One week from today, Californians will finish voting on a $15 billion General Obligation Bond to be issued by the state if approved by voters. Currently, the state has $73 billion of voter-approved General Obligation Bond obligations outstanding that cost the General Fund $5 billion a year.

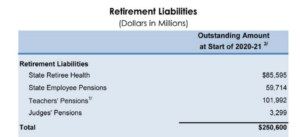

Meanwhile, also outstanding are $250 billion of non-voter-approved obligati

Voter-approved debt obligations are issued to Wall Street underwriters. Non-voter-approved retirement obligations are issued to government employees. Under California law, government employees may donate to elected officials. Wall Street underwriters may not.

Annual spending on retirement obligations nearly tripled over the last decade and now is crowding out spending on classrooms and other government services at 4x the rate of spending on debt obligations. Absent reform, spending on retirement obligations will grow even faster, plus new retirement obligations are being issued every day without voter approval.

The only scrutiny over non-voter-approved retirement obligations issued to government employees is through the eyes of state lawmakers.