A recent article in the New York Times about election results in California included the following sentence (underline added by me): “A measure that would have raised taxes on commercial landlords to raise billions for a state that sorely needs revenue also seemed on track for defeat.” The reporters did not provide support for their assertion — which they expressed as a fact — that California “sorely needs revenue.” They should do so. Meanwhile, here are six relevant facts (sources in parentheses):

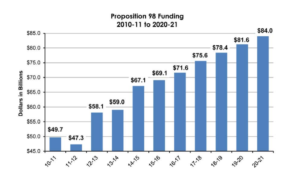

- 40 percent of the revenues from the proposed tax increase to which the NYT article refers would go to schools, which were the recipients of fast funding growth over the last decade (LAO analysis of Proposition 15; Governor’s Budget):

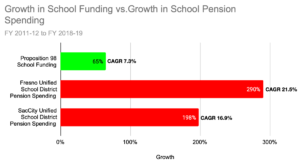

But school pension spending grew even faster (FUSD and SCUSDInterim Reports):

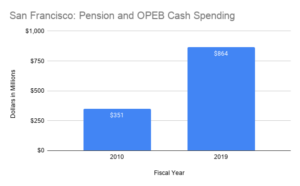

60 percent of revenues from the proposed tax increase would go to local governments like San Francisco, which increased cash spending on pensions and other post-employment benefits (OPEB) 146 percent from 2010 to 2019 (LAO analysis of Proposition 15; SFERS Annual Reports; SF CAFRs):

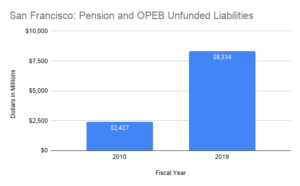

San Francisco’s unfunded liabilities grew even more (243 percent), portending even greater retirement spending down the road (SFERSAnnual Reports; SF CAFRs):

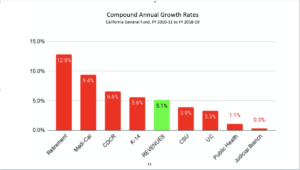

Absent reform, growth in school and local government pension and OPEB spending will continue to exceed growth in tax revenue, just as it has at the state government:

- Even during the pandemic, the state’s General Fund revenues are running 43 percent ahead of forecast fiscal year revenues (October Department of Finance Bulletin).

What California sorely needs is pension and OPEB reform.