California’s transportation future is bright. In every area of transportation innovation, California-based companies are leading the way. Consortiums of major global companies have offices throughout the San Francisco Bay area, pioneering self-driving cars that consolidate technologies from not just automakers, but cell phone manufacturers, chip designers, PC makers, telecoms, and software companies. In Southern California from the aerospace hub surrounding LAX to the Mojave desert, heavily funded consortiums experiment with everything from passenger drones to hyperloop technologies to hypersonic transports. It’s all happening here. It’s wondrous.

Meanwhile, instead of preparing the roads for smart cars, or designing hubs that integrate buses and cars-on-demand with aerial drones and hyperloop systems, the centerpiece of California’s transportation future is a train that isn’t very fast, being built at what is probably the highest cost-per-mile in the history of transportation, which hardly anyone will ever ride.

There is a stark contrast between California’s private entrepreneurial culture, as reflected in the marvels of transportation engineering they are developing, and California’s political culture, as reflected in their ongoing commitment to “high speed rail,” in all of its stupefying expense, its useless grandeur, its jobs for nothing, its monumental initial waste, situated miles from nowhere. Exploring that stark contrast, its origins, the players, the projects, the problems and the solutions, will be the topic of this and subsequent reports.

HIGH SPEED RAIL – THE FATALLY FLAWED CENTERPIECE

The fatally flawed centerpiece of California’s transportation future, the “Bullet Train,” unfairly dominates California’s transportation conversation. Unfair not only because it represents a prodigious waste of public resources and an epic failure of public policy, but because in spite of the Bullet Train fiasco, California’s private sector is designing and building a transportation future for the world at dazzling speed. But before surveying the excellent progress being made elsewhere in the Golden State, it is necessary, yet again, to tick through the reasons why the Bullet Train is the wrong solution, in the wrong place, at the wrong time.

Fifty years ago, before air travel became affordable to nearly anyone, before you could fly from San Francisco to Los Angeles for less money than it would cost in gasoline to drive there in your car, rail travel might have made sense. But today, airfare is only about twice the cost of bus fare, with total air travel time a minute fraction of what the same trip would take on a bus.

Fifty years ago, before land values and environmentalist lawsuits rendered any capital project prohibitively expensive, building a high-speed rail corridor between San Francisco and Los Angeles might have made sense. But today, the latest cost estimates for the SF/LA route exceed $100 billion.

Unrealistic Projections

High speed rail makes sense for intercity applications in megapolises. For example, a high speed rail line connects three of Japan’s largest cities, Tokyo, Nagoya, and Osaka. Nearly all of this 300 mile corridor is urbanized – in all, over 70 million Japanese live in this region of Japan.

By contrast, just phase one of the California high speed rail project, linking San Francisco with Los Angeles, will be 520 miles long, connecting about 24 million people. This doesn’t pass the density test. Compared to a successful high speed rail system – which the Tokyo/Osaka system certainly is – the San Francisco/Los Angeles system would be nearly twice as long, and serve only about one third as many people.

Put another way, there are 233,000 Japanese, per mile, living along the Tokyo/Osaka route, whereas there are 46,000 Californians, per mile, living along the proposed San Francisco/Los Angeles route. That means there are five times as many potential riders on Japan’s centerpiece bullet train as there might be on California’s.

Low ridership isn’t just a consequence of insufficient population density, although that is a critical precondition. Low ridership also stems from impracticality. The California High Speed Rail Authority’s 2018 “business plan” is disingenuous on this topic. They claim that travel to and from the airport chews up time, yet ignore travel time to and from a high-speed rail station. Travel time to these stations, air vs. rail, are entirely offsetting. Then they claim time that boarding high speed rail is quicker than boarding an airplane. Why? A frequent air traveler has TSA Pre, and typically sails through check-in and security. And won’t security be in place for high speed rail? Of course it will. Boarding time – also entirely offsetting. Which brings us to the actual travel time.

The current projection according to the CA HSR 2018 business plan (ref. page 7) is three hours for nonstop service from San Francisco to Los Angeles. This is definitely a best-case estimate. As reported on March 18th in the Los Angeles Times, “Of the roughly 434 miles of track between Los Angeles and San Francisco, 136 miles — nearly one-third of the total — could have at least some speed restrictions.” This would include tunnels, sharp curves, all transits through urban areas, and, incredibly, shared track and shared right-of-way with conventional rail carriers.

It is going to take twice as long to travel from San Francisco to Los Angeles via high speed rail vs. an airplane. Let’s not forget there are three major airports in the San Francisco Bay Area – SJC, OAK, and SFO. Five major airports serve the Los Angeles area – LAX, ONT, BUR, LGB and SNA. And flights connect all of them to each other, all day, every day.

Perpetual Financial Drain

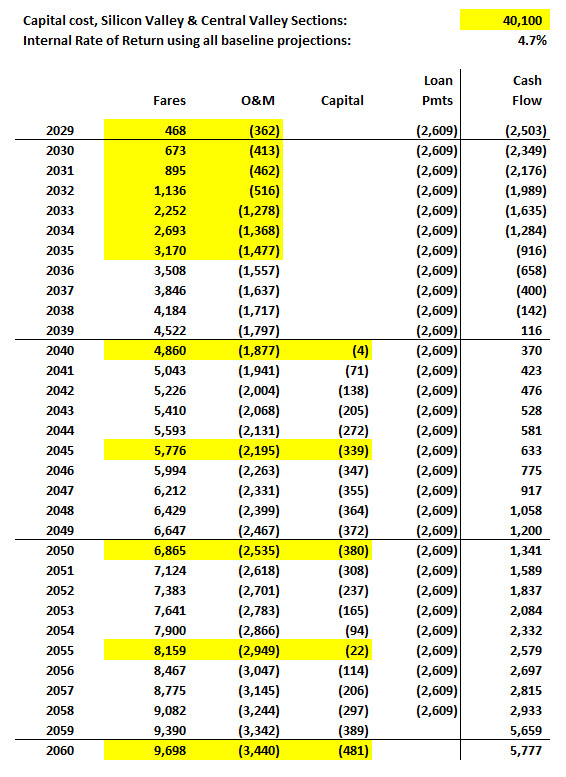

Even if you accept the official projections for California’s high speed rail, the financial projections are unlikely to attract private capital. The table depicted below uses baseline projections from the CA HSR 2018 business plan (numbers directly taken from the business plan are highlighted in yellow, with numbers in intermediate years, which were not disclosed in the business plan, arrived at by extrapolation) to construct a cash flow for the “Phase One” portion of the project, those segments connecting San Francisco to Bakersfield. All of the variables are taken from that document. Several generous assumptions are necessary to accept these projections. They are:

(1) The entire capital cost for construction of the Phase One system linking San Francisco to Bakersfield is $40.1 billion (ref. page 32, exhibit 3.2 “Summary of Cost Estimates by Phase and by Range”). This is crazy. It will probably cost half that just to bore a tunnel under the Pacheco Pass.

(2) Ridership on this segment will grow to 31.9 million fares per year by 2035. Assuming primarily commuter traffic, this assumes over 120,000 riders per day (ref. page 90, exhibit 7.1 “Ridership: Silicon Valley to Central Valley Line through Phase 1,” “Medium Ridership”).

(3) Incredibly, fare revenue will hit $1.86 billion by 2035. This assumes an average ticket price, in 2017 dollars, of $60. This, in turn, infers that the average commuter will be spending $1,220 per month to ride the bullet train (ref. page 90, exhibit 7.3 “Farebox Revenue: Silicon Valley to Central Valley Line through Phase 1,” “Medium Revenue”). This is perhaps the most far fetched of all assumptions made in the entire business plan. Imagine over 120,000 regular commuters spending $1,200 per month to ride this train, noting the fact that this sum would not include the additional costs virtually all commuters would incur to travel from their home to the HSR station, and then from the HSR station to their workplace, on both their outbound and inbound commute, day after day.

(4) Operations and maintenance for the train will be a mere $1.4 billion in 2035, then, after adjusting for 3% inflation, will only increase 11% by 2060 even though ridership is projected to rise from 31.9 million passengers in 2035 to 51.2 million by 2060 (ref. page 91, exhibit 7.5 “O&M Costs: Silicon Valley to Central Valley Line through Phase 1,” “Medium Cost Estimate”). This defies credulity. How will ridership increase by 61% between 2035 and 2060 while O&M costs only increase 11%?

(5) “Lifecycle Costs,” the capital reinvestment necessary to replace worn out rolling stock and other fixed assets, i.e. “capital rehabilitation and replacement costs for the infrastructure and assets of the future high-speed rail system,” as near as can be determined from the 2018 business plan, is estimated to only total around $5 billion between commencement of operations in 2029 and 2060, over 30 years (ref. page 91, exhibit 7.6 “Lifecycle Costs: Silicon Valley to Central Valley Line through Phase 1,” “Medium Lifecycle Cost”).

(6) In the analysis below, loan payments are deferred for up to ten years until rail operations begin in 2029. In reality, of course, payments begin as soon as the money is loaned. Notwithstanding that, the annual loan payments are calculated based on loan of $40.1 billion, a 30 year term, and 5% interest.

CALIFORNIA HIGH SPEED RAIL

CASH FLOW USING 2018 BUSINESS PLAN’S “BASELINE” PROJECTIONS, $=M

Taking into account these are – for the six reasons just stated – very optimistic projections, there remain problems with these numbers that would give any investor pause. For starters, there is a cumulative negative cash flow of $14 billion, representing the period up until 2039 when the system is projected to become cash-positive. This represents over 20 years of negative cash flow. Where will this $14 billion come from? Bear in mind it will be more than $14 billion, since payments on the loans commence when the monies are loaned, not when the system begins operations. Maybe some of it will come from “cap and trade” proceeds, although if so, it would consume nearly all of them. Would private investors step up?

The problem with that is if you review this best-case scenario, you can see that selling the future positive cash flow to finance the initial negative cash flow would yield an internal rate of return of 4.7%. While that’s not an impossibly low rate for a municipal financing, it is exceedingly low for a private financing subject to this level of risk. And what about the risk?

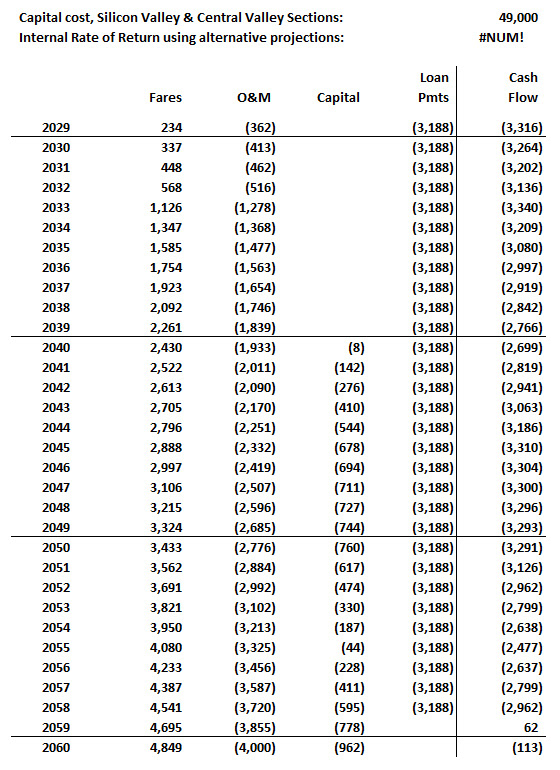

High Speed Rail Cash Flow Using Conservative Assumptions

The next chart shows a cash flow scenario for high speed rail, phase one, with key assumptions changed. Instead of costing $40.1 billion, it costs $49 billion, the “High” range of cost estimates as disclosed on the HSR 2018 business plan, page 32. Instead of an average ticket price of $60, a more affordable $30 price is used, based on the assumption that the average commuter will not be willing to spend more than $600 per month on train fare. As ridership grows by 60% between 2035 and 2060, operations and maintenance costs are escalated by 30% instead of only 11%. And instead of spending a mere $5 billion on ongoing capital investments between 2029 and 2060, that is doubled to a still paltry $10 billion. What happens?

CALIFORNIA HIGH SPEED RAIL

CASH FLOW USING ALTERNATIVE (CONSERVATIVE) PROJECTIONS, $=M

As can be seen on this alternative analysis, if ridership revenue is significantly lower than projected, and if – one might argue – realistic operations and capital budgets are projected, and, if one merely uses the HSR Authority’s own high estimate of capital costs, there is no financial viability whatsoever to this project. The internal rate of return formula basically blows up, which is what happens when you burn through $91 billion before having your first break-even year in 2059. The question instead becomes, what else might Californians have done with $50 billion? The other question raised by this more conservative financial scenario, more disturbing, is what if high speed rail never makes money? How many additional tens of billions will be required to subsidize its operation?

The problem with dismissing these more bleak financial scenarios is simple: this is the sort of analysis that any savvy investment banker would start with. Then they would ask questions. WHY do you think 120,000 people are going to be willing to spend $1,200 per month in train fares to commute, not even including their costs to get to and from the train station? WHY do you think you can increase ridership by 60%, but only increase operations costs by 11%? WHY do you think you can operate a $50 billion railroad, and only expect to reinvest ten percent of that amount in capital equipment over thirty years?

The “Monte Carlo” Method of What-If Analysis

Instead of confronting these questions in plain English, the high speed rail authority did what-ifs using a “Monte Carlo” analysis. Here’s how they describe this (ref. page 93):

“Breakeven forecasts measure the likelihood that farebox revenue is equal to or greater than operations and maintenance costs in a given operating year. The analysis works as though there are two large bags full of marbles, one with thousands of marbles each representing a potential operations and maintenance cost, with more of the marbles having values around the median cost estimate than around the extreme (high or low) values. The second bag of marbles contains potential revenue outcomes, again with more marbles with values around the median than the high or low outliers.

The breakeven Monte Carlo analysis simply “picks” one marble at random from the revenue bag and one marble at random from the cost bag, subtracts the number written on the cost marble from the one written on the revenue marble and records the value. The analysis then puts the marbles back into their respective bags and repeats the process thousands more times which builds a distribution of potential results and generates a degree of confidence (or confidence interval, expressed as a percentage) as to the likelihood of project breakeven.”

If anyone wonders why projects in California cost far more than they should, please consider the role of consultants. The variables governing success or failure for California’s high speed rail project are tangible. They require urgent debate by practical people. How much will it cost to bore a tunnel through the Pacheco Pass? How likely is it that Union Pacific will share their right-of-ways with high speed rail, and if so, how much will that reduce costs, and how much will that reduce the speed of the train along those segments, and why? What is the real cost of the many engineering and environmental studies, and how many of them are necessary? Why is it that so many other nations, from socialist Europe to fascist China, manage to build these systems for a fraction of what Californians must expect to pay?

These are the questions that require answers. Counting metaphorical marbles does not add value to the process, nor does it add credibility to the financial projections. These qualitative questions regarding California’s high speed rail project have not been answered, because perhaps they cannot be answered. But the reasons California’s high speed rail system is so staggeringly, prohibitively expensive, are not problems that are confined to the high speed rail project. They infect every infrastructure program in the United States, and especially in California. Identifying the reasons infrastructure projects cost far more than they should, along with exploring tantalizing alternatives to high speed rail, will be the topic of future reports.

* * *

Edward Ring co-founded the California Policy Center in 2010 and served as its president through 2016. He is a prolific writer on the topics of political reform and sustainable economic development.