Here’s another way to look at the complicated question of California’s commitment to public education in these flush economic times, with some compelling illustration of the state’s finances. And an unsettling conclusion: more and more tax increases will be the Golden State’s fate unless lawmakers get serious about reforming two large portions of California’s budget—K–12 schools and Medi-Cal, which account for more than one-half of California’s General Fund spending.

California’s Next Tax Hikes

California raised taxes in 2012, boosting the top income tax rate nearly 30 percent, to 13.3 percent. Because the state taxes capital gains at ordinary income tax rates and the country has experienced a long bull market, state revenues have grown sharply this decade:

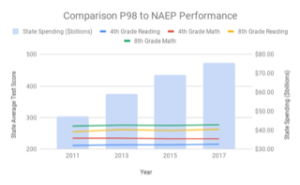

That’s because the spending increase wasn’t accompanied by reforms. (Here, P98 stands for ‘Proposition 98’ which governs school funding in California and NAEP stands for ‘National Assessment of Educational Progress’.)

Ninety percent of the state’s more than six million public school students attend government-run schools, which operate under strict central planning embodied in the state Education Codewritten by the governor and legislature.

Layoffs must be issued in reverse seniority regardless of performance. Tenure is granted after just two years of teaching. Districts are permitted to subsidize the health insurance of retired employees but not to suspend automatic pension increases even when those retirement costs leave less money with which to pay active teachers.

The 2012 tax hike was marketed to voters as a temporary tax increase for education. However, more than 100 percent of the expected revenue increase for schools went to increased school spending . . . on retirement costs. For example, the Fresno Unified School District increased its retirement spending by over 150 percent of the average expected revenue per student from the tax increase. As one result, teachers in several districts went on strike this year because new revenues, diverted instead to retirement costs, are not improving their salaries.

Including local and federal funds, California will spend $100 billion this year on K–12 education—more than $17,000 per student, up 50 percent this decade. Yet student performance is unchanged, and teachers are on strike. As I expressed it in a recent special report in the Economist, comparing California and Texas: “[K–12] education is the single largest enterprise in California. It has 6m student customers. And it sucks.”

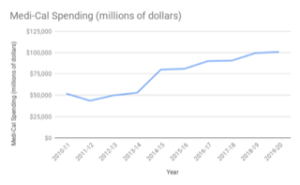

Another $100 billion enterprise in need of reform is Medi-Cal, which provides health insurance for thirteen million residents, one-third of the state’s population. Spending (about 23 percent funded by the General Fund) doubled this decade:

But according to a recent National Bureau of Economic Research study, that spending increase significantly improved hospital profits but not patient health, and emergency room use increased. That’s also because of poor state governance. For example, the state limits the scopes of practice permitted to nurse practitioners, physicians’ assistants, and nurse midwives, thereby reducing access and raising costs.

Together K–12 education and Medi-Cal consume more than half of General Fund spending. Absent reform to those two gigantic state-operated enterprises, spending will continue to grow but services will continue to decline. That means more tax increases, which are relatively easy to pass by state ballot in California. This is because tax increases by state ballot measure require only majority approval. The 2012 tax increase was already extended by voters until 2030, and government-employee unions are already planning two additional increases for the 2020 ballot.

K–12 education and Medi-Cal cannot be reformed without at least 62 aye votes in the California State Legislature (21 in the state senate; 41 in the state assembly). I experienced the power of the legislature firsthand while serving in several roles in state government during the last decade, including as special adviser to Governor Arnold Schwarzenegger, a board member of the California State Teachers’ Retirement System (CalSTRS), and a member of the University of California’s Board of Regents.

After I questioned the state’s accounting for pensions, the legislature removed me from CalSTRS’s board and denied me a full term on the UC Board of Regents. When Governor Schwarzenegger sought to reform pensions, his proposal was rejected by the legislature—that includes Republican legislators with strong ties to government-employee unions.

Generally, California governors won’t seek reforms unless they know sixty-two votes can be obtained. That’s because, traditionally, only special interests pay attention to state legislators, and proposed reforms detrimental to those special interests—especially to the government-employee unions and the health-care enterprises that collect most of the $200 billion per year spent on K–12 schools and Medi-Cal—can be fatal to political careers. Hence, reforms are unlikely unless individuals pay sufficient attention to at least sixty-two legislators.

The key to reform lies with Democratic legislators. That’s because in the last decade California adopted two political reforms (independent redistricting and a top-two “jungle” primary) that produce more competition in legislative races, producing different “shades” of Democrats. (The country’s most aggressive pension reformer is a Democrat, Rhode Island governor Gina Raimondo, who is well regarded by a number of California Democrats.)

When Democratic reformers are combined with willing Republican legislators, reaching sixty-two votes is possible—but only if individual political donors protect legislators from special-interest retribution. That protection takes the form of political contributions, limited to $4,700 per donor per legislator per election.

K–12 education reforms should include (a) requiring school districts to standardize health-benefit plans and to means-test retiree health-insurance subsidies; (b) eliminating school district requirements to offer tenure or to lay off employees in order of reverse seniority; and (c) liberating school districts to terminate underperforming employees, suspend automatic pension benefit increases, reduce pension accruals for years not yet worked, and pay more to employees who perform better or take on tougher tasks.

Medi-Cal reforms should include (a) expanding the scope of practice permitted to nurse practitioners, physicians’ assistants, and nurse midwives; (b) rewarding and punishing hospital performance; (c) evaluating global hospital budget policies; and (d) using machine learning and social services to intervene before costly medical treatment is required.

Just one of those reforms alone (means-testing health insurance subsidies for retired state and school employees) could eliminate more than $90 billion of unfunded retirement liabilities, provide $9,000 per year in salary increases for active teachers in affected school districts, and free up more than $2 billion per year of General Fund spending.

Reforming K–12 education and Medi-Cal will not be a guarantee against future tax hikes, but failure to reform those two enormous state-operated enterprises makes perpetual tax hikes a certainty. Government-employee unions and health-care enterprises have filled a vacuum created by the absence of citizen involvement in legislative politics. Individual political donors need to support and protect state legislators willing to make these reforms.

(Originally published in EUREKA at the Hoover Institution)