Dear Legislators,

Soon you will be addressing the budget. Three suggestions:

- Permit no cuts, layoffs or borrowings before retirement spending is trimmed. School districts, UC, CSU, community colleges and the state are diverting $25 billion per year to retirement spending that should be reduced before services are cut, employees are laid off, or funds borrowed.

- UC is spending $1.3 billion per year on “OPEB,” an unnecessary health insurance subsidy for retired employees the vast majority of whom already have access to Medicare, Medicaid, the Affordable Care Act, new state subsidies or employer insurance. The OPEB subsidy also raises the cost of health insurance premiums for active employees. UC could save ~$1 billion by adopting OPEB reforms the City of Glendaleenacted in 2015 to protect its employees and services while holding vulnerable retirees harmless.

- The State of California and CSU are spending $2.8 billion per year on OPEB to which the legislature should apply a Glendale-like reform.

- Even before COVID, SacCity Unified School District was laying off teachers because it is diverting money to OPEB, and so are Fresno Unified, SF Unified, LA Unified and other districts at a cost of more than $500 million per year. The legislature should require all districts to reform OPEB, and the same should apply to community colleges.

- School districts, community colleges and the state are spending nearly $6 billion per year on school employee pensions that include automatic increases, which should be replaced with cost-of-living (COLA) increases and suspended until the funded ratio of pension funds exceed 80 percent.

- This year the state, CSU and UC are spending more than $15 billion on pensions that include COLA payments, which should be suspended until the funded ratio of state pension funds exceeds 80 percent.

- To help avoid layoffs and wage cuts, the state and its universities, colleges and schools should move active employees to hybrid pension plans while preserving their accrued benefits to date.

- Cities, transit districts, special districts and other state subsidiaries are diverting billions more to OPEB subsidies and pensions. They should be required to enact the reforms outlined above before laying off active employees, cutting services for residents, or borrowing funds.

- In the event of layoffs, protect earlier-in-career teachers from discrimination. Earlier-in-career teachers need protection from disproportionate layoffs under California’s discriminatory “last-in, first-out” layoffs law.

- If borrowing is undertaken, do so transparently and at the lowest cost. Deferring contributions to pension funds should not be an option, because that’s no different than borrowing at a 7 percent rate. You have more transparent and less expensive options.

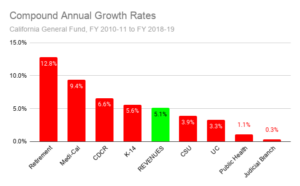

Over the last eight budget years, no General Fund expenditure grew faster than retirement spending. That’s because of a retroactive pension increase granted in 1999 and a self-interested decision by state pension funds in 2005 to reject recommendations to boost pension contributions at that time. As a result, retirement spending exploded despite an economic and stock market recovery:

Because retirement spending grew faster than revenues (which were boosted by a tax increase enacted in 2012 and renewed in 2016), funding for most discretionary programs grew slower than revenues. Absent reform, retirement spending will continue to grow faster than revenues even after the COVID recession has ended.

Without voter approval, the state is diverting $25 billion per year from schools, colleges, universities and state services to retired employees. Local governments and transit agencies are diverting billions more. Retired government employees must start sharing in pain that has already afflicted active employees, residents and taxpayers.