It’s looking like even the Blues Brothers won’t be able to rescue Illinois from “insolvency,” the fancy word for bankruptcy. Supposedly states can’t go bankrupt, although Arkansas effectively did in 1933, during the depths of the Great Depression.

The Land of Lincoln’s credit rating dropped to just a guitar string above junk-bond levels because, according to Moody’s, “Legislative gridlock has sidetracked efforts not only to address pension needs, but also to achieve fiscal balance, allowing a backlog of bills to approach $15 billion, or about 40 percent of the state’s operating budget.” The Prairie State’s deficit clocks at $6 billion, the equivalent of about $20 billion for California. And that’s during a time of national prosperity.

Not surprisingly, lawmakers in the state’s Democratic Legislature attacked Republican Gov. Bruce Rauner and demanded – you’ll really be surprised! – tax increases. Getting in touch with his inner Bernie Sanders, state Rep. Jay Hoffman insisted, “I’m willing to say people like Bruce Rauner and his multimillion-dollar friends can pay more in taxes, while at the same time we should provide credits to the middle class, so they could have a reduction in taxes…. We’re willing to take the tough votes, whether it’s cuts, or making sure we have additional revenue in order to meet the demands of the state.”

Of course, for anyone expecting the “tough votes” would include, say, pension reform to reduce costs, I have a bargain deal to sell you the Sears Tower.

Hoffman also is dreaming if he thinks he can squeeze more money out of rich people. Illinois already suffers the highest property taxes in the country; they don’t have anything like our Proposition 13 protections. The top state income tax is 3.5%, compared to 13.3% for Taxifornia. But according to the 10th Edition of the “Rich States, Poor States” survey by the American Legislative Exchange Council and economist Arthur Laffer, Illinois’ economic outlook ranks 44th among the states, albeit above California at 47th.

Among the negatives: a 7.75% corporate income tax rate, ranking 31st. A death tax. A highly litigious environment for businesses. High workers compensations costs. And few limits on tax increases, meaning they could go to the moon.

No wonder Absolute Net Migration – American citizens leaving the state – totaled 695,578 from 2006-15. And Chicago, Murder City USA, has suffered a more recent mass exodus. According to U.S. Census data, between July 2015 and July 2016, “Cook County, which encompasses Chicago, also led all counties in population drops, with roughly 21,300 fewer residents,” reported the New York Post.

What’s all that got to do with California? Because without Silicon Valley and sunshine, that’s where we would be. And likely will be again the next time there’s a dot-com bust of the magnitude of the one that hit from 2000-02. We can’t know when, but busts inevitably follow bubbles. Indeed, already our net-outmigration was 1.1 million during 2006-15.

Sure, Illinois has a big high-tech sector situated around the University of Illinois Urbana-Champaign. That’s where the Mosaic browser, which first popularized the Internet, was created. It’s also where, in 2001, the Heuristically Programmed Algorithmic Computer 9000 was perfected. (“I’m sorry, Dave. I’m afraid I can’t do that.”)

Similar mini-Silicon Valleys have cropped up in every state: Austin, Tex.; Massachusetts’ Route 128; Ann Arbor, Mich.

But Silicon Valley can pull along the California economy and budget almost all by itself, at least during prosperous times, because it’s the Mt. Everest, the Big Enchilada, the Hercules of global high-tech areas. It’s what Detroit was for automobiles until the 1970s; and what Washington, D.C. is today for government. Even the Great Recession of 2008-10 hardly phased the silicon behemoths.

Which means even a brief downturn in Silicon Valley would turn California into Illinois.

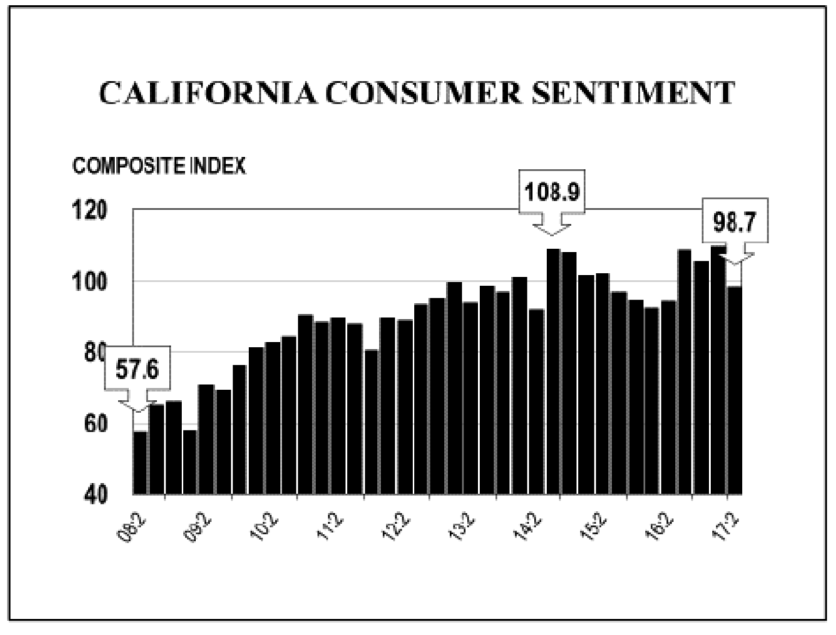

Meanwhile, there are warning signs the state’s economy is starting to wheeze. The Chapman University Consumer Sentiment Survey for California rings a loud claxon: The index “decreased over 10 points from the first quarter revised reading of 109.5 to a reading of 98.7. An index level below 100 indicates a higher percentage of pessimistic consumers versus those who are optimistic.”

Consumer spending comprises about 70% of the economy, so the sharp decline could be warning of impending danger. Perhaps that danger will pass. It did for a decline that began two years ago. And we’re nowhere the Index of 57.6 of the second quarter of 2008, as the Great Recession was digging in.

And you can’t blame President Trump, because the national economy is booming. I’m looking for more details on the national and state economies at Chapman’s next Economic Forecast Conference on June 21.

The problems for the Golden State are the ones I’ve highlighted in my articles here on Fox and Hounds: high taxes, the high cost of living from stiff restrictions on housing construction and the minimum wage increasing to a jobs-asphyxiating $15 an hour. Joel Fox just detailed the interminable new business regulations. And Gov. Jerry Brown, in response to President Trump withdrawing from the Luddite Paris Agreement, is pushing the state’s own anti-industry schemes with other cities, states and countries.

How all these attacks on businesses are supposed to create jobs, reduce the state’s record poverty level and end skyrocketing homelessness remains less a question for economists than the famed psychoanalyst Dr. Leo Marvin.

The next recession well could turn California into Illinois. Anyway, no matter what happens with the economy, when the Windy City blows frigid and the top sport is ice fishing, we Californians still will be able to shout: Surf’s Up!

Longtime Orange County Register editorial writer John Seiler now writes freelance: [email protected]