About Governor Newsom’s request for $14 billion of additional federal support–

Even when added to the $8 billion already provided to California by the CARES Act, the total ($22 billion) would be less than half the $48 billion proposed for California under the HEROES Act passed by the US House of Representatives last week. But, absent reform, a large share of every federal dollar provided to California under any formula would be diverted to retirement costs. Accordingly, regardless of the amount the federal government provides, we will encourage Congress to help California help itself to billions more of the state’s own money with which to avoid cuts to services.

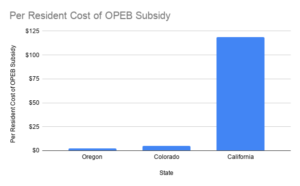

California spends orders-of-magnitude more on retirement costs than do the other members of the Western States Pact. E.g, California spends $5 billion per year on “OPEB” (“Other Post Employment Benefits”), a subsidy for retired employees on which Oregon and Colorado spend $10 million and $30 million. Translated for population differences, California’s OPEB spending per resident is 60x and 24x that of Oregon and Colorado:

That’s principally because California provides gold-plated OPEB benefits. While Oregon caps its monthly OPEB subsidy at $60 per Medicare-eligible retiree and Colorado’s cap is $115 for Medicare retirees and $230 for pre-Medicare retirees, California imposes no cap. Worse, California finances OPEB subsidies with cash and debt, resulting in $85 billion of OPEB debt on which annual interest expense amounts to $3 billion.

Many California cities, school districts and universities do the same. With just one-third as many residents as Oregon, San Francisco spends 40x ($400 million) on OPEB. LA Unified School District spends 25x and the University of California spends 130x.

California also sponsors a gold-plated pension system that has long favored employees over residents, once even granting a retroactive pension increase. State pension fund boards have been controlled by beneficiaries since 1992 with the result that decisions have been tilted in favor of keeping upfront contributions artificially low, thereby guaranteeing big deficits for taxpayers. Pension spending has exploded accordingly. From 2011 to 2019, state pension spending grew at a nearly 19 percent compound annual growth rate.

Congress could help California help itself by imitating the “Race To The Top” program enacted as part of the 2009 package of financial assistance to states. Under those sorts of programs, additional payments are triggered when a state meets certain requirements. To incentivize responsible retirement practices,Congress could offer additional funds to states that cap OPEB subsidies, suspend pension increases and benefit accruals for future work until pension funds are safely funded, make all actuarially determined contributions, and use stricter accounting rules. An alternative approach could be a PPP-type program under which Congress could make loans that are forgiven if the retirement plan changes are made. To protect employees and taxpayers, Congress should also subject public pensions to the ERISA rules that govern private sector pensions.

If the State of California adopted Oregon’s OPEB cap, every year the state could save more than $2 billion in cash and avoid $2 billion in new debt. Pension reforms could likely generate savings of at least $2 billion per year. Billions more could be saved by California’s cities, colleges, universities, school districts and transit agencies.

Absent reform, large amounts of every federal dollar provided California will be diverted to retirement costs. Congress should help California help itself to billions of the state’s own dollars.