The answer is probably “both,” but it is usually informed more by ideology than analysis. The following may be useful in guiding policy makers’ decisions on how much in new taxes versus program cuts to implement:

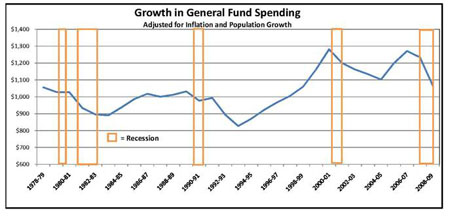

1. Over time, California has stepped up its spending, after adjusting for population growth and inflation. That is, the absolute level of public services has generally increased over time. The following chart shows that inflation-adjusted per capita spending over the past thirty years – since the passage of Proposition 13. For the first couple decades, spending ranged from $900 to $1,100 per capita, over the past decade, spending has averaged $1,100 to 1,300 per capita.

Growth in General Fund Spending

Growth in General Fund Spending

?

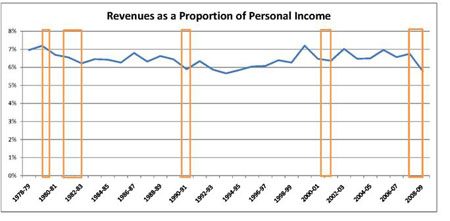

2. The overall tax burden in California has stayed about the same. As the economy rises and falls, revenues remain about six to seven percent of personal income.

Revenues as a proportion of Personal Income

Revenues as a proportion of Personal Income

?

The take-away is that the Legislature has attempted to finance a higher level of services during the past decade without increasing Californians’ tax burden. It should be no surprise, then, that state government is facing budget deficits.