When the phone calls come into the National Federation of Independent Business/California offices about AB 5 we know the questions will boil down to this: Is our type of business one of the lucky ones that gained an exemption under the new worker classification law?

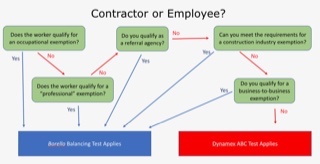

We’ve developed flow charts and explanations on how different businesses are affected by the law amounting to maps that only experienced cartographers can love.

That’s not the way it should be and that’s not the way small business—the backbone of California’s economy—should be treated.

To encourage entrepreneurship, the legislature should look at the problems and unintended consequences arising from AB 5 from the mom-and-pop perspective and offer an overall exemption for all small businesses.

Small businesses can accomplish their missions and provide services to the public with the help of independent contractors. If these contractors have to be converted to employees, it will lead to contractors losing work and businesses failing to meet obligations to customers.

AB 5 codified in law that businesses must demonstrate:

A) that a contractor is free from the control and direction of the hiring business in connection with the performance of the work

B) that the contracted person performs work which is outside the usual course of the hiring entity’s business

C) that the contractor is customarily engaged in an independently established occupation.

This test has been labeled the “ABC” test. If a contractor is granted an exemption, the person is governed by a test adopted 30 years ago under the Borello court case that has worked fine over the subsequent decades for workers and businesses alike.

Right now, the situation is chaotic. There seems to be no rhyme or reason why some businesses get an exemption and other similar businesses don’t. There are 37 haphazard exemptions offered to contractors but so many more professions that don’t get an exemption for no discernable reason. Some examples:

- · There is an exemption for graphic artists and fine artists, but no exemption for musical artists.

- · There is an exemption for tax and HR consultants, but not environmental consultants, business development consultants, nutritional consultants, etc.

- · There is an exemption for doctors, surgeons and dentists, but not for other health care professionals like optometrists, endodontists, pharmacists, mid-wives, physical trainers, or nurses.

- · There are exemptions available for many occupations requiring professional licensure; however, California requires occupational licensing for many professions that do not enjoy exemption like pest control agents and vegetation pesticide handlers.

Some industries, especially those with good representation in front of the legislature, have convinced the exemption writers to keep their businesses from being trapped under the AB 5 net. Other businesses are not so influential and not so lucky and businesses and independent contractors are suffering for it.

What is needed is a business-to-business exemption for all small businesses. The law provides a business-to-business exemption now, but the strict qualification criteria keep a lot of enterprises on the outside looking in at those privileged exempt organizations.

For instance, while AB 5 does provide a limited exemption for hair stylists, it likely does not help many of these salon owners who want to continue working with independent hair stylists. That’s because one of the restrictions imposed on this exemption prohibits hair stylists from utilizing the salon’s payment processing system. Because credit-card processing systems are prohibitively expensive, this represents a major regulatory problem for independent contractors.

All of this can be fixed while ensuring that workers are treated fairly, and it begins with ensuring that legitimate entrepreneurs have a path to launching and growing their own independent businesses.

As an organization that has the words “independent” and “business” in its title, NFIB will continue the fight to create a fair law so the economic and job-creating powerhouse of small business will flourish.