With news of California companies moving to states where taxes and other operating costs are lower, it’s difficult to believe that some groups want to hit in-state employers with another tax increase.

But that is precisely the pitch made by special-interest groups trying to convince voters that California’s business taxes are too low. Taxes must be increased so businesses will pay their “fair share,” the argument goes.

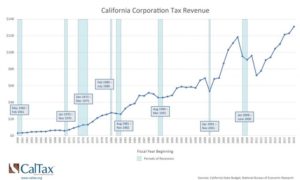

What tax-increase proponents don’t mention is that the corporation tax is a growing and vibrant source of state revenue. From 1960 to 2018, California’s corporation tax revenue grew from $272 million to $12.2 billion – an increase of more than 4,500 percent. Even after adjusting the 1960 number for inflation, the growth was 535 percent.

Gov. Gavin Newsom’s Department of Finance projects that the corporation tax will grow another 6.4 percent this year, to reach $13.1 billion.

The tax is one of the big three sources of state revenue, along with the personal income tax and the sales tax. Businesses of all sizes pay the tax. Revenue generated by the franchise tax and the income tax on incorporated businesses pays for schools, public safety, medical assistance programs and much more.

Businesses also pay local taxes that fund local government services, and annual property taxes. Businesses, unlike homeowners, pay property taxes not just on land and buildings, but also on office furniture, computers and other equipment.

California’s state budget reserves have grown to $19.6 billion under this tax structure. With the state on solid fiscal footing, tax hikes are unnecessary, and likely will backfire.

California has the second-worst business tax climate in the United States, above only New Jersey, according to the Washington, D.C.-based Tax Foundation’s annual analysis. This severely hinders our ability to attract and maintain jobs and investments that fuel economic growth.

In 2016, 1,800 companies left California, according to the Dallas Business Journal’s review of the most recent available data.

The result: Californians missed out on their fair share of employment opportunities, as 275,000 jobs and $76.7 billion in capital funds were diverted to other states. Corporate income tax revenue won’t continue to grow if more corporations compare the costs of doing business and decide to leave the Golden State.

California’s problems would not be limited to job losses. Negative impacts of a business tax increase would be felt far and wide, because business taxes get passed on to consumers and shareholders, and have a negative impact on wages for jobs that are preserved.

The last thing middle-class Californians need is an even higher cost of living, wage stagnation or more risk for their retirement investments.

The principles of sound tax policy say a tax structure should generate sufficient revenue while keeping rates as low as possible, to improve economic competitiveness and minimize the impact on taxpayers’ behavior.

With the state enjoying a record-setting state budget reserve, and competition for jobs already at a fever pitch, tax increases on California employers should be off the table.