Flim and Flam

Only hours after being sent a package of tax increase bills by the Legislature, Governor Arnold Schwarzenegger held a news conference yesterday to announce that he would reject the Democrats’ flim-flam. The flim was the unlawful tax increases. The flam was the parody called “economic stimulus.”

The Governor said the package “fell short on every single level,” and in particular called out the obvious lack of reforms that would aid the state in recovering from the economic recession. He indicated that the package did not include economic stimulus provisions that were needed, including relaxed state workplace rules and streamlined environmental laws to expedite public works projects. The Governor’s summary of the Legislative economic package: “It actually doesn’t do anything and it makes it more difficult, actually, to do certain projects.”

The Governor also indicated his displeasure with raising taxes on working families during an economic downturn. In fact, the tax increases approved by the Legislature are a slap in the face to voters, who (1) rejected Proposition 56 in 2004, which would have eliminated the two-thirds vote requirement for state tax increases, and (2) rejected Proposition 87 in 2006, which would have imposed an oil severance tax similar to the one approved by the Legislature yesterday.

The Governor appropriately called the Legislature on its attempted subterfuge. Now it’s back to the negotiating table to navigate a solution that keeps faith with voters, the Consitution and the fragile California economy.

Reducing greenhouse gases in California – they still won’t tell us the cost

Next Thursday the California Air Resources Board (CARB) will achieve a milestone in environmental regulation when it will likely adopt a Final Scoping Plan to implement the Global Warming Solutions Act of 2006. Perhaps the most far-reaching regulatory effort ever undertaken by a governmental agency, this plan will touch every aspect of Californians’ lives and the economy. But lost in the ceremony surrounding the plan – adopted even as California tumbles into the worst recession in a quarter century – is an honest assessment of its effect on Californians and our economy.

The Board has proposed an exhaustive list of measures to achieve a 30 percent reduction in California’s greenhouse gas emissions by 2020 – from what would have been a “business as usual” pace, or an absolute 15 percent reduction from today’s levels. This will require enormous investments in renewable energy technologies, smaller and more fuel efficient automobiles, and pervasive, expensive energy efficiency measures, as well as reduced driving and other energy-intensive economic activities.

Can the feds bailout California?

Speaker Bass has taken the position that the Legislature has already made $10 to $12 billion in cuts over the past several years, and enough is enough. Therefore, her preference in addressing the budget deficit is "I want to do 50 percent revenue and 50 percent from the federal government." This is an understandable position from a Democratic Speaker, but is it practical? After all, with a twenty-month budget deficit pegged by the Legislative Analyst at $27.8 billion, could we expect Washington to deliver $13 billion or so next year just to California?

California Housing Blues

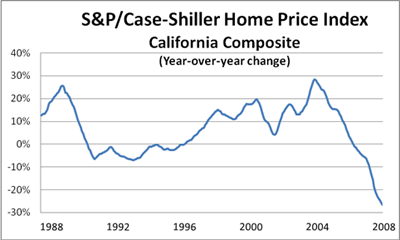

If you’re looking for a bottom in the California home price free-fall, keep looking. Standard and Poor’s released its monthly index of metro home prices, and the outlook is dismal for Sunbelt states, and for California in particular. The composite year-over-year average of San Francisco, Los Angeles and San Diego prices dropped in August by 27 percent, accelerating a trend that began in December of 2006.

Home Price Index

Home Price Index

Lottery: The Schools Win Again!

Modernizing the State Lottery and allowing the state to “securitize” (get an advance on) future revenues are well-known elements of the budget deal hammered out in September. A constitutional amendment and related changes to the lottery initiative will be proposed to voters at the next statewide election. The Governor estimates that these changes will result in a $5 billion bump in revenues in 2009-10, which will be used “to pay down debt and fill the rainy-day fund in the out-years.”

But one of the lesser-known features of this deal will be to disconnect the Lottery from its original purpose to supplement public school and college budgets. Instead, any surplus revenues beyond prizes, administration, and loan repayment will be deposited in the state General Fund. In return, the amount of lottery spending for public education this year will be added to the Proposition 98 guarantee, and increased as the constitutional minimum floor is raised. This is not a trivial change: for the eight years through 2006-07 (most recent data), lottery revenues increased by 34 percent while the Prop 98 guarantee increased by 54 percent.

Pay now, pay later — but by all means pay more

Much of the debate over controlling greenhouse gases is a variation of “pay now or pay later.” Pay a higher price (for a light bulb, refrigerator, or automobile) and save on more efficient operation later.

Since autos and light trucks account for more than a quarter of all GHG emissions in California, regulators are focusing their attention on more efficient automobiles. New technology to produce highly efficient cars will cost more, but the Air Resources Board, claims that “because these technology improvements will also reduce the operating cost of vehicles … the average consumer will ultimately save $30 a month.”

But are regulators considering all the operating costs of smaller or more efficient vehicles when determining a net benefit in purchasing and operating these vehicles? Perhaps not.

Memo to the Special Session: Taxes have already been raised on business this year

The sun rose this morning, the Cubs are not in the World Series, and California’s budget is in crisis. All may not be well with the world, but we can count on some things remaining constant.

Also predictable: renewed positioning for new taxes to solve the budget deficit.

But if the Governor calls the Legislature into special session next month to address the deficit, they should be mindful that this year’s budget was predicated on nearly $6 billion in new or accelerated taxes on California businesses and investors. When it comes to taxing California’s employers, they gave at the office.

What are the tax changes?

Housing: Not at the bottom yet

Amid the dismal news of financial markets, a new report on the housing sector provides no relief. The closely-watched Case-Shiller index reports that homes in Californian metro areas are still rapidly losing value. Year-over-year changes in the index for Los Angeles, San Diego and San Francisco were -26.2%, -25% and -24.8%, respectively, with index declines from June to July at -1.6%, -1.8% and -1.8%, respectively.

California did not suffer the worst performance nationally; that anti-distinction went to Las Vegas, Phoenix and Miami. Seeking signs of good news – but finding few – the chairman of the S&P index committee, David M. Blitzer, said, "There are signs of a slow down in the rate of decline across metro areas, but no evidence of a bottom."

Majority Vote? Not so simple.

Legislative Democrats and their allied interest groups are pressing the case to reduce the budget vote to a simple majority to avoid future standoffs. But be careful what you wish for.

In Washington, House Democrats are giving their majority vote authority the cold shoulder. As of Thursday night, the financial rescue deal is reported off track because House Republicans are insisting on a very different approach. Democrats could have approved the deal, reportedly signed off by the Senate and the White House, with a simple majority of the House, including about 50 Republicans. But instead of voting for it along mostly party lines, Democrats are insisting on a broader consensus that includes a majority of Republicans.

Would that circumstance never arise in a California budget debate?

If it sounds too good to be true…

Here is the conclusion from the just-released economic analysis by the California Air Resources Board’s of AB32, the Global Warming Solutions Act of 2006:

The analysis we have conducted indicates that if California implements the comprehensive greenhouse gas strategy, as recommended in the draft Scoping Plan, not only will the economy grow by a similar amount as we move toward 2020, but it will grow at a slightly higher rate. Increased economic growth is anticipated primarily because the investments motivated by several measures, such as the expansion and strengthening of existing energy efficiency programs and implementation of new and existing policies to reduce emissions from the transportation sector, result in substantial energy savings that more than pay back the cost of the investments at expected future energy prices.