchers report companies in all sectors moving to independent contractors, and even as the internet platforms for independent contractors, such as Uber, Lyft and TaskRabbit grow. It may be that the self-employment data are missing independent contractor growth in California in the past two years; or it may be that this growth has been exaggerated. This is an area that calls for more detailed research and understanding in the next years.

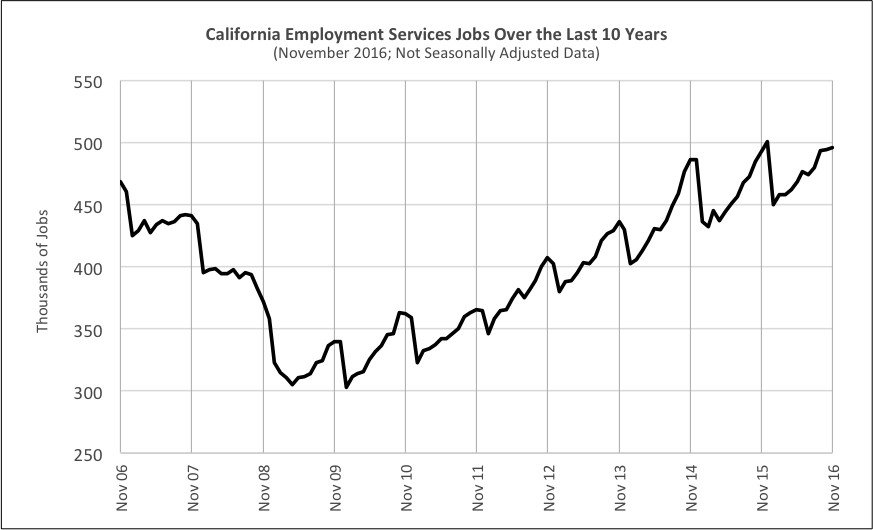

Staffing companies in California: Turning to staffing companies, the data are clearer on the uptick in workers employed by staffing companies. These workers operate under the employer-employee structure in most cases; but their employment often is more contingent and project based than other employment. The chart below tracks the Employment Services jobs over the past 10 years.

As of November 2016, staffing companies employed 495,900 workers in California, slightly above the 492,400 workers employed by staffing companies in November 2015, and growing fairly steadily since November 2011.

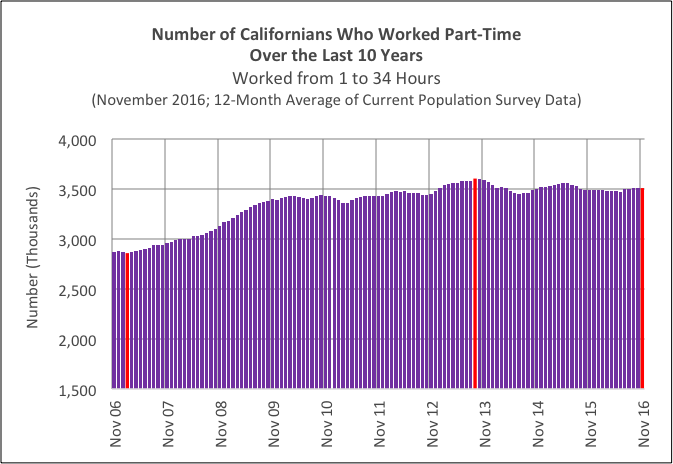

Part Time Employment in California: The data on part-time employment in California also show an increase over the past year, as well as growth over the past decade. The number of part-time workers in California in November 2016 stood at 3,505,00, above the number in November 2015 (3,491,000) and considerably above the number in November 2007 (2,957,000).

So what to make of these most recent data on elements of the gig economy in our state?

They do not show the dramatic gig economy growth that other recent nationwide studies on the gig economy have shown, particularly the study released last year by economists Lawrence Katz and Alan Krueger: “The Rise and Nature of Alternative Work Arrangements in the United States 1995-2015”. Using the four BLS alternative work categories, Katz/Krueger joined with RAND Institute to survey 6028 workers. They reported significant increases between 2005 and 2015 in alternative work arrangements, from 10.1% of the work force in February 2005 to 15.8% in 2016, and observed that “a striking implication of these estimates is that all of the net employment growth in the U.S. economy from 2005 to 2015 appears to have occurred in alternative work arrangements.” They did not include part-time employment in their analysis, and adding this component would increase the independent contractor/staffing/project-based/part time number to over 30% of the workforce. This estimate is consistent with the 2015 U.S. Government Accountability Office report that estimated over 40% of the workforce as independent contracting/staffing/project-based/part time.

Not everyone agrees that our gig economy in California is growing significantly. No firm tracks and analyzes employment data in California better than Beacon Economics, and for the past eight years I’ve had a running debate with Beacon Founding Partner Christopher Thornberg on this topic. He regards the gig economy talk as overblown, noting, among other things, that the great majority of California workers continue to be in payroll positions. I say there is something going on that is not being picked up by the government data not only in self-employment, but also in the more fragile nature of these payroll positions.

To be continued…